- Canada

- /

- Metals and Mining

- /

- TSXV:CERT

A Piece Of The Puzzle Missing From Cerrado Gold Inc.'s (CVE:CERT) 37% Share Price Climb

Cerrado Gold Inc. (CVE:CERT) shareholders are no doubt pleased to see that the share price has bounced 37% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 69% share price drop in the last twelve months.

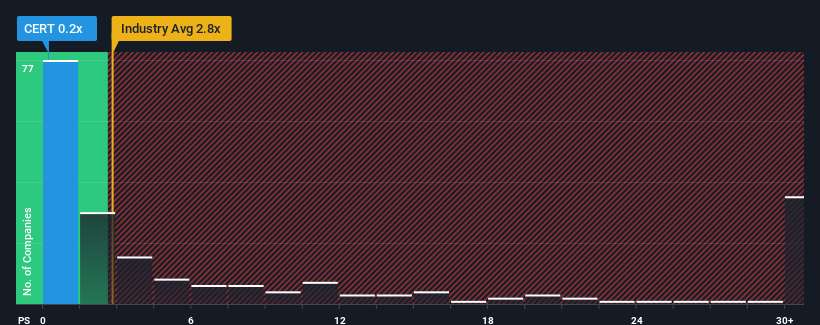

Even after such a large jump in price, Cerrado Gold may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 2.8x and even P/S higher than 16x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Cerrado Gold

How Has Cerrado Gold Performed Recently?

Cerrado Gold could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Cerrado Gold's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Cerrado Gold?

The only time you'd be truly comfortable seeing a P/S as depressed as Cerrado Gold's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 7.2% gain to the company's revenues. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 56% each year as estimated by the three analysts watching the company. With the industry only predicted to deliver 9.1% per year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Cerrado Gold is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Cerrado Gold's P/S?

Shares in Cerrado Gold have risen appreciably however, its P/S is still subdued. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Cerrado Gold's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Having said that, be aware Cerrado Gold is showing 5 warning signs in our investment analysis, and 2 of those are potentially serious.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CERT

Cerrado Gold

Operates as a gold mining and exploration company in Argentina and Canada.

Slight risk with acceptable track record.

Market Insights

Community Narratives