- Canada

- /

- Oil and Gas

- /

- TSXV:EOG

TSX Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

The Canadian market is currently navigating potential changes in U.S. tax policy that could significantly impact dividend withholding taxes, a development that investors should monitor closely. Amid these broader economic discussions, the allure of penny stocks remains strong for those seeking affordable investment opportunities with growth potential. While the term "penny stocks" might seem outdated, these smaller or newer companies can offer substantial value when they boast solid financials and clear growth prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.73 | CA$76.87M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.55 | CA$116.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.31 | CA$125.8M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.27 | CA$643.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$5.00 | CA$484.67M | ✅ 3 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.80 | CA$4.57M | ✅ 2 ⚠️ 5 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.79 | CA$168.18M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.59 | CA$558.14M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.60 | CA$133.49M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 901 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Hercules Metals (TSXV:BIG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hercules Metals Corp. is a junior mining company focused on the exploration and development of mineral properties in the United States, with a market cap of CA$170.11 million.

Operations: Hercules Metals Corp. currently has no reported revenue segments.

Market Cap: CA$170.11M

Hercules Metals Corp., a junior mining company with a market cap of CA$170.11 million, is currently pre-revenue and has no significant revenue streams. The company is actively pursuing its 2025 drilling campaign at the Hercules Project in Idaho, focusing on the Leviathan porphyry system. Recent developments include mobilizing additional drilling rigs to meet its 12,000-meter target and exploring high-priority zones based on a new 3D geological model. Despite these efforts, the company reported an increased net loss of CA$18.98 million for 2024 and faces auditor concerns about its ability to continue as a going concern due to financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Hercules Metals.

- Gain insights into Hercules Metals' historical outcomes by reviewing our past performance report.

Grid Battery Metals (TSXV:CELL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Grid Battery Metals Inc. is involved in the acquisition, exploration, and development of brine-based lithium and mineral resource properties in Canada and the United States, with a market cap of CA$15.46 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$15.46M

Grid Battery Metals Inc., with a market cap of CA$15.46 million, is pre-revenue and primarily focused on lithium exploration in North America. The company has experienced increased volatility and financial challenges, reporting a net loss of CA$1.55 million for Q3 2025, up from CA$0.82 million the previous year. Its cash runway is less than a year with free cash flow declining historically by 28.1% annually, raising concerns about sustainability without new funding or revenue streams. Despite an experienced management team and no debt obligations, the company's short-term financial outlook remains uncertain amidst ongoing losses and operational hurdles.

- Take a closer look at Grid Battery Metals' potential here in our financial health report.

- Review our historical performance report to gain insights into Grid Battery Metals' track record.

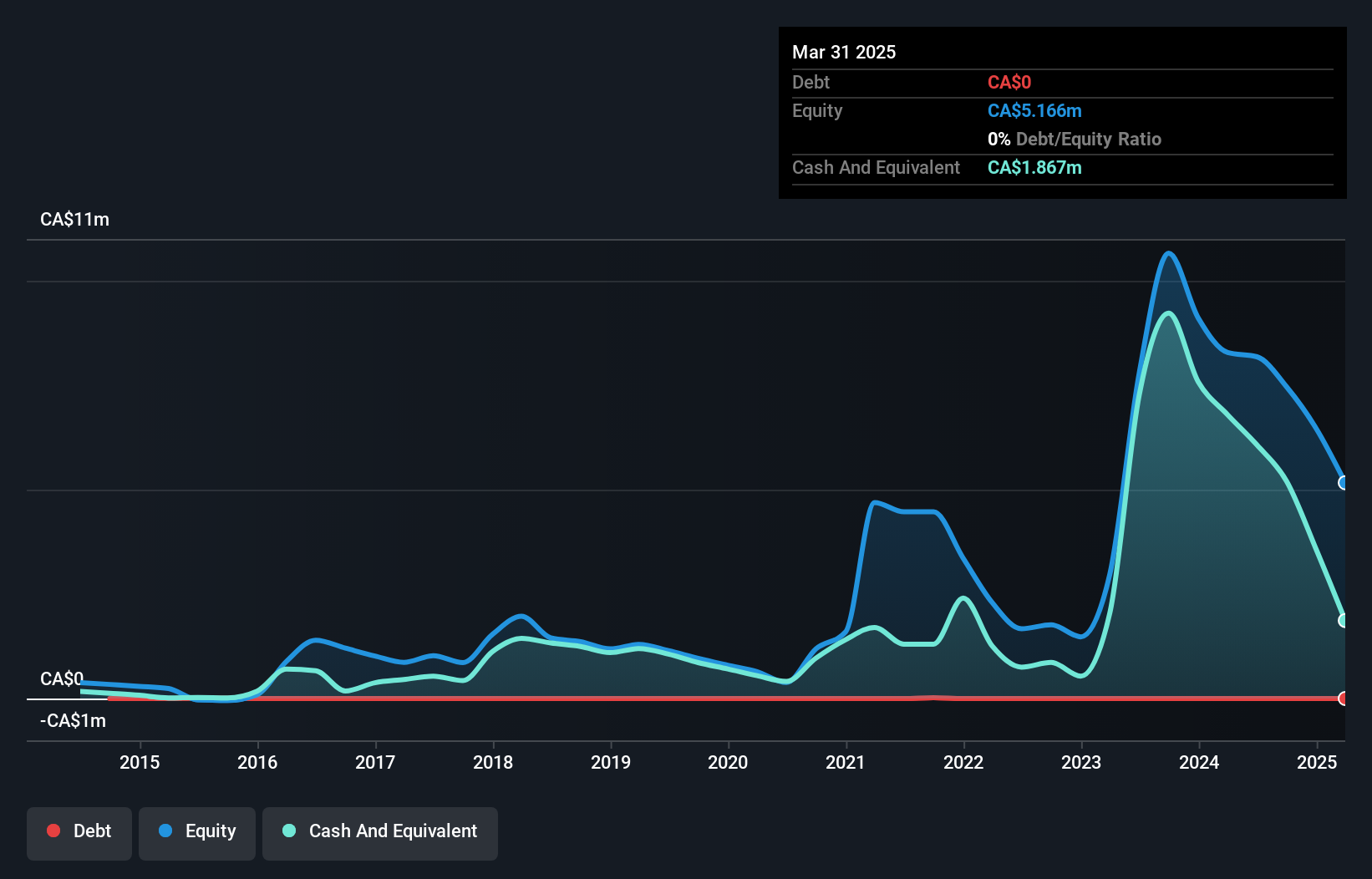

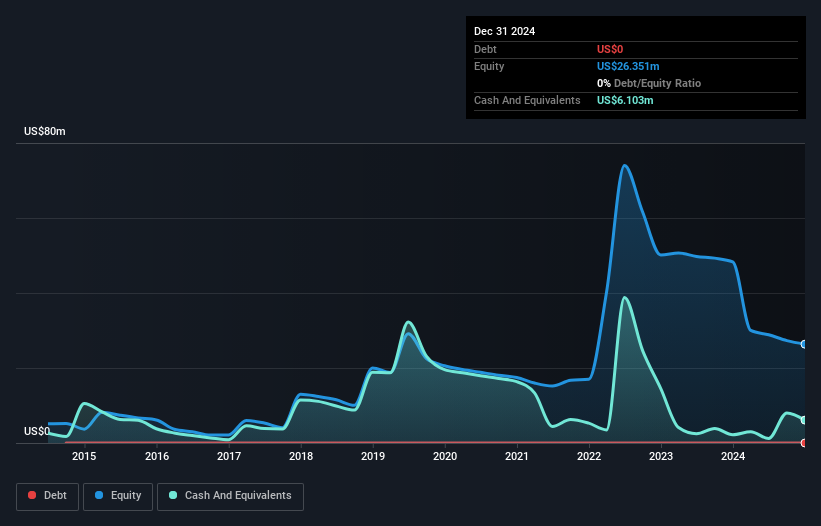

Eco (Atlantic) Oil & Gas (TSXV:EOG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Eco (Atlantic) Oil & Gas Ltd. focuses on the identification, acquisition, exploration, and development of petroleum, natural gas, and shale gas properties in Namibia and Guyana with a market cap of CA$61.47 million.

Operations: Eco (Atlantic) Oil & Gas Ltd. does not currently report distinct revenue segments.

Market Cap: CA$61.47M

Eco (Atlantic) Oil & Gas Ltd., with a market cap of CA$61.47 million, is pre-revenue and engaged in oil and gas exploration primarily in Namibia and Guyana. The company has no debt, but its cash runway is less than a year, raising concerns about financial sustainability without new funding or revenue streams. Recent developments include Eco's entry into Block 1 offshore South Africa through a Farm-In Agreement, acquiring substantial seismic data to enhance exploration prospects. While the company benefits from experienced board members and strategic asset positioning, it remains unprofitable with increasing losses over the past five years.

- Click here to discover the nuances of Eco (Atlantic) Oil & Gas with our detailed analytical financial health report.

- Evaluate Eco (Atlantic) Oil & Gas' prospects by accessing our earnings growth report.

Taking Advantage

- Jump into our full catalog of 901 TSX Penny Stocks here.

- Want To Explore Some Alternatives? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eco (Atlantic) Oil & Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:EOG

Eco (Atlantic) Oil & Gas

Engages in the identifying, acquiring, and exploring oil and gas assets in the Co-Operative Republic of Guyana, Republic of Namibia, and South Africa.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives