- Canada

- /

- Metals and Mining

- /

- TSXV:CDPR

Subdued Growth No Barrier To Cerro de Pasco Resources Inc. (CVE:CDPR) With Shares Advancing 32%

Cerro de Pasco Resources Inc. (CVE:CDPR) shares have continued their recent momentum with a 32% gain in the last month alone. The last month tops off a massive increase of 260% in the last year.

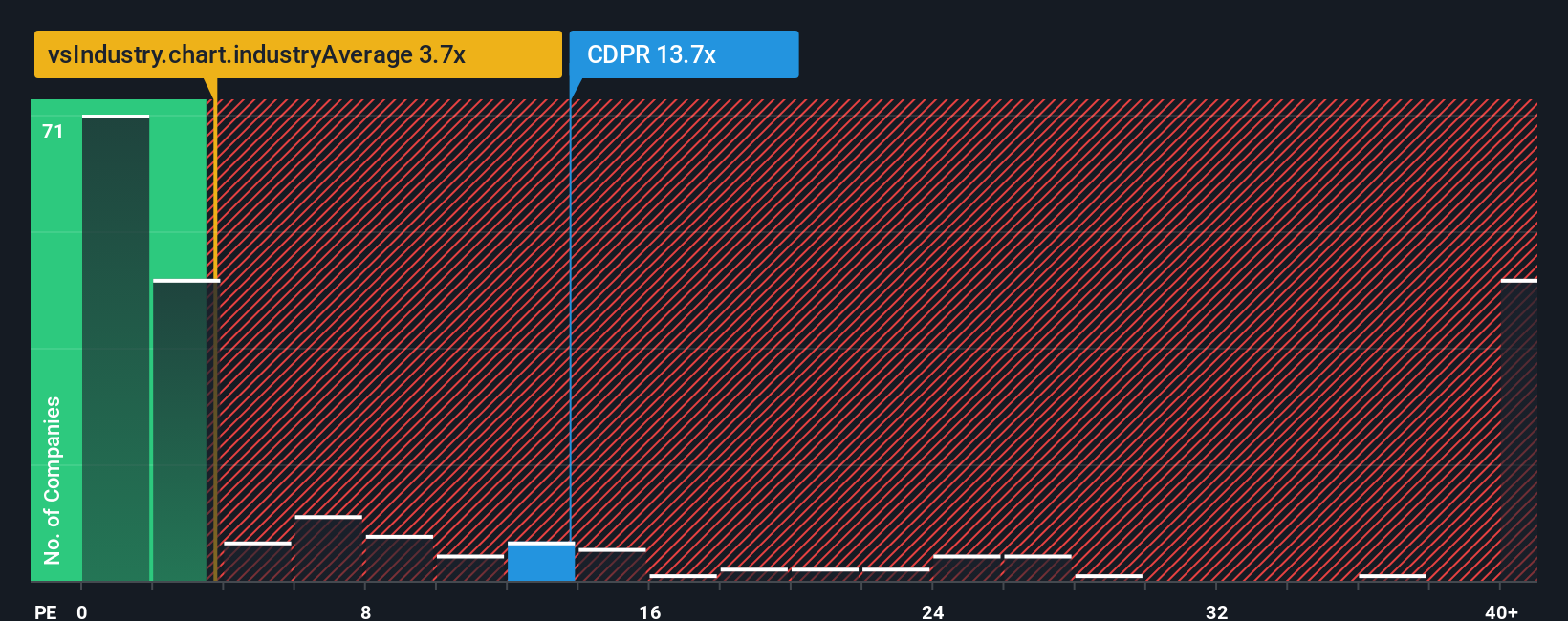

Since its price has surged higher, Cerro de Pasco Resources' price-to-sales (or "P/S") ratio of 13.7x might make it look like a strong sell right now compared to other companies in the Metals and Mining industry in Canada, where around half of the companies have P/S ratios below 3.7x and even P/S below 1.7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Cerro de Pasco Resources

How Cerro de Pasco Resources Has Been Performing

For example, consider that Cerro de Pasco Resources' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Cerro de Pasco Resources, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Cerro de Pasco Resources' Revenue Growth Trending?

In order to justify its P/S ratio, Cerro de Pasco Resources would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. Still, the latest three year period has seen an excellent 110% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 70% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Cerro de Pasco Resources is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

The strong share price surge has lead to Cerro de Pasco Resources' P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Cerro de Pasco Resources currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 2 warning signs for Cerro de Pasco Resources that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CDPR

Cerro de Pasco Resources

A natural resource company, engages in the acquisition, exploration, development, and reprocessing of mineral properties in Peru.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives