- Canada

- /

- Metals and Mining

- /

- TSX:ERD

TSX Penny Stocks To Consider In August 2025

Reviewed by Simply Wall St

The Canadian market is currently navigating a complex economic landscape, with inflationary pressures from tariffs potentially impacting goods prices, while services inflation shows signs of moderation. In this context, investors might find opportunities in the realm of penny stocks—an area that continues to hold potential despite its somewhat outdated terminology. These smaller or less-established companies can offer unique value and growth prospects, particularly when they demonstrate strong financial health and a clear path forward.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.69 | CA$69.79M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.15 | CA$110.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.735 | CA$488.99M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.97 | CA$201.5M | ✅ 2 ⚠️ 1 View Analysis > |

| Avino Silver & Gold Mines (TSX:ASM) | CA$4.45 | CA$646.16M | ✅ 3 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.68 | CA$158.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.88 | CA$179.49M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.51 | CA$8.62M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 439 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Erdene Resource Development (TSX:ERD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Erdene Resource Development Corporation is engaged in the exploration and development of precious and base metal deposits in Mongolia, with a market cap of CA$354.83 million.

Operations: Erdene Resource Development Corporation does not report any revenue segments as it is focused on the exploration and development of metal deposits in Mongolia.

Market Cap: CA$354.83M

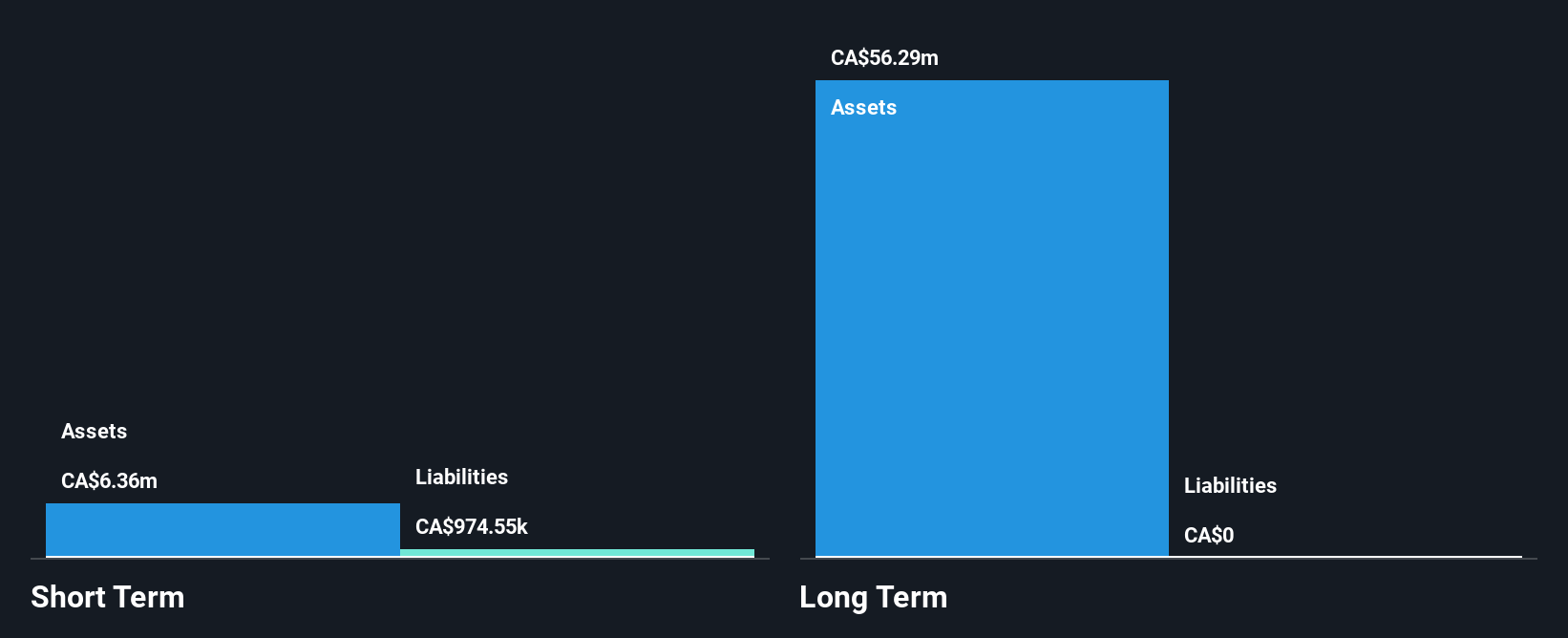

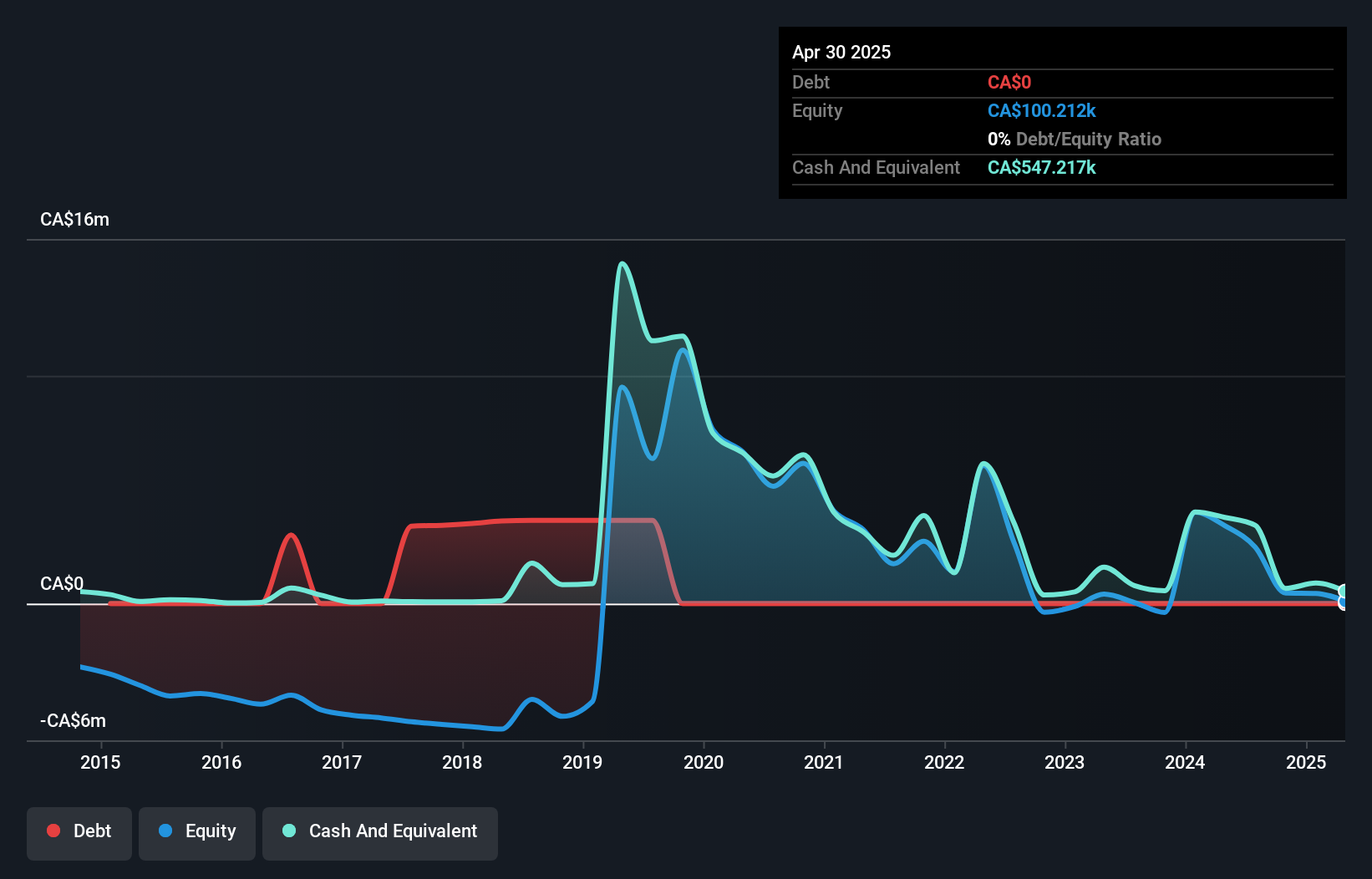

Erdene Resource Development Corporation, a pre-revenue entity focused on Mongolian metal exploration, is navigating its path with no current debt and sufficient cash runway for over a year. Recent strategic moves include an option agreement to acquire up to 80% of the Tereg Uul copper-gold prospect, potentially expanding its asset base near the prolific Oyu Tolgoi deposit. While unprofitable, Erdene has been reducing losses annually by 11.7%, supported by a seasoned management team with an average tenure of 14.5 years. The company maintains financial stability with short-term assets significantly exceeding liabilities and no meaningful shareholder dilution recently observed.

- Dive into the specifics of Erdene Resource Development here with our thorough balance sheet health report.

- Evaluate Erdene Resource Development's historical performance by accessing our past performance report.

Cantex Mine Development (TSXV:CD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cantex Mine Development Corp. is involved in the acquisition, exploration, and development of mineral properties mainly in Canada, Yemen, and the United States, with a market cap of CA$23.57 million.

Operations: Cantex Mine Development Corp. has not reported any revenue segments.

Market Cap: CA$23.57M

Cantex Mine Development Corp., a pre-revenue company focused on mineral exploration, recently announced a non-brokered private placement to raise up to CA$3 million, enhancing its financial flexibility. Despite being debt-free, the company faces challenges with short-term assets of CA$584.8K not covering long-term liabilities of CA$650.4K. With a negative return on equity and unprofitable status, Cantex's earnings have declined by 0.8% annually over five years. Nonetheless, its board is experienced with an average tenure of 22.3 years, and recent capital raising efforts could support ongoing operations and exploration activities in Canada and beyond.

- Unlock comprehensive insights into our analysis of Cantex Mine Development stock in this financial health report.

- Review our historical performance report to gain insights into Cantex Mine Development's track record.

Pivotree (TSXV:PVT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pivotree Inc. designs, integrates, deploys, and manages digital platforms for commerce, data management, and supply chain solutions globally for retail and branded manufacturers with a market cap of CA$37.24 million.

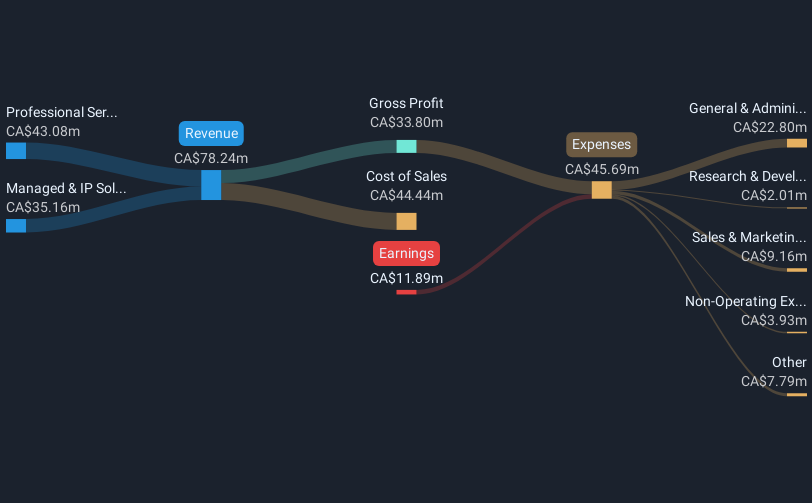

Operations: The company's revenue is derived from Professional Services, generating CA$42.71 million, and Managed & IP Solutions (MIPS) & Legacy Managed Services (LMS), contributing CA$33.76 million.

Market Cap: CA$37.24M

Pivotree Inc. has shown resilience despite reporting a slight decline in first-quarter sales to CA$19.16 million from CA$20.93 million the previous year, while achieving a net income of CA$0.23 million, reversing a prior loss. The company remains unprofitable with increasing losses over five years but enjoys financial stability with sufficient cash runway for over three years and no debt burden, as well as strong asset coverage for liabilities. Trading at 37% below its estimated fair value, Pivotree benefits from an experienced management team and board, positioning it well within the competitive digital platform sector in Canada.

- Take a closer look at Pivotree's potential here in our financial health report.

- Assess Pivotree's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Jump into our full catalog of 439 TSX Penny Stocks here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erdene Resource Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ERD

Erdene Resource Development

Focuses on the exploration and development of precious and base metal deposits in Mongolia.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives