- Canada

- /

- Metals and Mining

- /

- TSXV:CAF

TSX Penny Stocks With Market Caps Over CA$5M To Consider

Reviewed by Simply Wall St

The Canadian market is currently navigating a landscape where mega-cap tech companies are transitioning from asset-light to more asset-heavy models, driven by substantial investments in data centers and AI infrastructure. Amid these shifts, diversification remains crucial, and investors might find opportunities beyond the dominant technology sectors. Penny stocks—though an older term—still capture the essence of investing in smaller or newer companies that can offer significant value when backed by strong financials. In this article, we explore several penny stocks that combine balance sheet strength with long-term potential for growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.08 | CA$53.09M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.73 | CA$174.3M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.32 | CA$49.57M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.105 | CA$791.7M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.15 | CA$18.63M | ✅ 2 ⚠️ 4 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.16 | CA$945.72M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.81 | CA$144.65M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.17 | CA$208.34M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.73 | CA$9.96M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 413 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Canaf Investments (TSXV:CAF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Canaf Investments Inc. operates a coal processing business in South Africa and has a market cap of CA$15.65 million.

Operations: Canaf Investments Inc. has not reported any specific revenue segments.

Market Cap: CA$15.65M

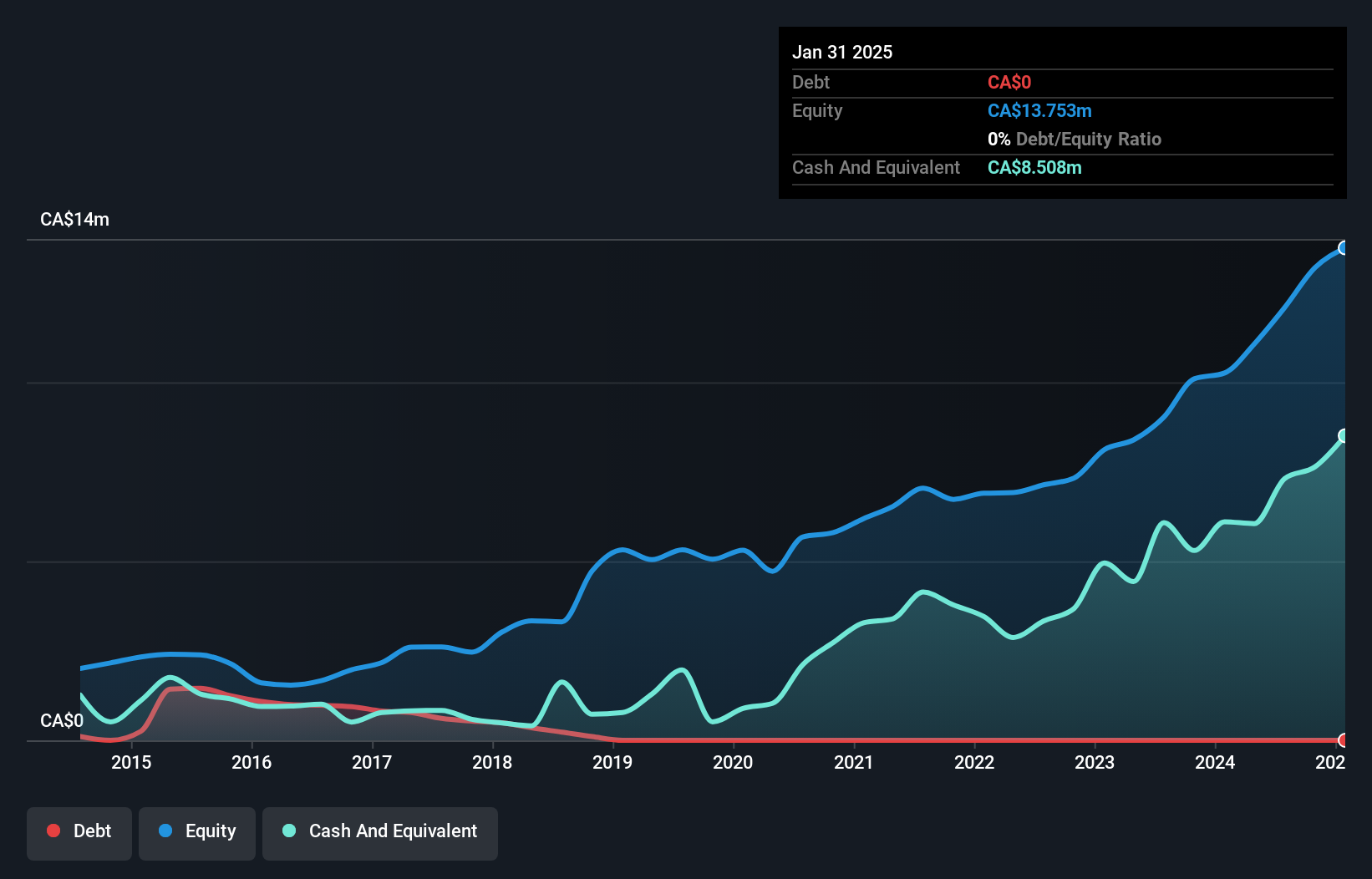

Canaf Investments Inc. has demonstrated consistent earnings growth, averaging 27% annually over the past five years, though recent growth slowed to 3.3%. The company's net profit margins improved from 6.6% to 8.7% year-over-year, and it maintains a strong financial position with no debt and short-term assets of CA$13.9M exceeding liabilities significantly. Despite trading at a substantial discount to its estimated fair value, Canaf's earnings did not outperform the broader Metals and Mining industry last year. Recent results showed sales of CA$20.51 million for nine months ending July 2025, with net income rising to CA$1.82 million from the previous year's CA$1.52 million.

- Dive into the specifics of Canaf Investments here with our thorough balance sheet health report.

- Evaluate Canaf Investments' historical performance by accessing our past performance report.

Imaflex (TSXV:IFX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Imaflex Inc. develops, manufactures, and sells flexible packaging materials for agriculture and packaging industries across Canada, the United States, and internationally, with a market cap of CA$56.78 million.

Operations: The company's revenue of CA$108.94 million is generated from its operations in the development, manufacturing, and sale of flexible packaging materials.

Market Cap: CA$56.78M

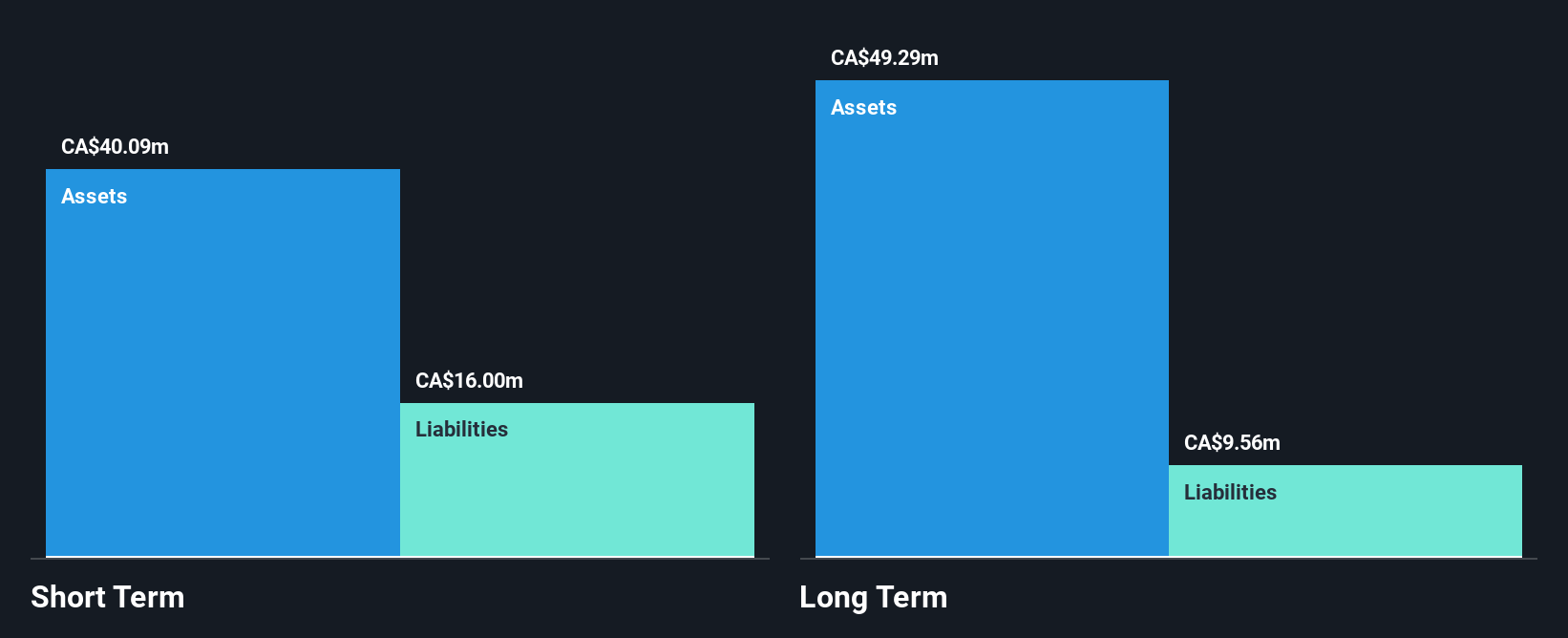

Imaflex Inc. maintains a solid financial position with no debt and short-term assets of CA$40.1 million exceeding both short and long-term liabilities, providing stability in the volatile penny stock market. Despite this, the company faces challenges with declining earnings, reporting a net loss for the recent quarter compared to a profit last year, and lower net profit margins at 2.1% from 4.3%. While trading significantly below its estimated fair value suggests potential upside, revenue growth is modest at 9.46% annually amid negative earnings trends over recent periods, highlighting risks for investors seeking growth in this sector.

- Unlock comprehensive insights into our analysis of Imaflex stock in this financial health report.

- Review our growth performance report to gain insights into Imaflex's future.

InZinc Mining (TSXV:IZN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: InZinc Mining Ltd. is a company focused on acquiring, exploring, and developing mineral properties in Canada, with a market cap of CA$5.55 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$5.55M

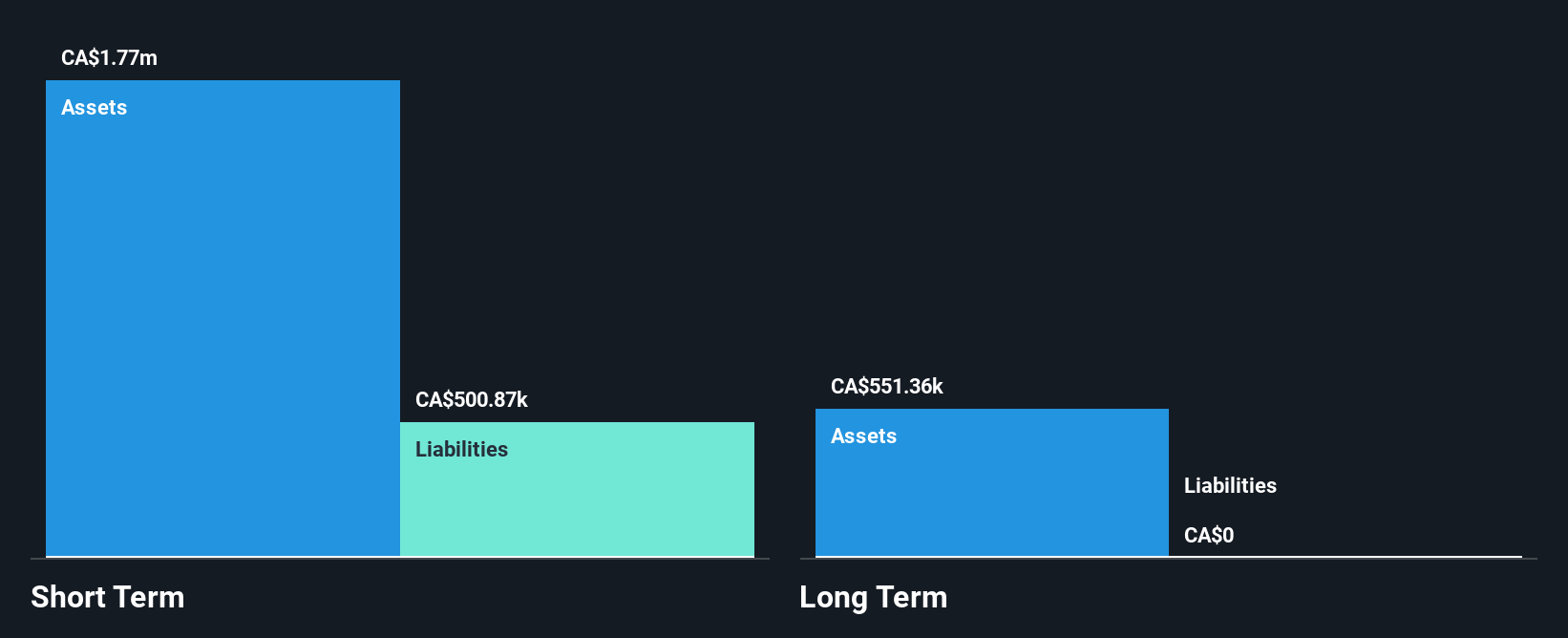

InZinc Mining Ltd., with a market cap of CA$5.55 million, is pre-revenue and debt-free, focusing on mineral exploration at its Indy project in British Columbia. Recent drilling has significantly extended the B-9 Zone to over 1000 meters in strike length, revealing promising zinc-lead-silver-gallium-barite mineralization close to surface. Despite high volatility and no revenues yet, InZinc's cash runway exceeds three years, offering some financial stability for ongoing exploration efforts. The seasoned board supports strategic direction as further exploration continues along open trends and depths at the Indy site, potentially unlocking value if substantial resources are confirmed.

- Click here to discover the nuances of InZinc Mining with our detailed analytical financial health report.

- Gain insights into InZinc Mining's past trends and performance with our report on the company's historical track record.

Next Steps

- Jump into our full catalog of 413 TSX Penny Stocks here.

- Contemplating Other Strategies? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CAF

Canaf Investments

Owns and operates a coal processing business in South Africa.

Flawless balance sheet and good value.

Market Insights

Community Narratives