- Canada

- /

- Energy Services

- /

- TSX:CFW

3 TSX Penny Stocks With Market Caps Under CA$500M To Consider

Reviewed by Simply Wall St

As the Canadian economy navigates a period of cooling labor markets and potential rate cuts by the Bank of Canada, investors are keeping a close eye on opportunities that may arise in this evolving landscape. Penny stocks, often representing smaller or newer companies, continue to capture interest due to their unique potential for growth at lower price points. In this article, we explore three such penny stocks that stand out for their financial resilience and promise as under-the-radar investment opportunities.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.65 | CA$593.32M | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$4.98 | CA$177.56M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.75 | CA$283.52M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$121.66M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$223.64M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.40 | CA$11.46M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.66M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.42 | CA$319.6M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$4.06 | CA$208.42M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.16 | CA$128.59M | ★★★★☆☆ |

Click here to see the full list of 960 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Calfrac Well Services (TSX:CFW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Calfrac Well Services Ltd., along with its subsidiaries, offers specialized oilfield services in Canada, the United States, and Argentina, with a market cap of CA$330.32 million.

Operations: The company generates revenue of CA$1.66 billion from its oil well equipment and services segment.

Market Cap: CA$330.32M

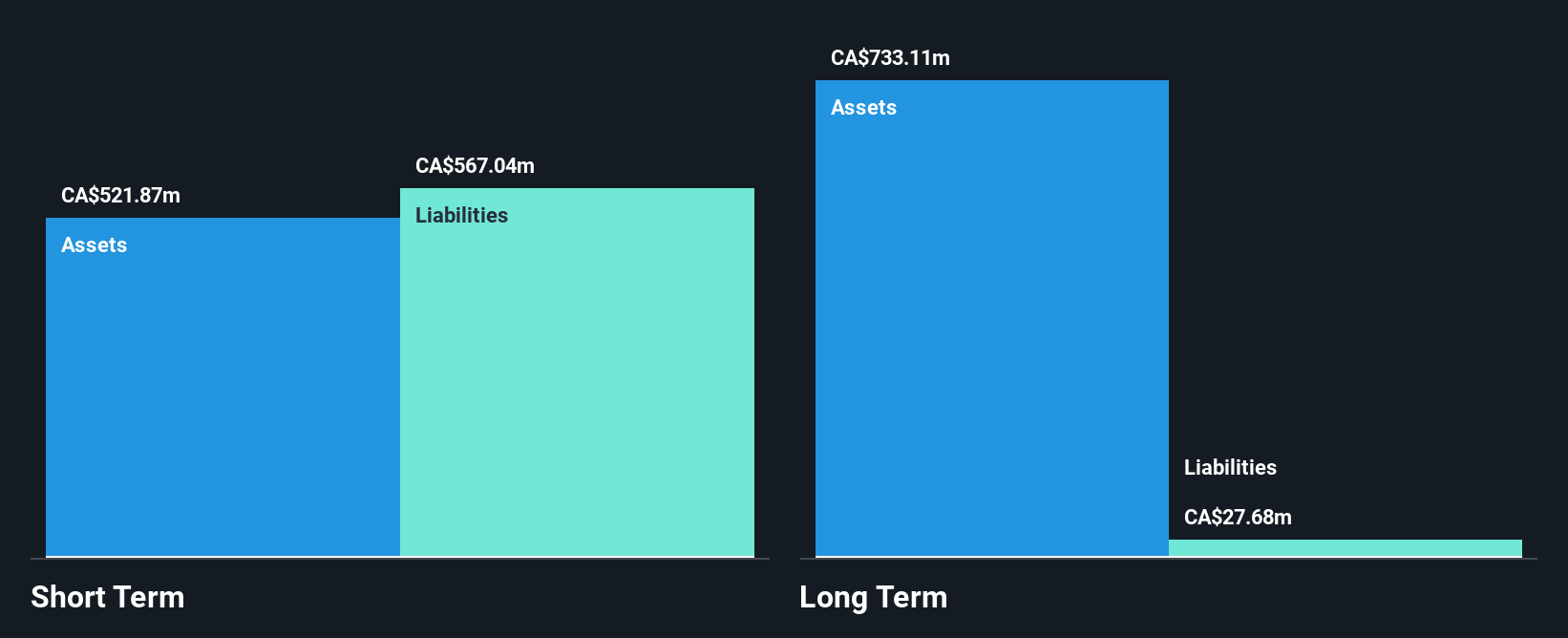

Calfrac Well Services Ltd., with a market cap of CA$330.32 million, faces challenges typical of penny stocks, such as high debt levels and recent shareholder dilution. Despite achieving profitability over the past five years, recent financial results show declining sales and earnings compared to the previous year. The company's net income for the second quarter was CA$23.09 million, down from CA$53.26 million a year ago, reflecting broader industry pressures. While its debt is well covered by cash flow and interest payments are manageable, ongoing impairments suggest caution for potential investors considering Calfrac's volatile performance in an unpredictable sector.

- Unlock comprehensive insights into our analysis of Calfrac Well Services stock in this financial health report.

- Gain insights into Calfrac Well Services' outlook and expected performance with our report on the company's earnings estimates.

Thinkific Labs (TSX:THNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thinkific Labs Inc. develops, markets, and supports a cloud-based platform in Canada, the United States, and internationally with a market cap of CA$176.27 million.

Operations: The company's revenue segment comprises $62.70 million from the development, marketing, and support management of its cloud-based platform.

Market Cap: CA$176.27M

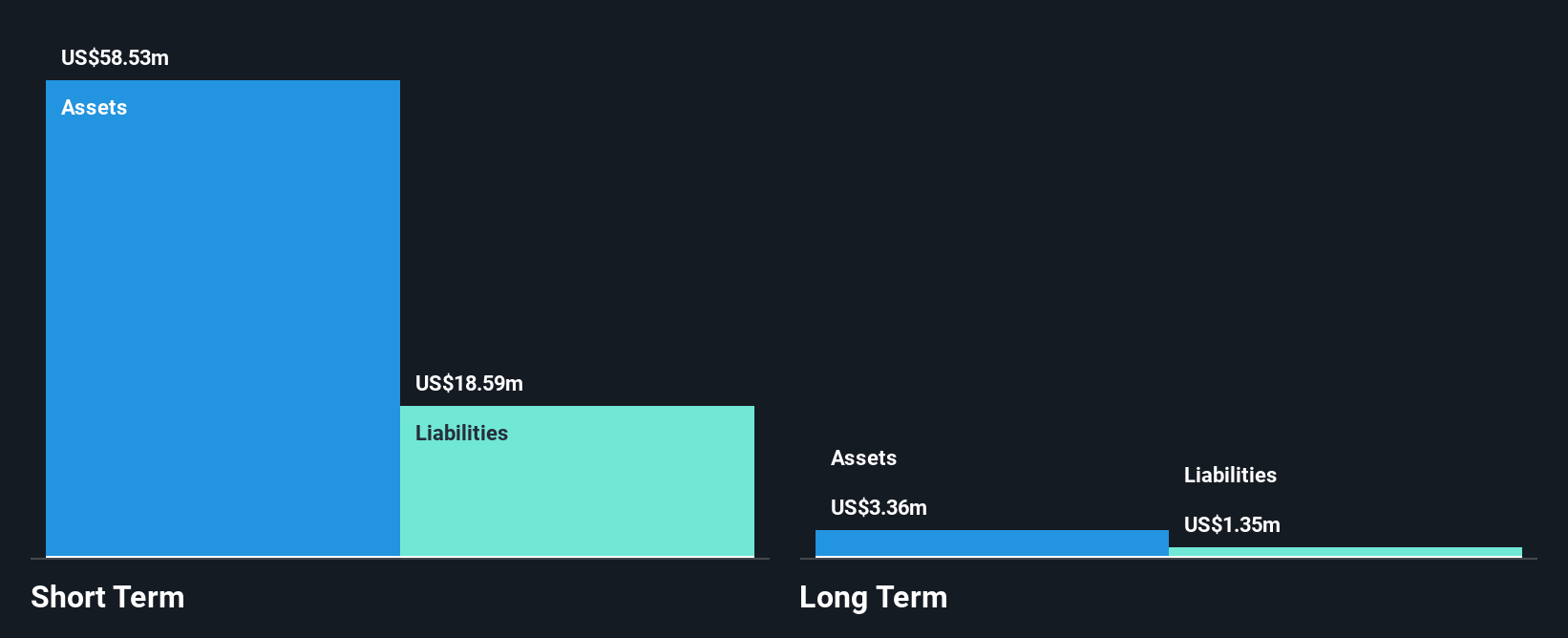

Thinkific Labs Inc., with a market cap of CA$176.27 million, demonstrates characteristics common to penny stocks, including recent management and board changes and an unprofitable status. However, the company shows potential with forecasted revenue growth of 13.77% annually despite expected earnings declines. Recent financial results indicate improvement, with second-quarter sales increasing to US$16.21 million from US$14.44 million the previous year and a net income turnaround to US$0.93 million from a loss of US$2.14 million. Thinkific's strong cash position supports its operations for over three years without significant shareholder dilution or debt concerns.

- Click to explore a detailed breakdown of our findings in Thinkific Labs' financial health report.

- Review our growth performance report to gain insights into Thinkific Labs' future.

Colonial Coal International (TSXV:CAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Colonial Coal International Corp. focuses on acquiring, exploring, and developing coal properties in Canada, with a market cap of CA$414.24 million.

Operations: Colonial Coal International Corp. has not reported any revenue segments.

Market Cap: CA$414.24M

Colonial Coal International Corp., with a market cap of CA$414.24 million, is pre-revenue and currently unprofitable, reporting a net loss of CA$5.57 million for the year ended July 31, 2024. Despite this, the company benefits from being debt-free and having no long-term liabilities. Its seasoned management team averages over 14 years of tenure, and its board members also bring extensive experience. The firm has not diluted shareholders significantly in the past year and maintains sufficient cash to support operations for more than three years based on current free cash flow trends.

- Navigate through the intricacies of Colonial Coal International with our comprehensive balance sheet health report here.

- Assess Colonial Coal International's previous results with our detailed historical performance reports.

Summing It All Up

- Access the full spectrum of 960 TSX Penny Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CFW

Calfrac Well Services

Provides specialized oilfield services in Canada, the United States, and Argentina.

Undervalued with adequate balance sheet.