- Canada

- /

- Metals and Mining

- /

- TSXV:GMA

Aston Bay Holdings And 2 Other TSX Penny Stocks To Watch

Reviewed by Simply Wall St

As we head into the second half of 2025, Canada's market is closely watching developments in trade negotiations, particularly between the U.S. and China, which could have significant implications for economic growth and inflation. In this context, investors may find opportunities in penny stocks—an investment area that still holds relevance despite its somewhat outdated terminology. These smaller or newer companies can offer a mix of affordability and growth potential when built on solid financials, presenting a chance to uncover hidden value amidst broader market uncertainties.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.69 | CA$624.3M | ✅ 3 ⚠️ 4 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.41 | CA$743.85M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.52 | CA$190.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.6M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.81 | CA$538.89M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.90 | CA$17.84M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.20 | CA$93.91M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.12 | CA$121.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$186.9M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.95 | CA$5.42M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 882 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Aston Bay Holdings (TSXV:BAY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aston Bay Holdings Ltd. is engaged in acquiring and exploring resource properties in the United States and Canada, with a market cap of CA$20.24 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$20.24M

Aston Bay Holdings is a pre-revenue exploration company with a market cap of CA$20.24 million, focusing on resource properties in North America. Recent developments include the commencement of drilling at the Storm Copper Project in Nunavut, where Aston Bay holds a 20% interest in partnership with American West Metals. The project targets high-grade copper mineralization, with promising drill results indicating potential for significant resource expansion. Despite its debt-free status and experienced board, Aston Bay faces challenges such as limited cash runway and high share price volatility, common traits among early-stage exploration ventures lacking consistent revenue streams.

- Get an in-depth perspective on Aston Bay Holdings' performance by reading our balance sheet health report here.

- Evaluate Aston Bay Holdings' historical performance by accessing our past performance report.

Geomega Resources (TSXV:GMA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Geomega Resources Inc. is involved in the acquisition, evaluation, and exploration of mining properties in Canada, with a market cap of CA$25.81 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$25.81M

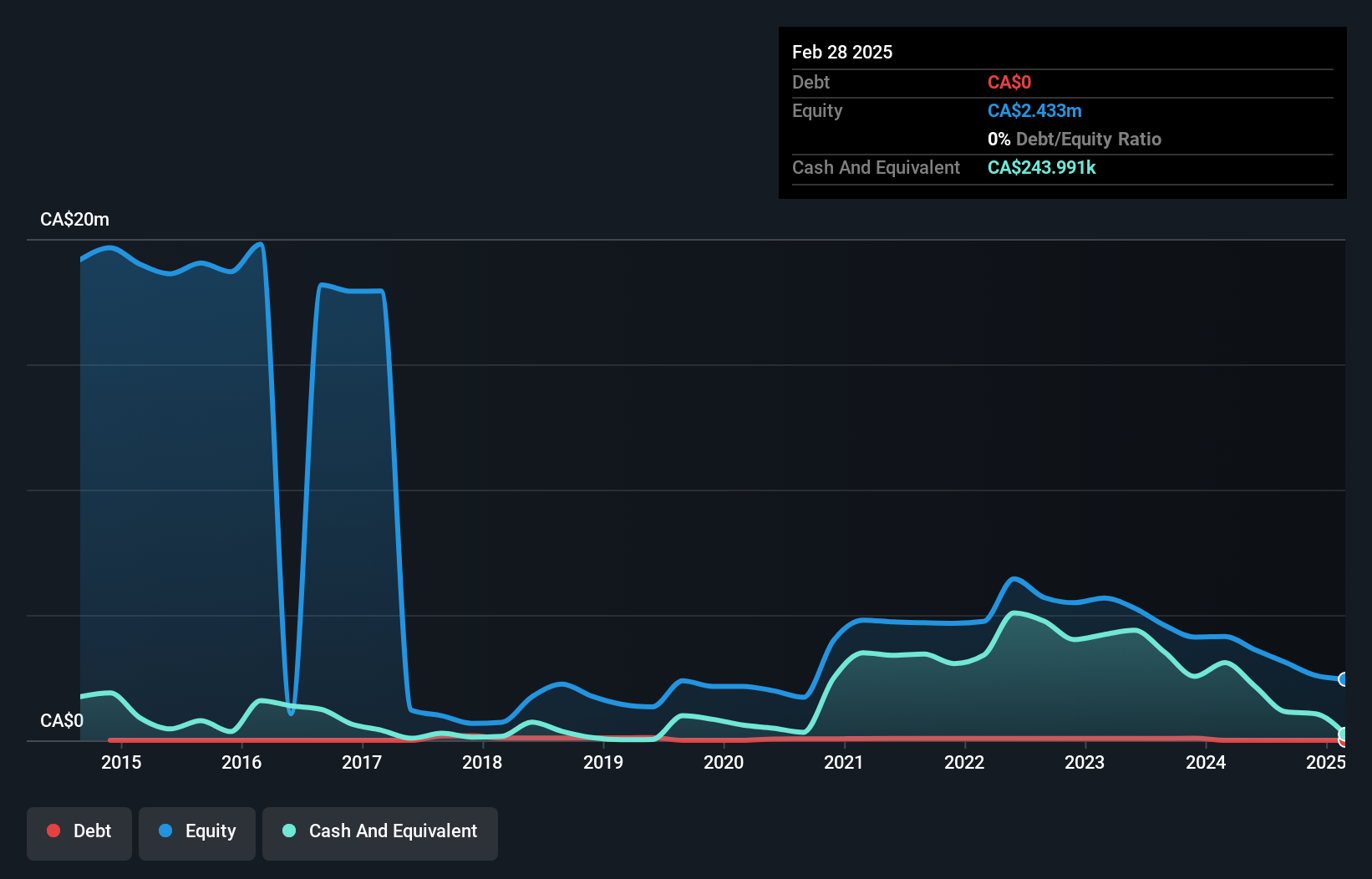

Geomega Resources, with a market cap of CA$25.81 million, is a pre-revenue company focused on innovative rare earth element extraction technologies. Recent updates highlight significant progress in constructing its rare earth magnet recycling plant in Quebec, aiming for completion by late 2025. The company remains debt-free and has experienced leadership but faces challenges typical of early-stage ventures, such as high share price volatility and limited cash runway despite recent capital raising efforts. Geomega's strategic partnerships and advancements in waste valorization technology underscore its commitment to sustainable resource management and potential future revenue streams from these initiatives.

- Click to explore a detailed breakdown of our findings in Geomega Resources' financial health report.

- Understand Geomega Resources' track record by examining our performance history report.

Cannara Biotech (TSXV:LOVE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cannara Biotech Inc., along with its subsidiaries, focuses on the indoor cultivation, processing, and sale of cannabis and cannabis-derived products in Canada, with a market cap of CA$112.46 million.

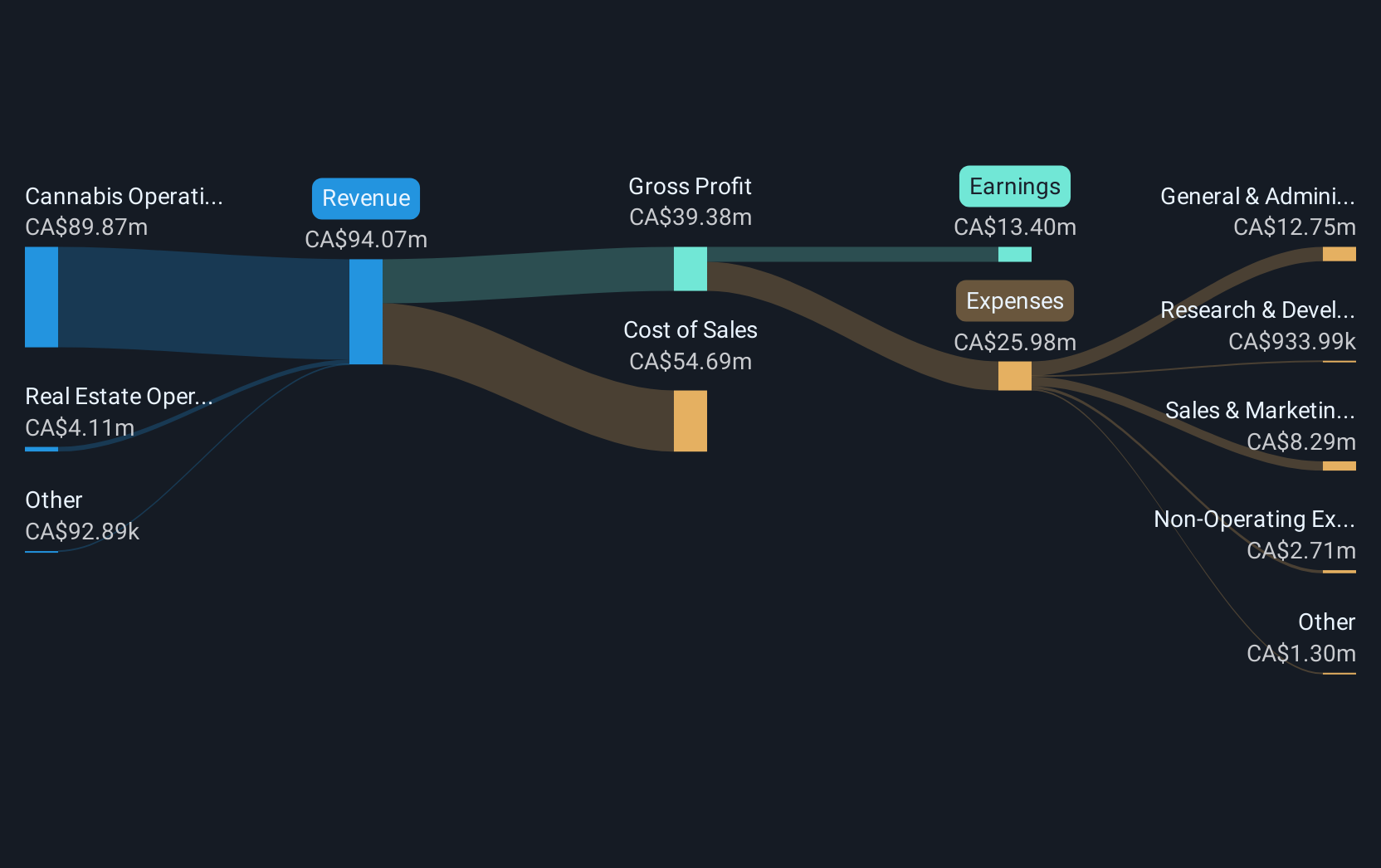

Operations: The company generates revenue from its cannabis operations, totaling CA$89.87 million, and real estate operations, contributing CA$4.11 million.

Market Cap: CA$112.46M

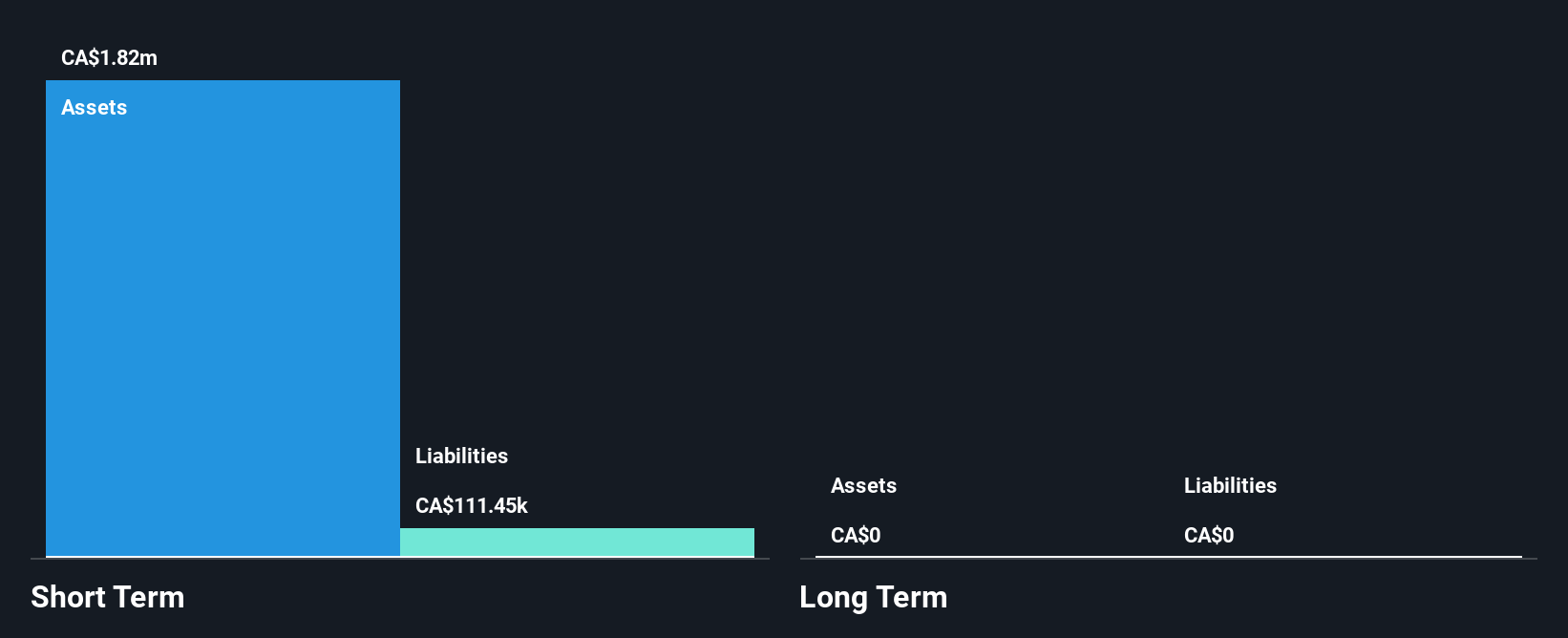

Cannara Biotech, with a market cap of CA$112.46 million, has shown significant financial improvement, reporting a net income of CA$3.31 million for Q2 2025 compared to a loss the previous year. Revenue rose to CA$26.59 million from CA$19.68 million year-over-year, reflecting growth in its cannabis operations despite high debt levels and one-off gains impacting results. The company’s debt is well covered by operating cash flow, and its price-to-earnings ratio suggests it may be undervalued relative to the Canadian market average. Recent board additions bring seasoned leadership aimed at strategic growth and operational efficiency improvements.

- Jump into the full analysis health report here for a deeper understanding of Cannara Biotech.

- Review our historical performance report to gain insights into Cannara Biotech's track record.

Next Steps

- Explore the 882 names from our TSX Penny Stocks screener here.

- Ready For A Different Approach? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GMA

Geomega Resources

Engages in the acquisition, evaluation, and exploration of mining properties in Canada.

Slight risk with worrying balance sheet.

Market Insights

Community Narratives