- Canada

- /

- Communications

- /

- TSXV:CMI

TSX Penny Stocks To Consider In November 2025

Reviewed by Simply Wall St

As Canadian markets brush off Halloween jitters and close October near record highs, investors are navigating a landscape shaped by cautious central bank policies and easing trade tensions. In this context, penny stocks remain an intriguing investment area, offering opportunities in smaller or newer companies that can blend affordability with growth potential. By focusing on those with strong financials and clear growth paths, investors may uncover promising candidates for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.59 | CA$65.48M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.37 | CA$238.78M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.40 | CA$3.34M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.375 | CA$56.33M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.06 | CA$705.22M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.13 | CA$22.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.94 | CA$149.22M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.13 | CA$201.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.75 | CA$9.33M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 410 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Roots (TSX:ROOT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Roots Corporation, along with its subsidiaries, designs, markets, and sells apparel, leather goods, footwear, and accessories under the Roots brand in Canada and internationally with a market cap of CA$128.74 million.

Operations: The company's revenue is primarily generated through its Direct-To-Consumer segment, which accounts for CA$231.09 million, and its Partners and Other segment, contributing CA$37.37 million.

Market Cap: CA$128.74M

Roots Corporation, with a market cap of CA$128.74 million, has been focusing on enhancing its retail presence in Canada through store refreshes and new concept stores. Despite reporting a net loss of CA$4.39 million for the second quarter of 2025, Roots showed improved sales compared to the previous year. The company has reduced its debt-to-equity ratio significantly over five years and maintains a satisfactory net debt level at 26.9%. While unprofitable, Roots benefits from a sufficient cash runway exceeding three years and stable weekly volatility over the past year, trading below estimated fair value without significant shareholder dilution recently.

- Dive into the specifics of Roots here with our thorough balance sheet health report.

- Understand Roots' earnings outlook by examining our growth report.

BCM Resources (TSXV:B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BCM Resources Corporation is involved in the acquisition, exploration, and development of mineral properties in Canada, with a market cap of CA$24.69 million.

Operations: No specific revenue segments have been reported for the company.

Market Cap: CA$24.69M

BCM Resources, with a market cap of CA$24.69 million, is pre-revenue and currently unprofitable, as indicated by its negative return on equity of -3.22%. The company has no long-term liabilities and its short-term assets match its short-term liabilities at CA$2.4 million. BCM Resources remains debt-free and boasts an experienced board with an average tenure of 8.4 years. Despite increasing losses over the past five years at 28.6% annually, the company has a sufficient cash runway for over three years based on current free cash flow trends, offering some financial stability amidst volatility reduction in recent months.

- Navigate through the intricacies of BCM Resources with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into BCM Resources' track record.

C-Com Satellite Systems (TSXV:CMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: C-Com Satellite Systems Inc. designs, develops, manufactures, and sells transportable and mobile satellite-based antenna systems internationally, with a market cap of CA$38.45 million.

Operations: The company's revenue is primarily derived from the design and manufacture of auto-deploying mobile satellite antennas, amounting to CA$5.57 million.

Market Cap: CA$38.45M

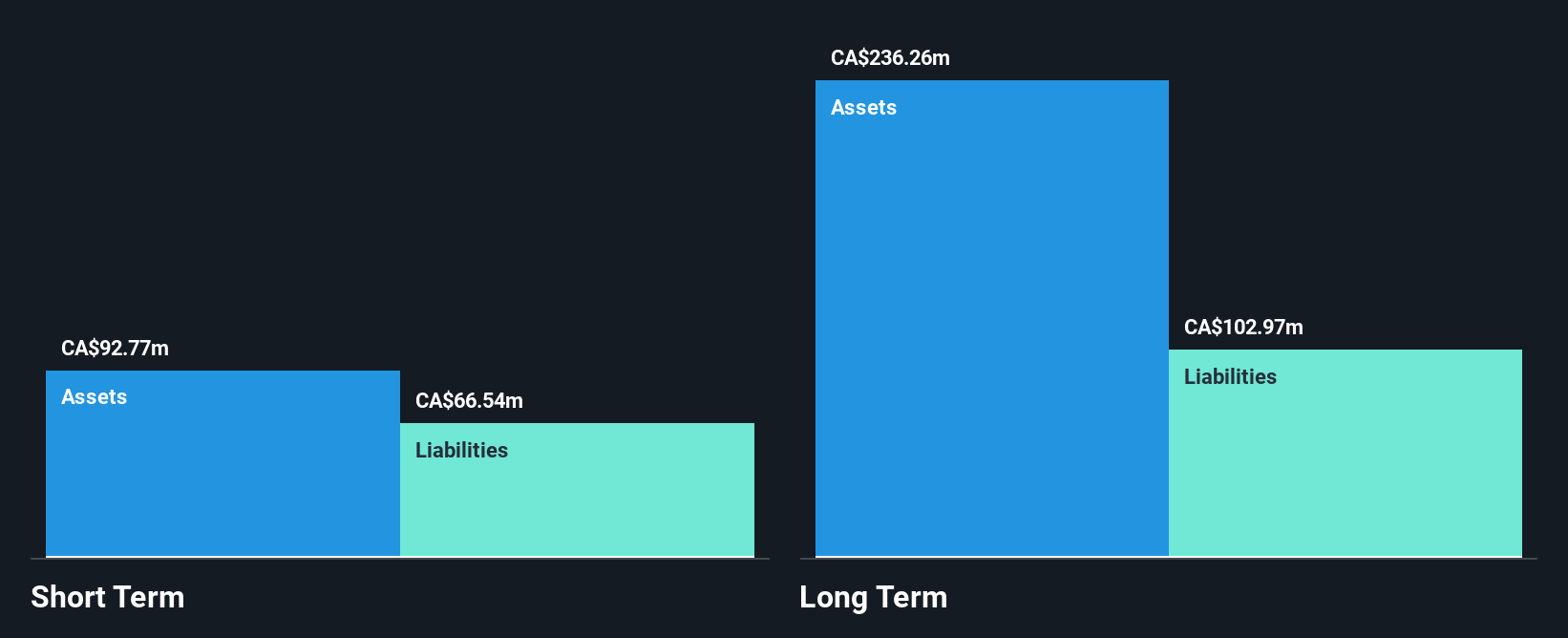

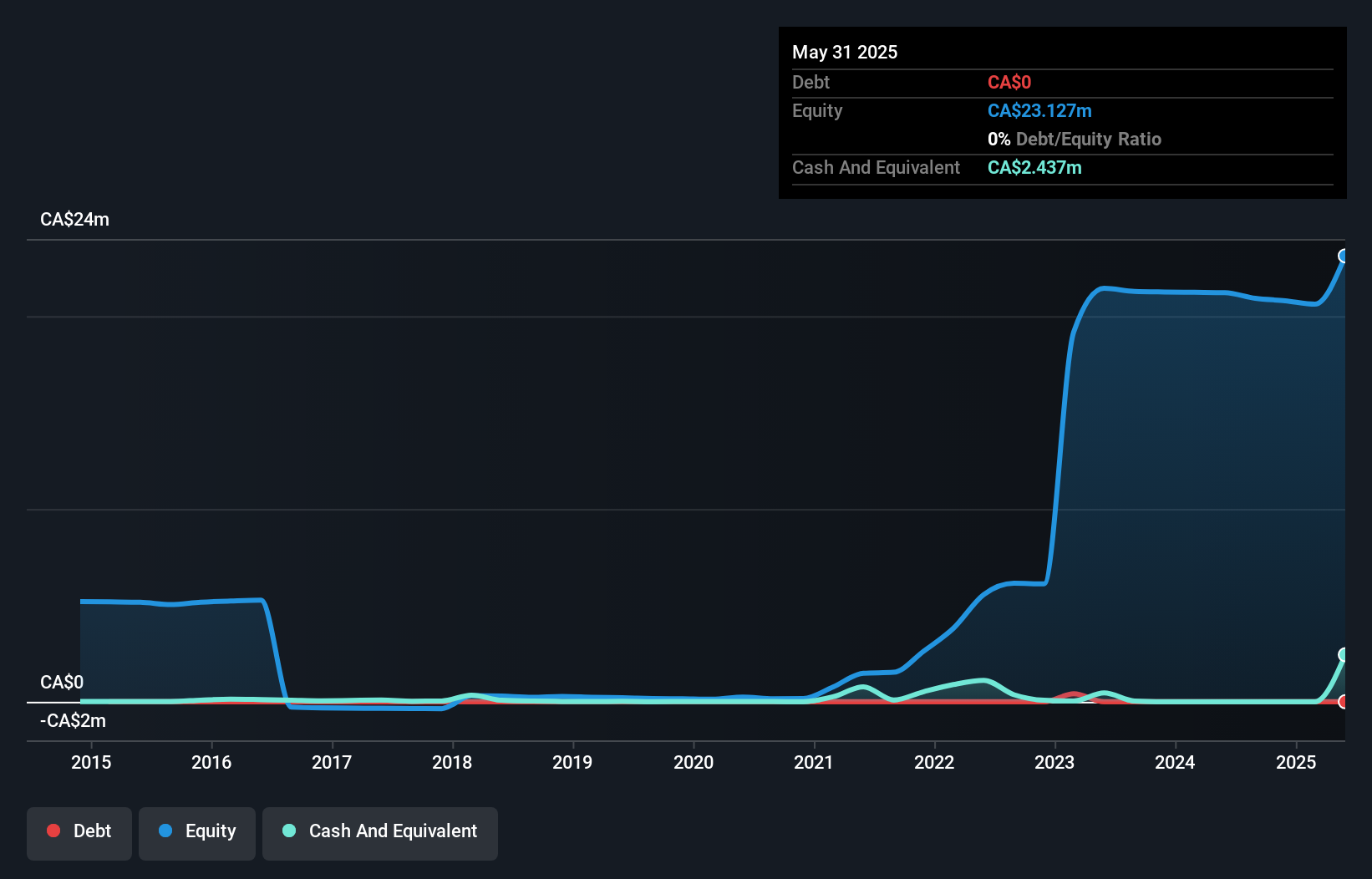

C-Com Satellite Systems, with a market cap of CA$38.45 million, focuses on mobile satellite antennas and reported CA$1.93 million in third-quarter sales, up from CA$1.32 million the previous year. Despite this growth, it remains unprofitable with a net loss of CA$0.44 million for the nine months ending August 2025. The company is debt-free and has substantial short-term assets (CA$24.4M) exceeding its liabilities, indicating financial stability despite earnings volatility over five years at 27.3% annually. Its experienced management team and board offer strategic guidance as it navigates industry challenges without meaningful revenue growth yet achieved.

- Click to explore a detailed breakdown of our findings in C-Com Satellite Systems' financial health report.

- Learn about C-Com Satellite Systems' historical performance here.

Where To Now?

- Gain an insight into the universe of 410 TSX Penny Stocks by clicking here.

- Contemplating Other Strategies? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CMI

C-Com Satellite Systems

Designs, develops, manufactures, and sells transportable and mobile satellite-based antenna systems in Canada, Indonesia, Brazil, the United States, Bangladesh, Kazakhstan, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives