- Canada

- /

- Metals and Mining

- /

- TSXV:AZM

Increases to CEO Compensation Might Be Put On Hold For Now at Azimut Exploration Inc. (CVE:AZM)

Key Insights

- Azimut Exploration to hold its Annual General Meeting on 20th of February

- Salary of CA$340.0k is part of CEO Jean-Marc Lulin's total remuneration

- Total compensation is 112% above industry average

- Azimut Exploration's EPS declined by 51% over the past three years while total shareholder loss over the past three years was 59%

In the past three years, the share price of Azimut Exploration Inc. (CVE:AZM) has struggled to grow and now shareholders are sitting on a loss. Per share earnings growth is also lacking, despite revenue growth. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 20th of February, where they can impact on future company performance by voting on resolutions, including executive compensation. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

See our latest analysis for Azimut Exploration

Comparing Azimut Exploration Inc.'s CEO Compensation With The Industry

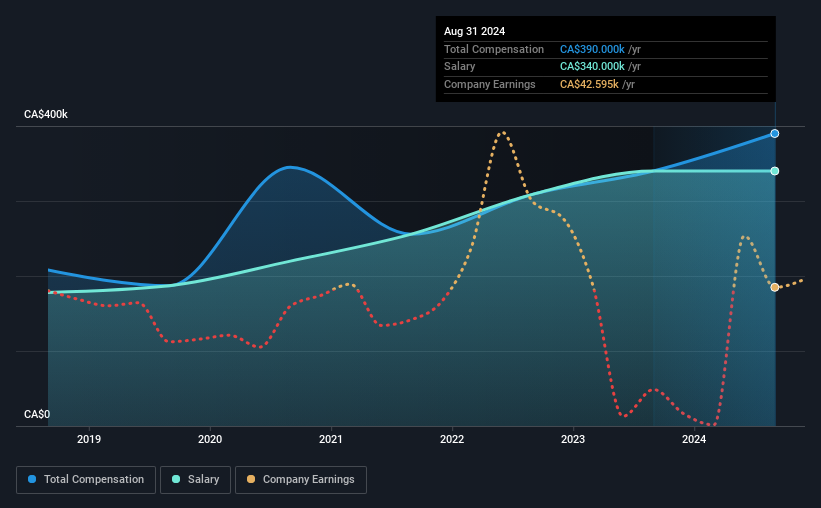

According to our data, Azimut Exploration Inc. has a market capitalization of CA$51m, and paid its CEO total annual compensation worth CA$390k over the year to August 2024. That's a notable increase of 15% on last year. We note that the salary portion, which stands at CA$340.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Canadian Metals and Mining industry with market capitalizations below CA$284m, reported a median total CEO compensation of CA$184k. Accordingly, our analysis reveals that Azimut Exploration Inc. pays Jean-Marc Lulin north of the industry median. Moreover, Jean-Marc Lulin also holds CA$1.4m worth of Azimut Exploration stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CA$340k | CA$340k | 87% |

| Other | CA$50k | - | 13% |

| Total Compensation | CA$390k | CA$340k | 100% |

Talking in terms of the industry, salary represented approximately 95% of total compensation out of all the companies we analyzed, while other remuneration made up 5% of the pie. Although there is a difference in how total compensation is set, Azimut Exploration more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Azimut Exploration Inc.'s Growth

Azimut Exploration Inc. has reduced its earnings per share by 51% a year over the last three years. In the last year, its revenue is up 110%.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Azimut Exploration Inc. Been A Good Investment?

The return of -59% over three years would not have pleased Azimut Exploration Inc. shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 3 warning signs for Azimut Exploration (2 make us uncomfortable!) that you should be aware of before investing here.

Switching gears from Azimut Exploration, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:AZM

Azimut Exploration

Engages in the acquisition, exploration, and evaluation of mineral properties in Canada.

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026