- Canada

- /

- Metals and Mining

- /

- TSXV:AZM

3 TSX Penny Stocks With Market Caps Under CA$90M

Reviewed by Simply Wall St

As the Canadian market navigates a period of moderated inflation and stable bond yields, investors are closely watching for opportunities amidst growth concerns. Though often considered relics of past trading days, penny stocks continue to offer intriguing prospects for investors seeking value in smaller or newer companies. By focusing on those with robust financials and potential for growth, these stocks can provide an avenue to uncover hidden gems within the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.83 | CA$176.58M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.83 | CA$453.58M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.9M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$632.31M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$32.24M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.90 | CA$416.19M | ★★★★★☆ |

| New Gold (TSX:NGD) | CA$4.02 | CA$3.18B | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.00 | CA$197.39M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.08 | CA$208.88M | ★★★★☆☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Loncor Gold (TSX:LN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Loncor Gold Inc. is a gold exploration company focused on acquiring, exploring, and developing precious metal projects in the Ngayu greenstone belt in the northeast of the Democratic Republic of the Congo and Canada, with a market cap of CA$85.04 million.

Operations: Loncor Gold Inc. has not reported any revenue segments.

Market Cap: CA$85.04M

Loncor Gold Inc., with a market cap of CA$85.04 million, is a pre-revenue gold exploration company focused on projects in the Democratic Republic of the Congo. Recent drilling results from its Adumbi deposit show promising potential with significant gold intercepts, although logistical challenges have affected deep drilling operations. The company is debt-free and has stable weekly volatility at 12%, but it faces financial constraints with less than one year of cash runway. Despite being unprofitable, Loncor's seasoned management and board bring extensive experience to navigate these challenges as they aim for resource expansion.

- Click here to discover the nuances of Loncor Gold with our detailed analytical financial health report.

- Understand Loncor Gold's track record by examining our performance history report.

Azimut Exploration (TSXV:AZM)

Simply Wall St Financial Health Rating: ★★★★★★

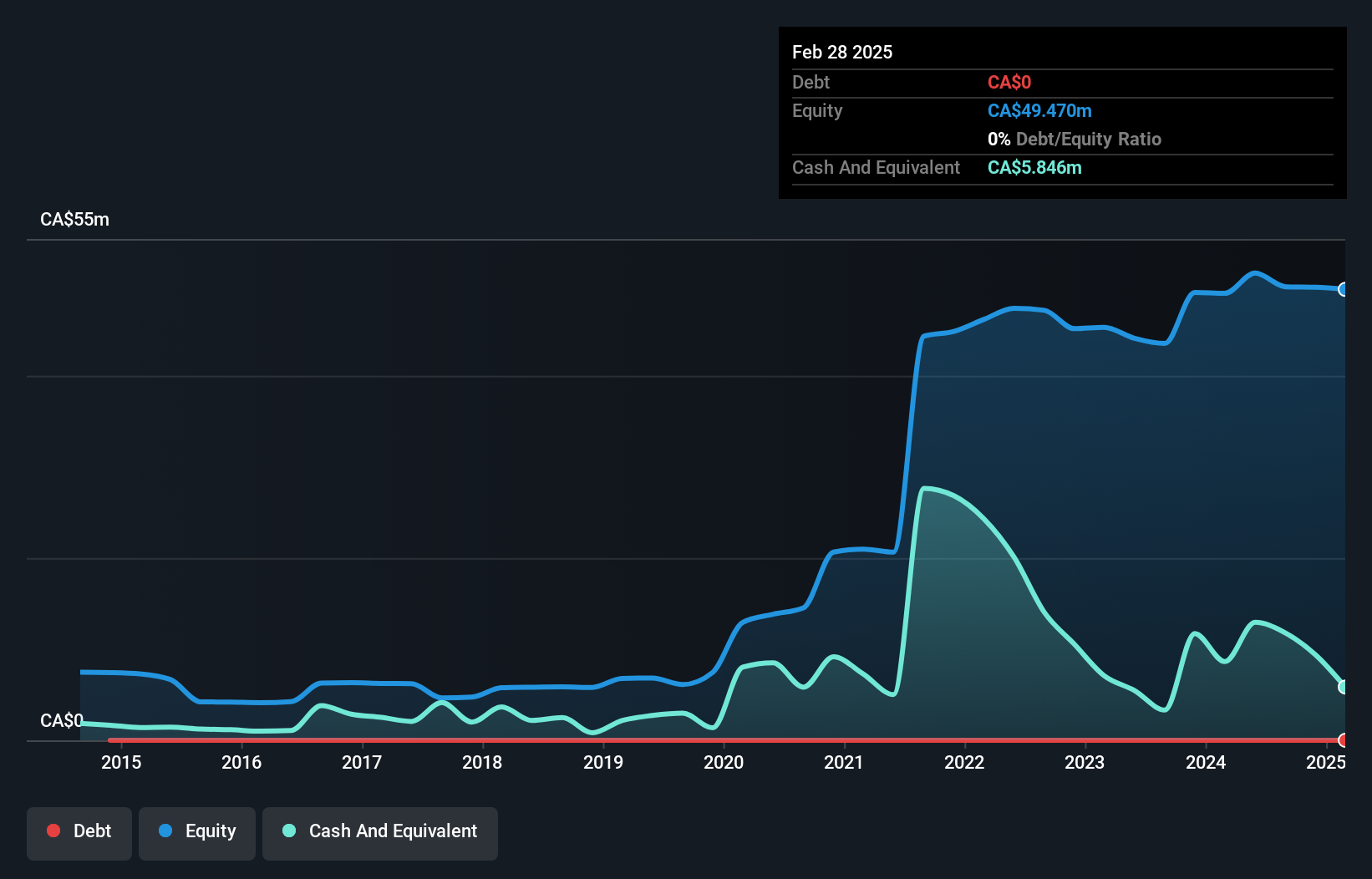

Overview: Azimut Exploration Inc. is involved in the acquisition, exploration, and evaluation of mineral properties in Canada with a market cap of CA$50.56 million.

Operations: The company's revenue is derived entirely from its activities in the acquisition, exploration, and evaluation of exploration properties, totaling CA$0.42 million.

Market Cap: CA$50.56M

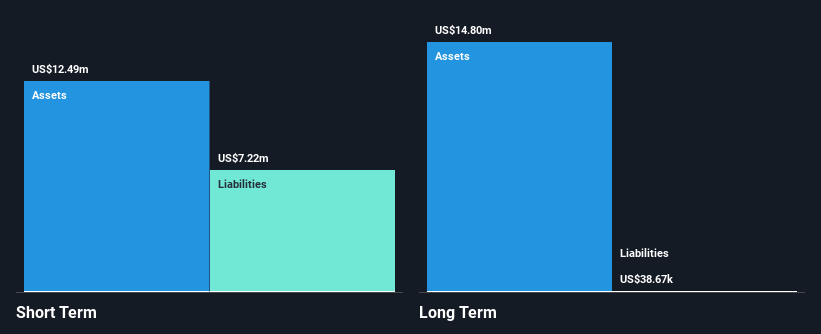

Azimut Exploration Inc., with a market cap of CA$50.56 million, is pre-revenue and focuses on mineral exploration in Canada. The company recently became profitable, reporting net income for the year ending August 31, 2024. Azimut's financial stability is supported by its debt-free status and short-term assets exceeding liabilities. Recent drilling programs at the Kukamas Property revealed significant high-grade nickel and platinum group element discoveries, highlighting potential for further exploration success. The seasoned management team averages over a decade of experience, enhancing operational effectiveness as they advance key projects like the Perseus Zone and Wabamisk Property's antimony-gold system.

- Click to explore a detailed breakdown of our findings in Azimut Exploration's financial health report.

- Explore historical data to track Azimut Exploration's performance over time in our past results report.

Max Resource (TSXV:MAX)

Simply Wall St Financial Health Rating: ★★★★☆☆

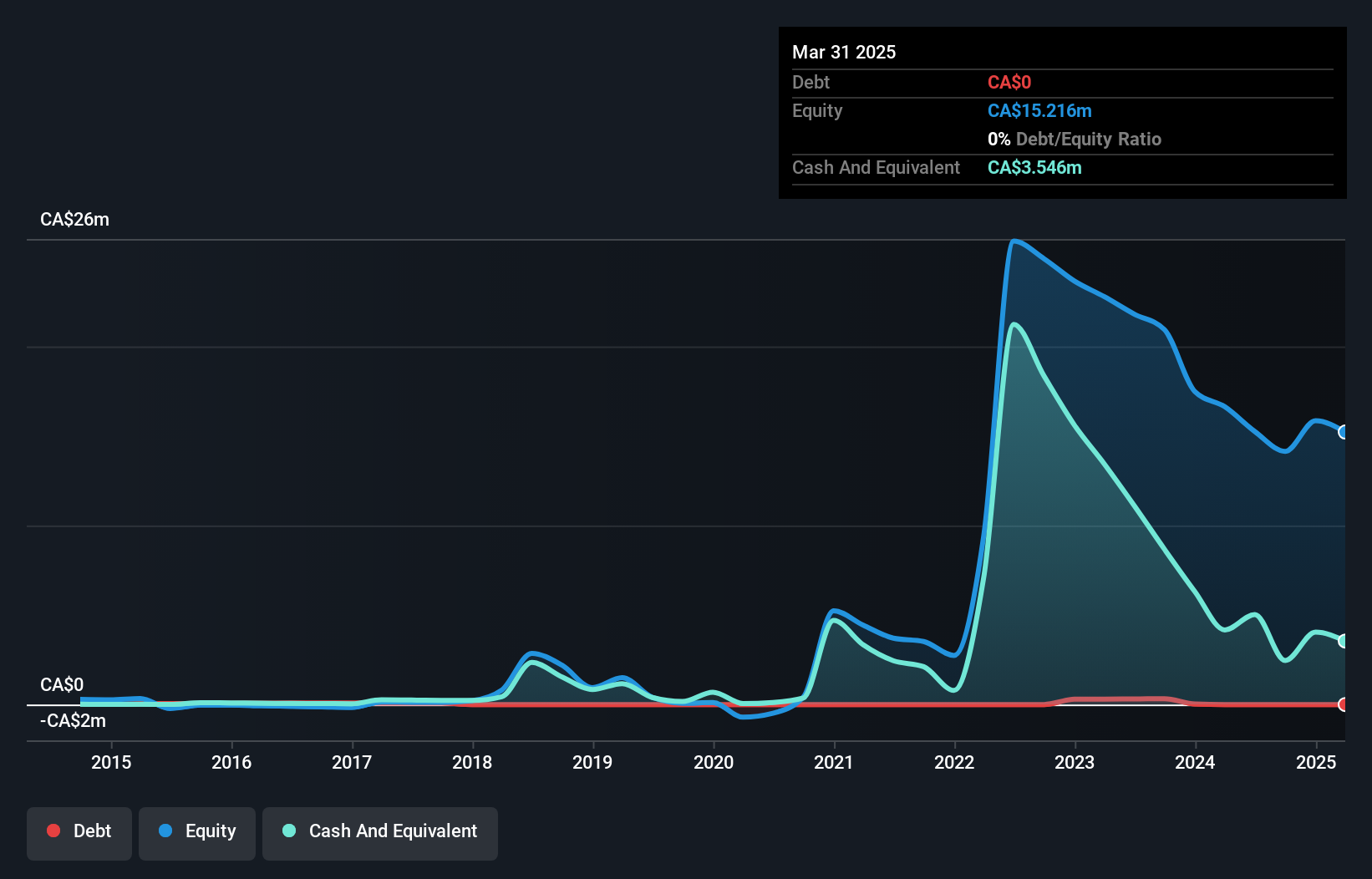

Overview: Max Resource Corp. is involved in acquiring and exploring mineral properties in South America and Canada, with a market cap of CA$8.99 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$8.99M

Max Resource Corp., with a market cap of CA$8.99 million, is pre-revenue and focused on mineral exploration in South America and Canada. The company remains unprofitable, with increasing losses over the past five years at 12.5% per year. Despite being debt-free, Max faces financial challenges with less than a year of cash runway if current cash flow trends persist. Recent earnings reports indicate a net loss increase to CA$4.91 million for the nine months ending September 2024, up from CA$2.71 million the previous year, reflecting ongoing operational hurdles amidst its volatile share price environment.

- Dive into the specifics of Max Resource here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Max Resource's track record.

Summing It All Up

- Explore the 934 names from our TSX Penny Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AZM

Azimut Exploration

Engages in the acquisition, exploration, and evaluation of mineral properties in Canada.

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives