With Canada's election concluded and a new government in place, the focus now shifts to addressing trade and economic challenges, with potential fiscal stimulus on the horizon. Amid this backdrop, investors may find opportunities in penny stocks—often smaller or newer companies that can offer significant growth potential when backed by strong financials. In this article, we explore three Canadian penny stocks that stand out for their financial resilience and potential for impressive returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.79 | CA$80.92M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.11 | CA$84.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.08 | CA$124.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.65 | CA$412.48M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.19 | CA$591.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$283.88M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.56 | CA$512.64M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.52 | CA$126.99M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.465 | CA$13.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Enterprise Group (TSX:E) | CA$1.61 | CA$124.83M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 922 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Azimut Exploration (TSXV:AZM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Azimut Exploration Inc. is involved in the acquisition, exploration, and evaluation of mineral properties in Canada, with a market cap of CA$54.08 million.

Operations: The company generates its revenue of CA$0.36 million from activities related to the acquisition, exploration, and evaluation of exploration properties.

Market Cap: CA$54.08M

Azimut Exploration Inc., with a market cap of CA$54.08 million, remains pre-revenue, generating only CA$0.36 million from its mineral exploration activities. The company recently secured CA$5.66 million through a private placement involving Centerra Gold Inc., boosting its financial runway and indicating investor confidence despite ongoing losses. Azimut's projects like the Elmer Gold Project and the Wabamisk Property show promising exploration potential, particularly in antimony-gold zones amid rising antimony prices. Its debt-free status and seasoned management team further support its strategic focus on expanding resource bases using advanced data analytics systems.

- Jump into the full analysis health report here for a deeper understanding of Azimut Exploration.

- Gain insights into Azimut Exploration's past trends and performance with our report on the company's historical track record.

BIGG Digital Assets (TSXV:BIGG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BIGG Digital Assets Inc. operates and invests in the cryptocurrency industry in Canada, with a market cap of CA$40.91 million.

Operations: Currently, there are no reported revenue segments for BIGG Digital Assets Inc.

Market Cap: CA$40.91M

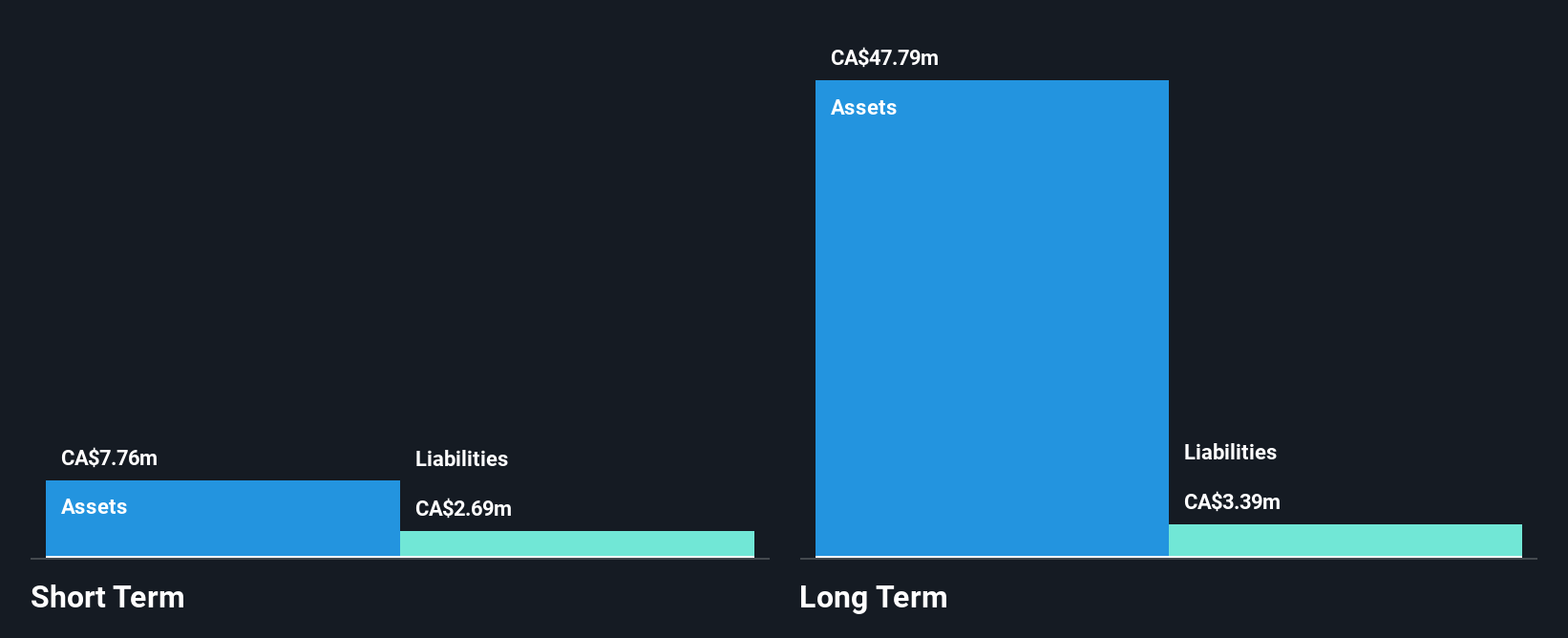

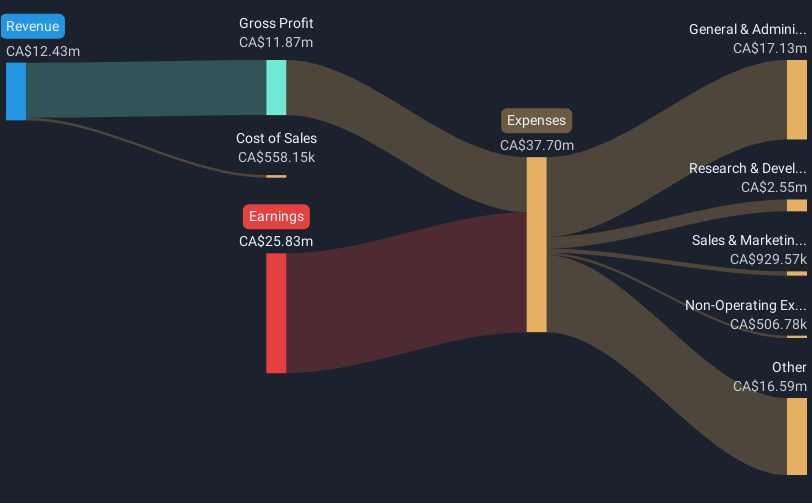

BIGG Digital Assets Inc., with a market cap of CA$40.91 million, recently reported annual revenues of CA$12.43 million, doubling from the previous year, yet it remains unprofitable with a net loss of CA$25.83 million. Despite its financial challenges, BIGG's short-term assets exceed both its short and long-term liabilities, indicating some financial stability. The company is debt-free but has less than a year of cash runway based on current free cash flow levels. Recent product enhancements in their Netcoins platform aim to enhance user experience and expand their footprint in the competitive cryptocurrency trading space.

- Get an in-depth perspective on BIGG Digital Assets' performance by reading our balance sheet health report here.

- Understand BIGG Digital Assets' track record by examining our performance history report.

Western Copper and Gold (TSX:WRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Western Copper and Gold Corporation is an exploration stage company focused on the exploration and development of mineral properties in Canada, with a market cap of CA$306 million.

Operations: Western Copper and Gold Corporation does not report any revenue segments as it is an exploration stage company.

Market Cap: CA$306M

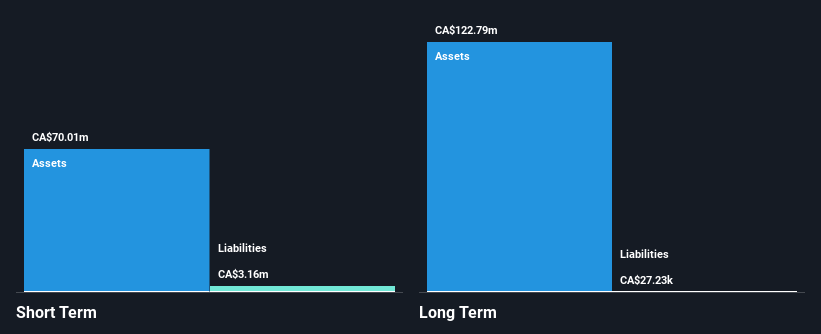

Western Copper and Gold Corporation, with a market cap of CA$306 million, remains pre-revenue as it focuses on developing its Casino Copper-Gold Project. The company is debt-free and has sufficient cash runway for over three years, despite being unprofitable. Recent infrastructure initiatives underscore the project's strategic importance to Yukon's development, supported by a CA$40 million funding agreement with Natural Resources Canada for an energy corridor project. While executive changes have occurred, Western's board remains experienced. The Casino Project benefits from political support and favorable commodity prices but faces challenges in achieving profitability within the next three years.

- Unlock comprehensive insights into our analysis of Western Copper and Gold stock in this financial health report.

- Learn about Western Copper and Gold's future growth trajectory here.

Taking Advantage

- Click through to start exploring the rest of the 919 TSX Penny Stocks now.

- Curious About Other Options? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BIGG Digital Assets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BIGG

BIGG Digital Assets

Owns, operates, and invests in businesses in the digital assets space industry in Canada, the United States of America, Europe, and internationally.

Adequate balance sheet slight.

Market Insights

Community Narratives