- Canada

- /

- Metals and Mining

- /

- TSXV:TRO

TSX Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

The Canadian market has been navigating a complex landscape, with recent shifts in bond yields suggesting potential opportunities for fixed-income investments. As investors assess their portfolios, the allure of penny stocks remains significant, offering a chance to explore smaller or newer companies that might not be on everyone's radar. Despite the term's outdated feel, these stocks can still present valuable opportunities when backed by solid financials and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.92 | CA$372.82M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$117.44M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.20 | CA$939.87M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.55 | CA$510.73M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.35 | CA$224.43M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.26 | CA$33.58M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$174.58M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.84 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 959 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Pulse Seismic (TSX:PSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulse Seismic Inc. acquires, markets, and licenses 2D and 3D seismic data for the energy sector in Canada, with a market cap of CA$117.44 million.

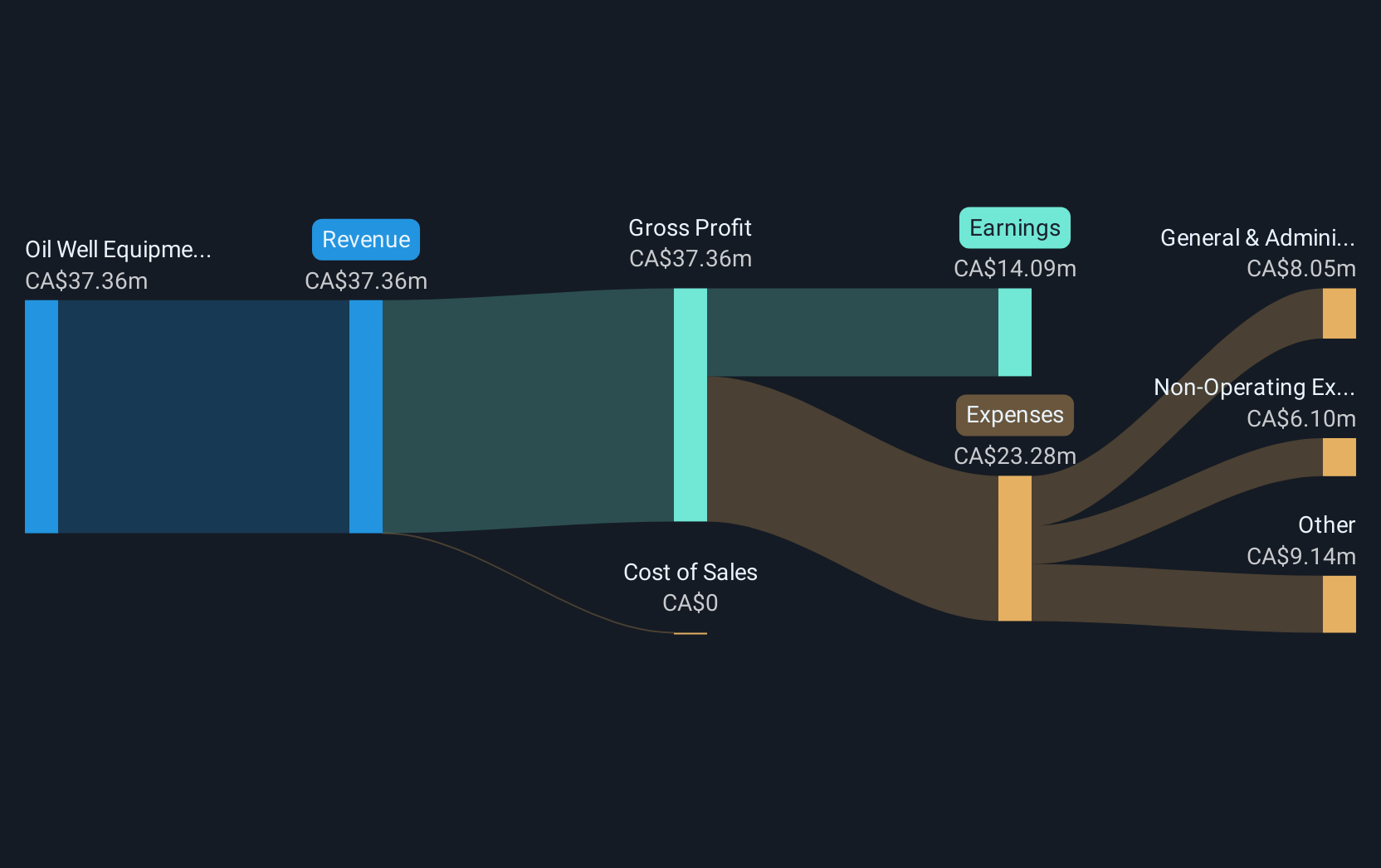

Operations: The company's revenue primarily comes from its Oil Well Equipment & Services segment, totaling CA$34.66 million.

Market Cap: CA$117.44M

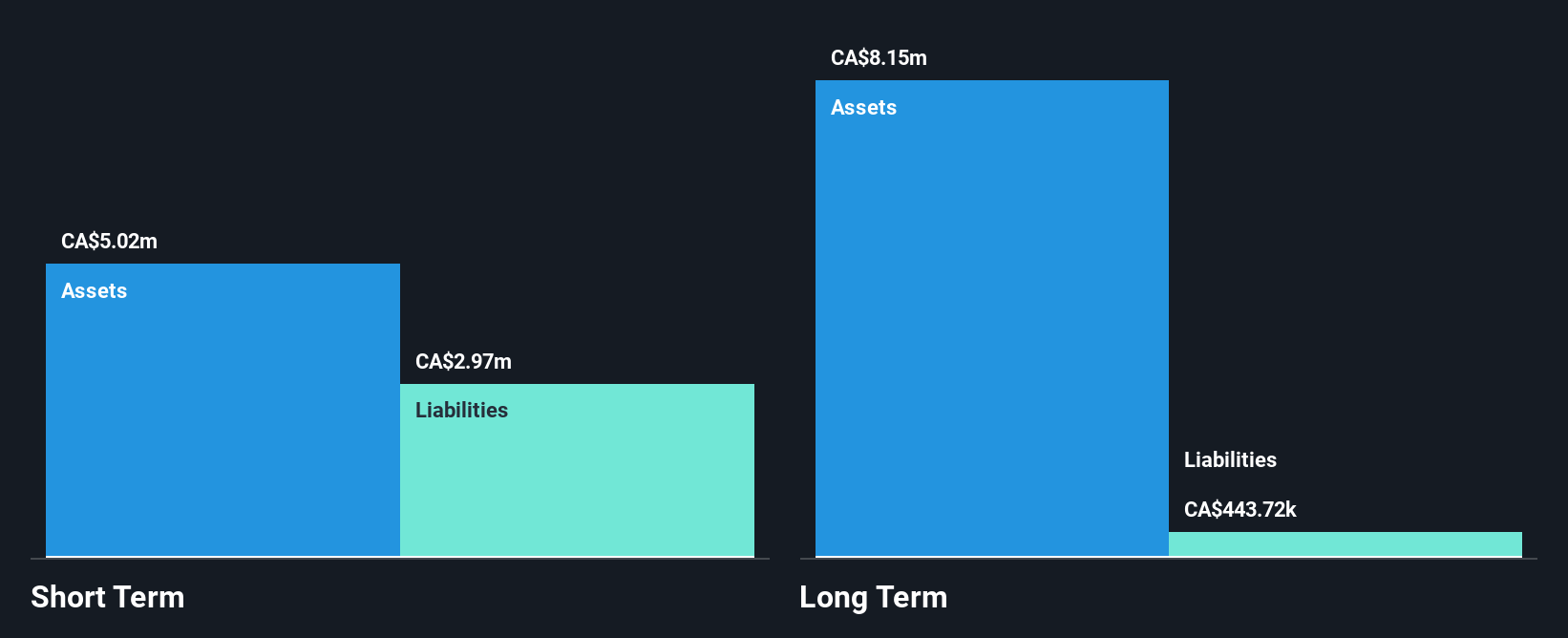

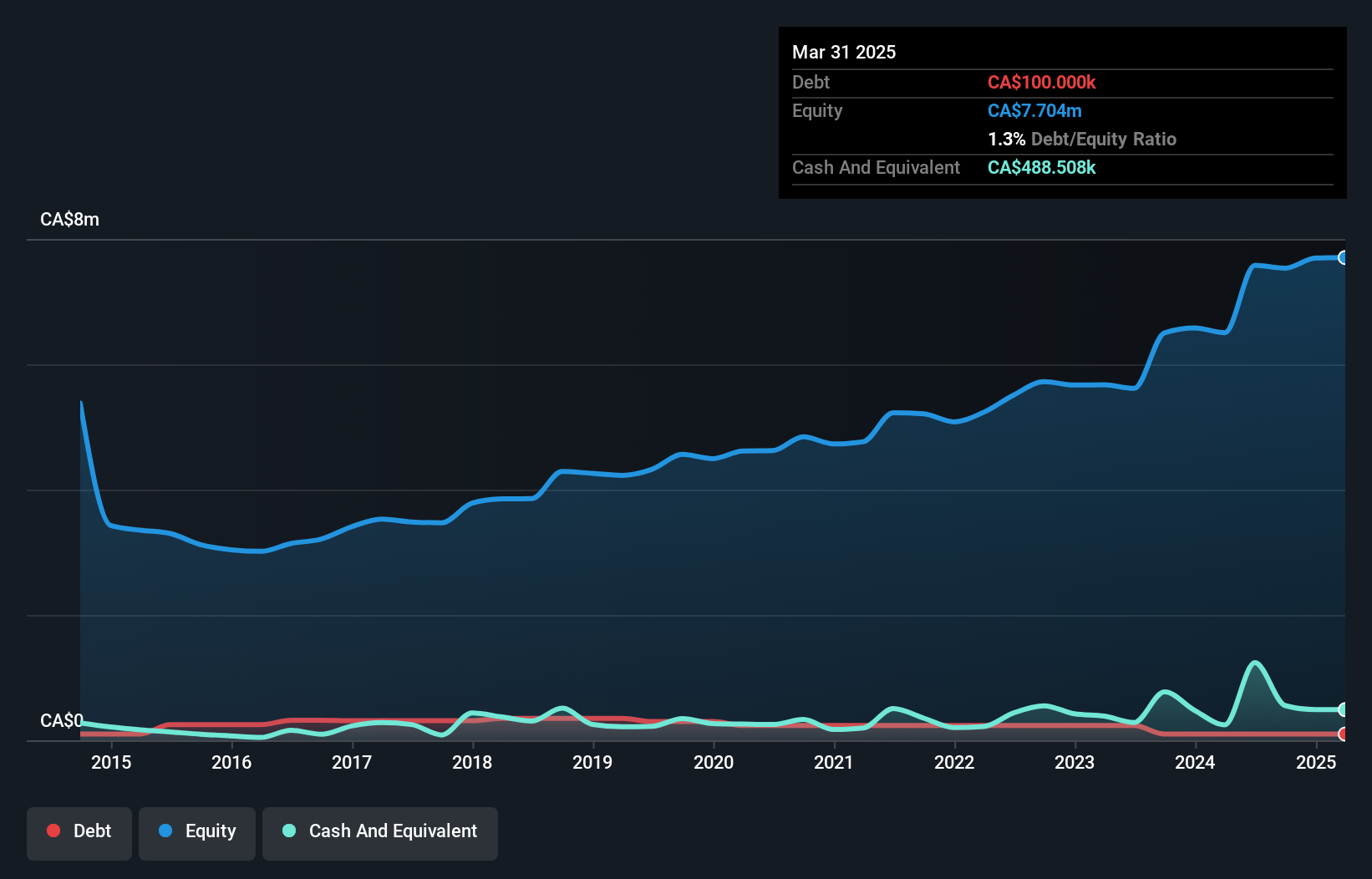

Pulse Seismic Inc. has demonstrated strong financial metrics with a notable Return on Equity of 56.5% and a significant earnings growth of 129.9% over the past year, outperforming the Energy Services industry. Despite reporting a net loss of CA$1.41 million in Q3 2024, the company maintains a debt-free status, enhancing its financial stability. Pulse's short-term assets comfortably cover both short- and long-term liabilities, indicating sound liquidity management. However, its dividend history is unstable, which could be a consideration for income-focused investors despite recent dividend affirmations and share buybacks signaling shareholder returns focus.

- Get an in-depth perspective on Pulse Seismic's performance by reading our balance sheet health report here.

- Evaluate Pulse Seismic's historical performance by accessing our past performance report.

Aluula Composites (TSXV:AUUA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aluula Composites Inc. manufactures and sells composite materials for various industries including wind sports, aerospace, and sailing across multiple international markets, with a market cap of CA$13.78 million.

Operations: The company generates revenue of CA$5.57 million from its composite materials segment.

Market Cap: CA$13.78M

Aluula Composites Inc., with a market cap of CA$13.78 million, has shown impressive revenue growth of 122.3% over the past year, reaching CA$5.57 million from its composite materials segment. Despite being unprofitable and experiencing high share price volatility recently, the company maintains a satisfactory net debt to equity ratio of 5.2%. Aluula's short-term assets exceed both its short- and long-term liabilities, indicating solid liquidity management. Recent strategic moves include raising CA$2.5 million through a follow-on equity offering and strengthening its leadership team with new appointments focused on innovation in sustainable materials.

- Take a closer look at Aluula Composites' potential here in our financial health report.

- Examine Aluula Composites' past performance report to understand how it has performed in prior years.

Taranis Resources (TSXV:TRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taranis Resources Inc. is an exploration stage company focused on acquiring, exploring, and developing precious and base metal deposits in Canada, with a market cap of CA$28.52 million.

Operations: Taranis Resources Inc. has not reported any revenue segments as it is currently in the exploration stage, focusing on precious and base metal deposits in Canada.

Market Cap: CA$28.52M

Taranis Resources Inc., with a market cap of CA$28.52 million, remains in the exploration stage and is pre-revenue, focusing on its Thor project in British Columbia. The company has faced challenges such as increased losses over the past five years and high share price volatility. Despite these hurdles, Taranis has made progress with its exploration efforts at Thor, receiving an extended permit for a 10,000-tonne Bulk Sample to refine mineral data. Recent capital raises have slightly diluted shareholders but provided necessary funds for ongoing operations. The board's extensive experience supports strategic decisions amid financial constraints and operational uncertainties.

- Jump into the full analysis health report here for a deeper understanding of Taranis Resources.

- Gain insights into Taranis Resources' past trends and performance with our report on the company's historical track record.

Next Steps

- Click this link to deep-dive into the 959 companies within our TSX Penny Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taranis Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TRO

Taranis Resources

An exploration stage company, engages in the acquisition, exploration, and development of precious and base metal projects in Canada.

Excellent balance sheet slight.

Market Insights

Community Narratives