Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Aurcana Silver Corporation (CVE:AUN) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Aurcana Silver

What Is Aurcana Silver's Net Debt?

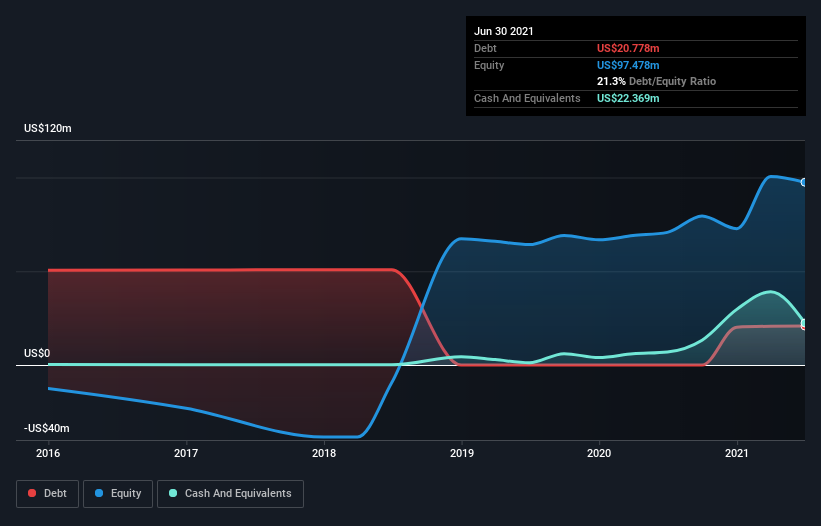

As you can see below, at the end of June 2021, Aurcana Silver had US$20.8m of debt, up from none a year ago. Click the image for more detail. However, it does have US$22.4m in cash offsetting this, leading to net cash of US$1.59m.

A Look At Aurcana Silver's Liabilities

According to the last reported balance sheet, Aurcana Silver had liabilities of US$3.23m due within 12 months, and liabilities of US$32.3m due beyond 12 months. On the other hand, it had cash of US$22.4m and US$57.5k worth of receivables due within a year. So its liabilities total US$13.1m more than the combination of its cash and short-term receivables.

Of course, Aurcana Silver has a market capitalization of US$167.8m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Aurcana Silver also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Aurcana Silver will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Given its lack of meaningful operating revenue, investors are probably hoping that Aurcana Silver finds some valuable resources, before it runs out of money.

So How Risky Is Aurcana Silver?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Aurcana Silver had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of US$51m and booked a US$15m accounting loss. With only US$1.59m on the balance sheet, it would appear that its going to need to raise capital again soon. Importantly, Aurcana Silver's revenue growth is hot to trot. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 4 warning signs for Aurcana Silver (2 are a bit concerning!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:AUN.H

Aurcana Silver

Engages in the exploration and development of mineral properties in the United States.

Low with weak fundamentals.

Market Insights

Community Narratives