TSX Opportunities: Haivision Systems And Two Other Promising Penny Stocks

Reviewed by Simply Wall St

The Canadian stock market has been experiencing a period of steady growth, with the TSX reaching new highs amid easing trade uncertainties and robust corporate earnings. As investors navigate this landscape, attention often turns to smaller or newer companies that can offer unique opportunities. Despite its vintage connotation, the term "penny stocks" still identifies such companies that may provide significant value when backed by solid financials and clear growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.66 | CA$66.76M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Foraco International (TSX:FAR) | CA$1.71 | CA$169.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.46M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.75 | CA$505.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.91 | CA$18.04M | ✅ 2 ⚠️ 4 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.83 | CA$104.35M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.74 | CA$185.26M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$185.21M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.58 | CA$9.02M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 453 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Haivision Systems (TSX:HAI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Haivision Systems Inc. offers mission-critical, real-time video networking and visual collaboration solutions across Canada, the United States, and internationally, with a market cap of CA$130.06 million.

Operations: The company generates revenue from its Internet Telephone segment, amounting to CA$123.24 million.

Market Cap: CA$130.06M

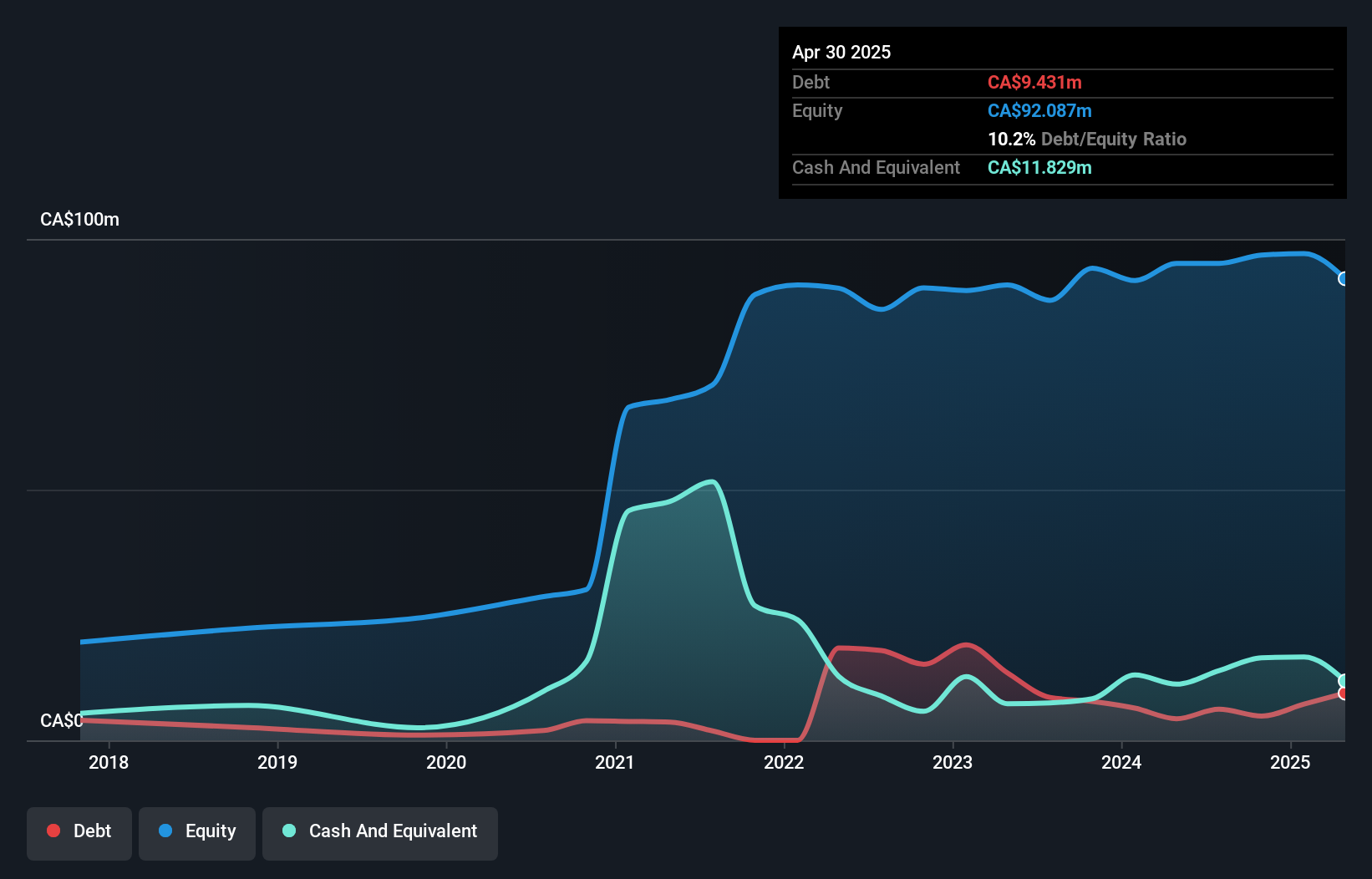

Haivision Systems Inc., with a market cap of CA$130.06 million, offers video networking solutions but remains unprofitable despite reducing losses by 17.6% annually over five years. The company has a stable cash runway exceeding three years, supported by positive free cash flow growth of 10.6% per year and more cash than total debt. Recent earnings for Q2 2025 showed sales of CA$34.29 million, slightly up from the previous year, yet resulted in a net loss of CA$2.39 million compared to prior net income, highlighting challenges in achieving profitability amidst its strategic share buyback activity amounting to CA$1.85 million.

- Click here and access our complete financial health analysis report to understand the dynamics of Haivision Systems.

- Learn about Haivision Systems' future growth trajectory here.

Medicenna Therapeutics (TSX:MDNA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Medicenna Therapeutics Corp. is a clinical-stage immunotherapy company focused on developing and commercializing Superkines and empowered Superkines for treating cancer, inflammation, and immune-mediated diseases, with a market cap of CA$67.56 million.

Operations: Medicenna Therapeutics Corp. currently does not report any revenue segments.

Market Cap: CA$67.56M

Medicenna Therapeutics Corp., with a market cap of CA$67.56 million, is pre-revenue and focuses on advanced immunotherapy development. The company reported a reduced net loss of CA$11.81 million for the year ending March 2025, down from CA$25.47 million the previous year, indicating some financial improvement despite ongoing unprofitability. Recent presentations highlighted promising pre-clinical data for MDNA113, showcasing its potential in cancer treatment through innovative tumor-targeting mechanisms. With no debt and short-term assets exceeding liabilities, Medicenna maintains financial stability but faces challenges in achieving profitability within the next three years amidst ambitious growth forecasts and strategic financing activities like a CA$75 million shelf registration filing.

- Dive into the specifics of Medicenna Therapeutics here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Medicenna Therapeutics' future.

Golden Sky Minerals (TSXV:AUEN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Golden Sky Minerals Corp. is a mineral exploration company focused on acquiring, developing, exploring, and evaluating mineral properties in Canada with a market capitalization of CA$8.48 million.

Operations: Golden Sky Minerals Corp. has not reported any revenue segments.

Market Cap: CA$8.48M

Golden Sky Minerals Corp., with a market cap of CA$8.48 million, is pre-revenue and focuses on mineral exploration in Canada. The company recently completed a significant geophysical survey on its Rayfield Property, identifying a large anomaly indicative of potential porphyry systems, which could guide future drilling efforts. Despite being unprofitable and experiencing increased losses over the past five years, Golden Sky has managed to maintain financial stability with short-term assets covering liabilities and no debt burden. However, its cash runway is limited to five months without additional capital infusion from recent private placements or other financing activities.

- Navigate through the intricacies of Golden Sky Minerals with our comprehensive balance sheet health report here.

- Evaluate Golden Sky Minerals' historical performance by accessing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 453 TSX Penny Stocks by using our screener here.

- Contemplating Other Strategies? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MDNA

Medicenna Therapeutics

A clinical-stage immunotherapy company, engages in the development and commercialization of Superkines and empowered Superkines for the treatment of cancer, inflammation, and immune-mediated diseases.

Medium-low risk with excellent balance sheet.

Market Insights

Community Narratives