- Canada

- /

- Metals and Mining

- /

- TSX:AAUC

Three TSX Growth Companies With High Insider Ownership And Earnings Growth Up To 68%

Reviewed by Simply Wall St

As the Canadian market navigates through evolving economic conditions, with a focus on artificial intelligence and its broad applications across various sectors, investors are increasingly attentive to growth opportunities beyond the traditional technology sphere. This shift underscores the importance of diversifying investment portfolios and highlights the potential in companies that not only show robust earnings growth but also have significant insider ownership, signaling strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| goeasy (TSX:GSY) | 21.7% | 15.9% |

| Payfare (TSX:PAY) | 15% | 57.7% |

| Aritzia (TSX:ATZ) | 19.1% | 51.6% |

| Allied Gold (TSX:AAUC) | 22.4% | 68.1% |

| ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

| Magna Mining (TSXV:NICU) | 10.5% | 95.1% |

| Artemis Gold (TSXV:ARTG) | 31.8% | 45.6% |

| Ivanhoe Mines (TSX:IVN) | 12.3% | 37.8% |

| UGE International (TSXV:UGE) | 35.4% | 63.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Allied Gold (TSX:AAUC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Allied Gold Corporation, along with its subsidiaries, is engaged in the exploration and production of mineral deposits in Africa, with a market capitalization of approximately CA$794.80 million.

Operations: The company generates revenue from three primary mines: Agbaou Mine (CA$141.39 million), Bonikro Mine (CA$192.71 million), and Sadiola Mine (CA$342.34 million).

Insider Ownership: 22.4%

Earnings Growth Forecast: 68.1% p.a.

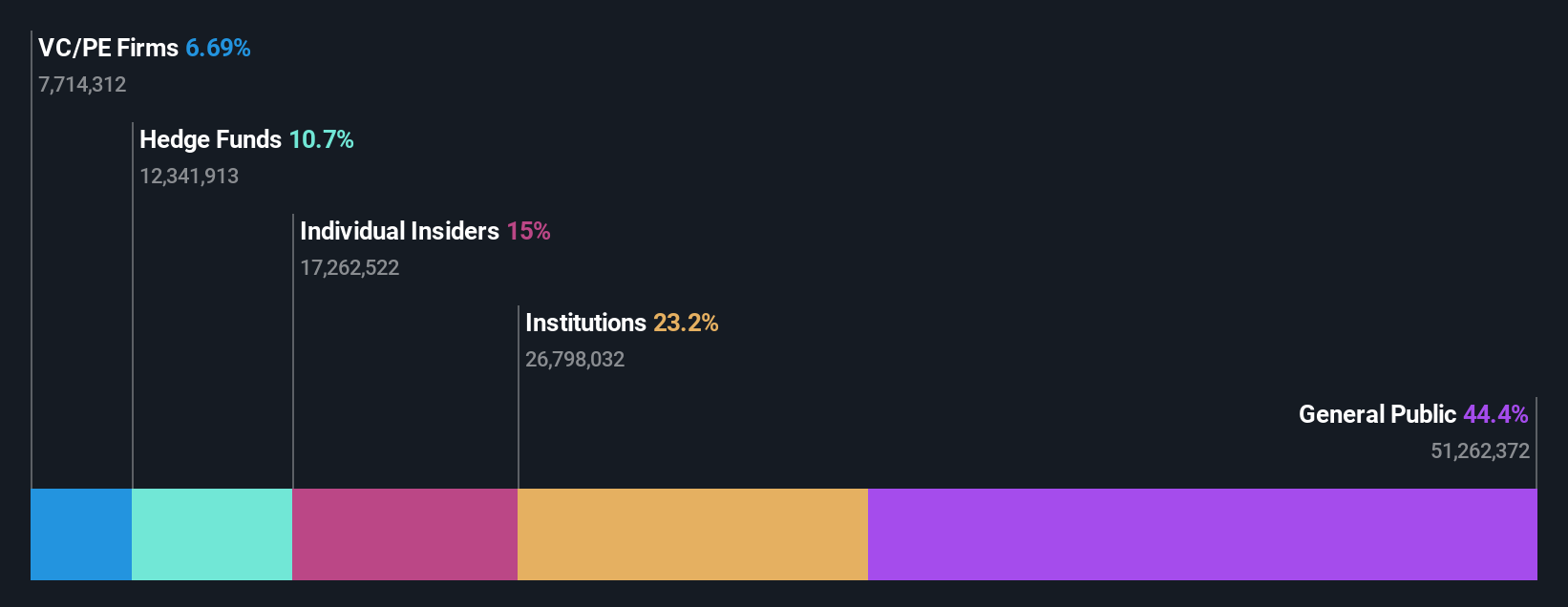

Allied Gold, a Canadian growth company with high insider ownership, recently affirmed its 2024 gold production guidance and projected significant increases for 2025 and 2026. The first quarter of 2024 showed improved production and sales results compared to the previous year, alongside a notable reduction in net loss. Analysts predict a substantial price increase for Allied Gold's stock, viewing it as undervalued based on current estimates. Insider transactions over the past three months reflect more buying than selling, highlighting confidence from within.

- Navigate through the intricacies of Allied Gold with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Allied Gold is trading behind its estimated value.

North American Construction Group (TSX:NOA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: North American Construction Group Ltd. specializes in mining and heavy civil construction services for the resource development and industrial construction sectors across Australia, Canada, and the United States, with a market capitalization of CA$725.43 million.

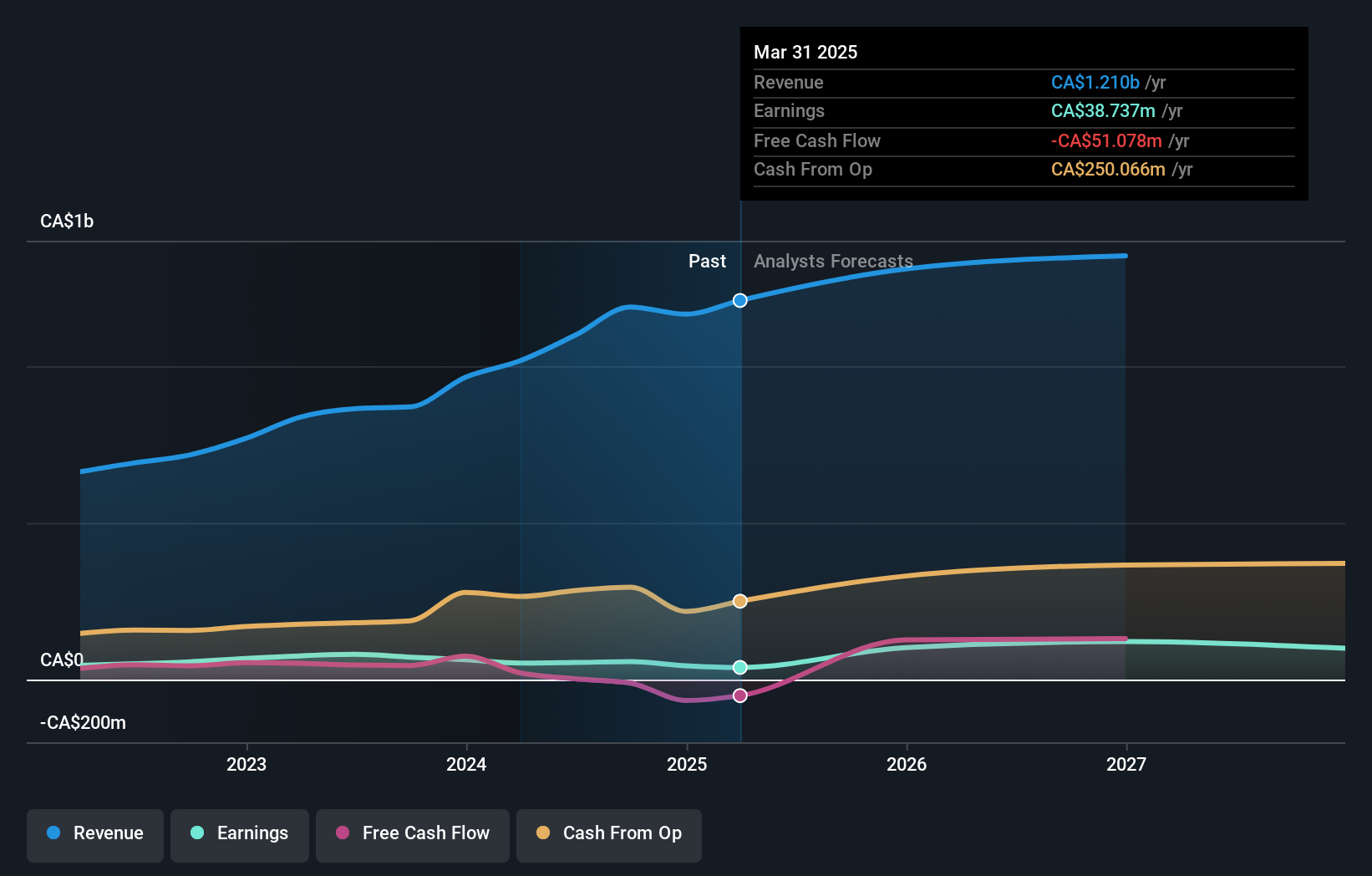

Operations: The company generates its revenue by offering mining and heavy civil construction services across Australia, Canada, and the United States.

Insider Ownership: 11.2%

Earnings Growth Forecast: 44.8% p.a.

North American Construction Group, a player in the Canadian growth sector with high insider ownership, reported a decrease in net income and earnings per share for Q1 2024 compared to the previous year. Despite this, sales increased from CAD 244.33 million to CAD 297.03 million over the same period. The company's revenue is expected to grow at 17.4% annually, outpacing the Canadian market's 6.9%. Earnings are projected to surge by approximately 44.8% annually, significantly above market expectations of 13.7%. However, its interest coverage remains weak, and recent insider activity shows more selling than buying over the past three months.

- Dive into the specifics of North American Construction Group here with our thorough growth forecast report.

- Our valuation report here indicates North American Construction Group may be undervalued.

Artemis Gold (TSXV:ARTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company engaged in identifying, acquiring, and developing gold properties, with a market capitalization of approximately CA$2.18 billion.

Operations: The company primarily generates revenue through the development of gold properties.

Insider Ownership: 31.8%

Earnings Growth Forecast: 45.6% p.a.

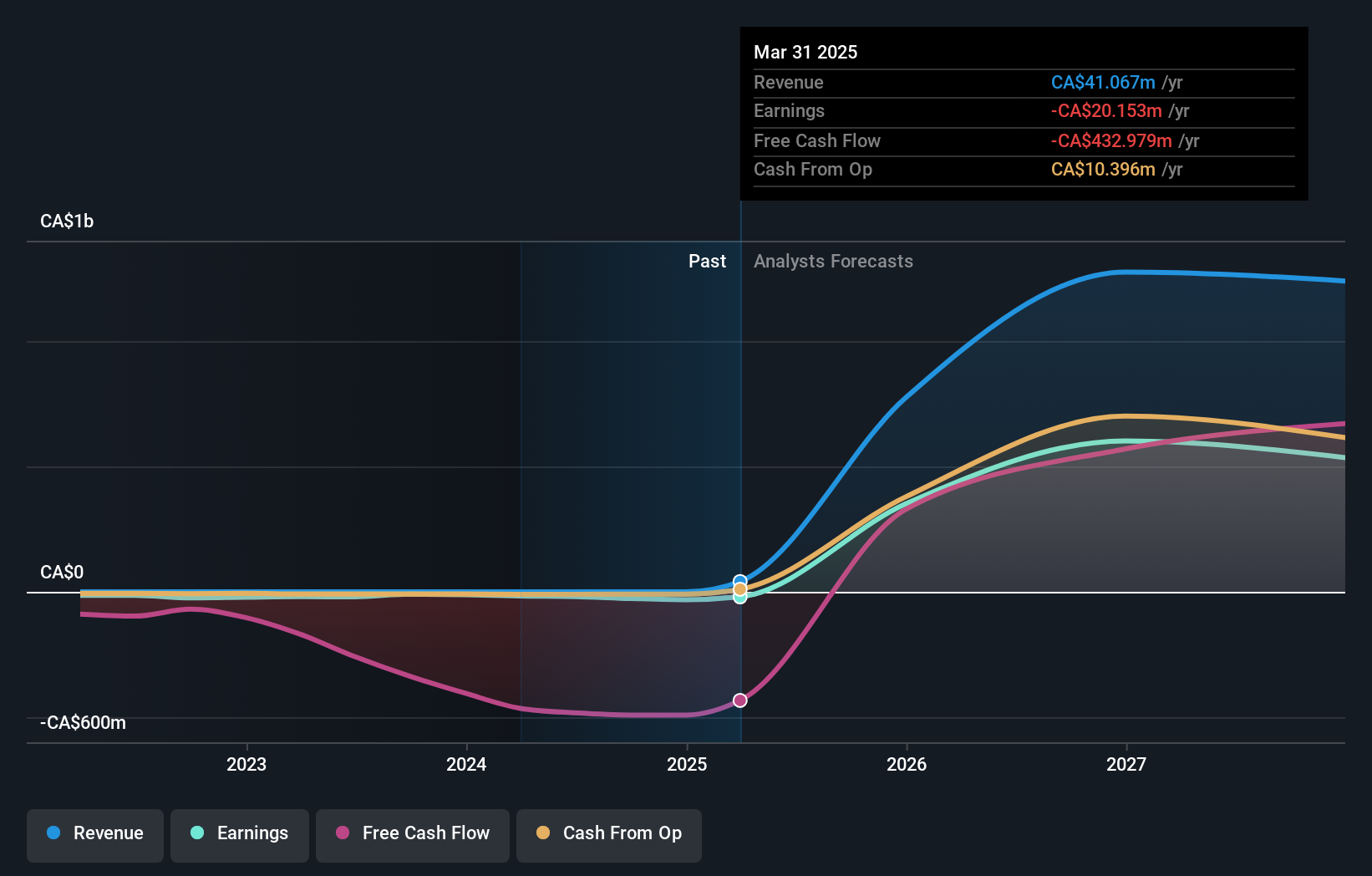

Artemis Gold, a Canadian growth company with high insider ownership, is navigating through substantial development phases. Despite a net loss of CAD 6.65 million in Q1 2024, the company's ambitious Blackwater Mine project is on track for its first gold pour in the second half of 2024. With revenue expected to grow by 50.8% annually, Artemis Gold's insiders have shown confidence through recent share purchases. However, shareholder dilution over the past year and less than a year of cash runway present challenges as it transitions towards profitability within three years.

- Click to explore a detailed breakdown of our findings in Artemis Gold's earnings growth report.

- Our valuation report unveils the possibility Artemis Gold's shares may be trading at a premium.

Seize The Opportunity

- Navigate through the entire inventory of 34 Fast Growing TSX Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAUC

Very undervalued with high growth potential.

Market Insights

Community Narratives