- Canada

- /

- Metals and Mining

- /

- TSXV:ARTG

Exploring High Insider Ownership Growth Stocks On The TSX

Reviewed by Simply Wall St

In the last week, the Canadian market has remained stable, while it has experienced a 12% increase over the past 12 months, with earnings expected to grow by 14% annually. In this context, stocks with high insider ownership can be particularly compelling as they often indicate that company leaders have a vested interest in the business's success and growth.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| goeasy (TSX:GSY) | 21.7% | 15.9% |

| Payfare (TSX:PAY) | 15% | 57.7% |

| Vox Royalty (TSX:VOXR) | 12.4% | 77.3% |

| Aritzia (TSX:ATZ) | 19.1% | 51.6% |

| Allied Gold (TSX:AAUC) | 22.4% | 68.1% |

| ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

| Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

| Ivanhoe Mines (TSX:IVN) | 12.3% | 38.5% |

| UGE International (TSXV:UGE) | 35.4% | 63.5% |

Let's explore several standout options from the results in the screener.

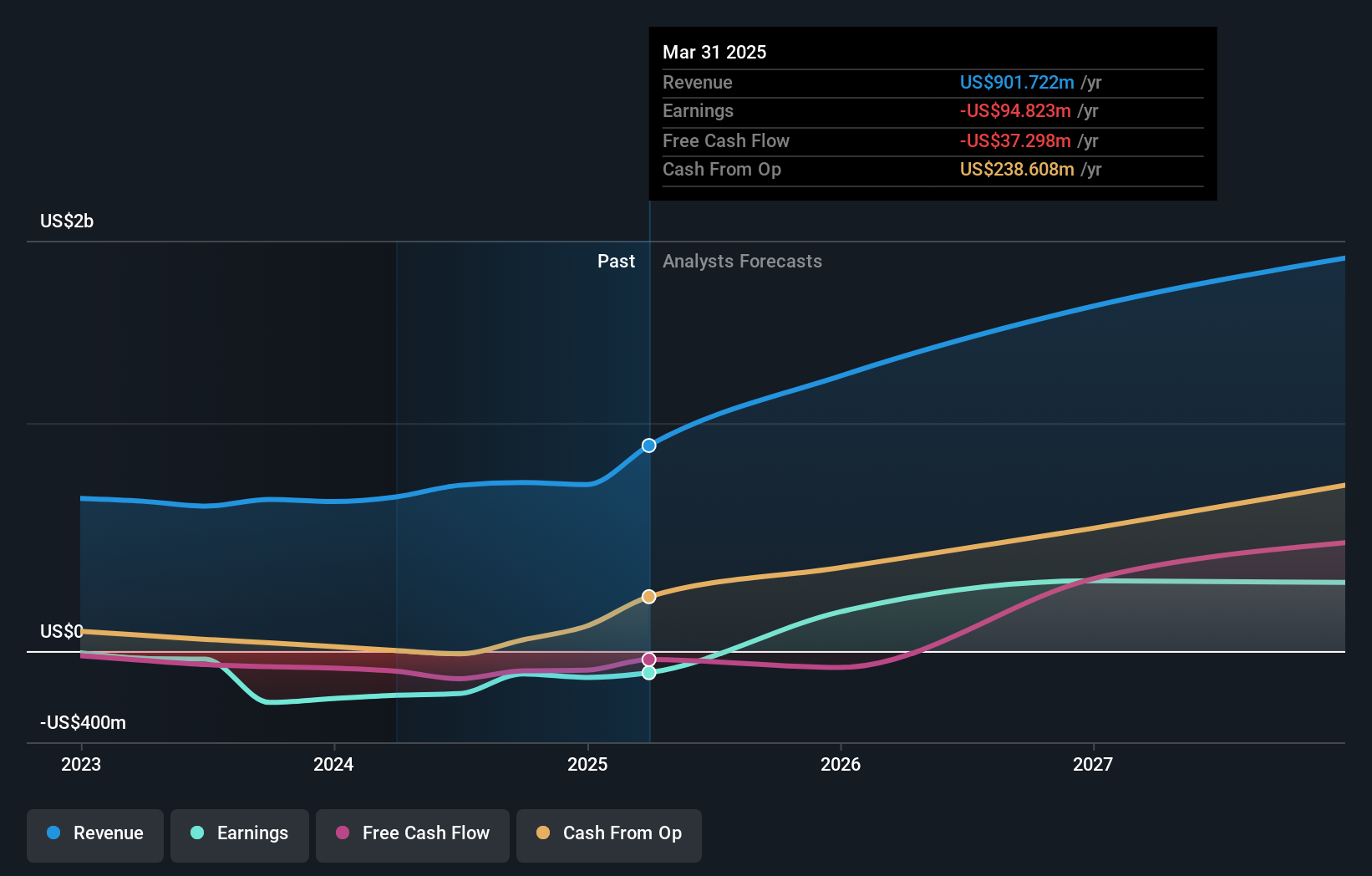

Allied Gold (TSX:AAUC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Allied Gold Corporation, operating in Africa, focuses on the exploration and production of mineral deposits with a market capitalization of approximately CA$0.80 billion.

Operations: The company generates revenue from three primary mines: Agbaou Mine at CA$141.39 million, Bonikro Mine at CA$192.71 million, and Sadiola Mine at CA$342.34 million.

Insider Ownership: 22.4%

Return On Equity Forecast: 21% (2027 estimate)

Allied Gold, with high insider ownership, is poised for significant growth. The company is expected to become profitable within three years, outpacing average market profit growth. Revenue forecasts also exceed market averages, indicating robust future performance. Recent insider activities show more buying than selling, reflecting confidence from those closest to the company. Allied Gold's strategic auditor appointment and solid quarterly results further underscore its upward trajectory in a competitive landscape.

- Click to explore a detailed breakdown of our findings in Allied Gold's earnings growth report.

- The valuation report we've compiled suggests that Allied Gold's current price could be quite moderate.

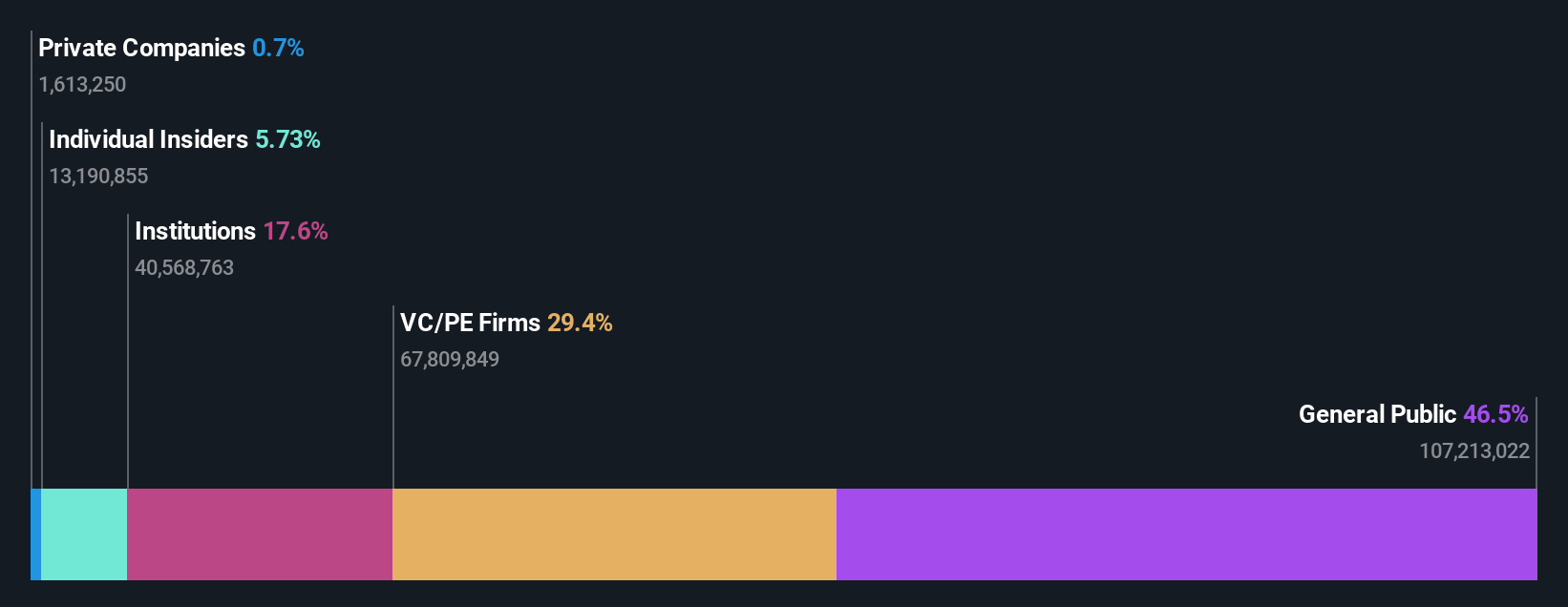

Artemis Gold (TSXV:ARTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company that specializes in identifying, acquiring, and developing gold properties, with a market capitalization of approximately CA$2.10 billion.

Operations: The company specializes in the gold sector, focusing on property development.

Insider Ownership: 31.8%

Return On Equity Forecast: N/A (2027 estimate)

Artemis Gold, characterized by high insider ownership, is navigating a challenging financial landscape with a net loss increase in Q1 2024 but remains on track with its Blackwater Mine project, expected to start operations in late 2024. Despite recent losses, insider transactions over the past three months show more buying than selling, suggesting confidence among those closest to the company. The firm's revenue is projected to grow significantly at 50.8% annually, outpacing the Canadian market average growth rate.

- Delve into the full analysis future growth report here for a deeper understanding of Artemis Gold.

- Our valuation report unveils the possibility Artemis Gold's shares may be trading at a premium.

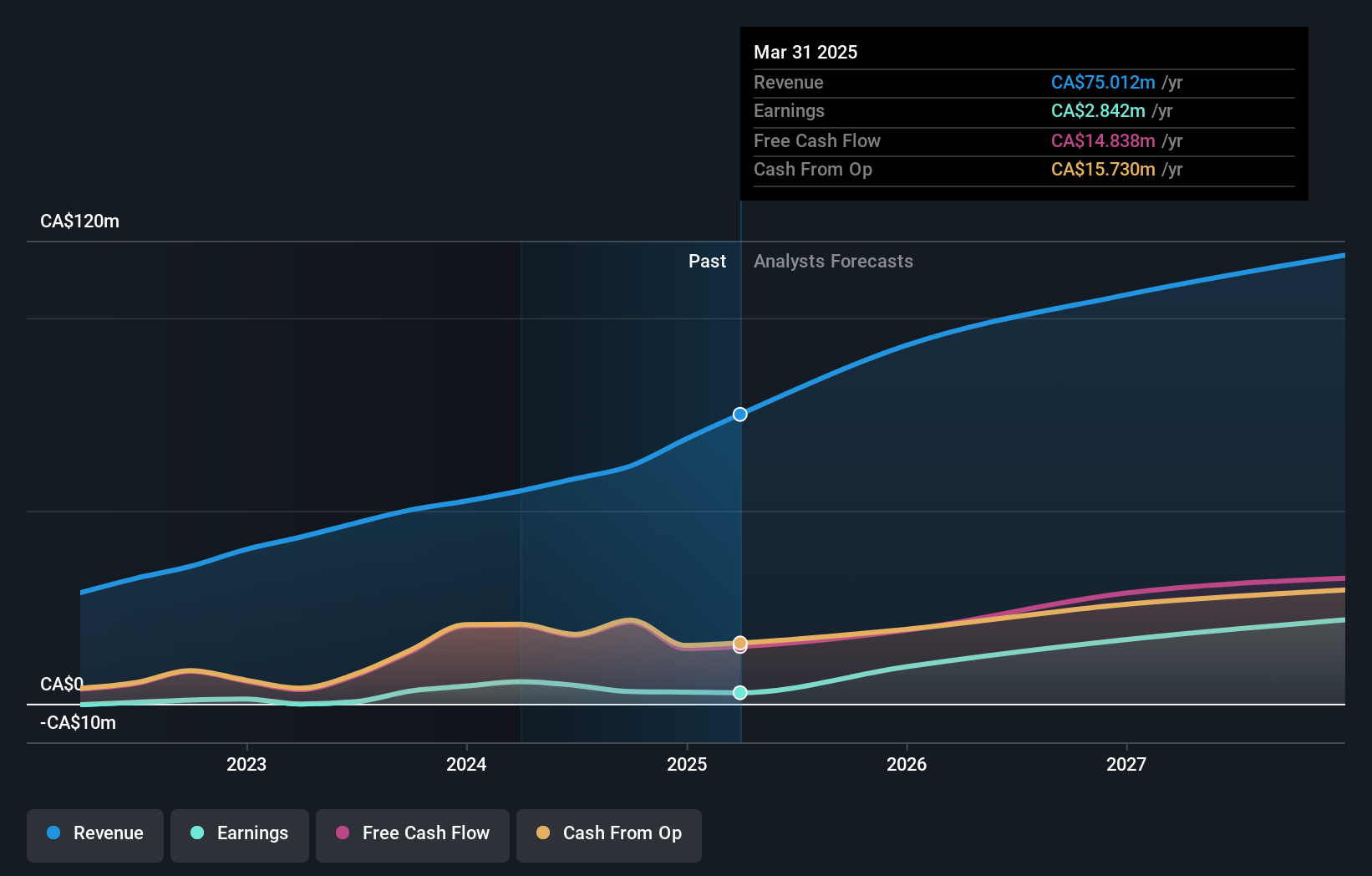

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. offers technology solutions for health and human service providers across Canada, the U.S., the U.K., Australia, Western Asia, and other international markets, with a market capitalization of approximately CA$353.68 million.

Operations: The company generates revenue by providing technology solutions to health and human service providers in various global regions.

Insider Ownership: 15.1%

Return On Equity Forecast: N/A (2027 estimate)

Vitalhub, a growth-oriented company with high insider ownership, reported a substantial increase in Q1 2024 revenue to CAD 15.26 million and net income to CAD 1.32 million. Recent executive team enhancements aim to boost operational efficiency and expansion prospects. Despite some shareholder dilution last year, insider buying activity outstrips selling, indicating strong internal confidence. The firm's earnings are expected to grow at an impressive rate of 37.7% annually over the next three years, although revenue growth projections are more modest at 12.8% annually.

- Dive into the specifics of Vitalhub here with our thorough growth forecast report.

- The analysis detailed in our Vitalhub valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Get an in-depth perspective on all 33 Fast Growing TSX Companies With High Insider Ownership by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ARTG

Artemis Gold

Focuses on the identification, acquisition, and development of gold properties.

Exceptional growth potential and good value.

Market Insights

Community Narratives