- Canada

- /

- Metals and Mining

- /

- TSXV:DBG

TSX Penny Stocks With Market Caps Over CA$100M To Watch

Reviewed by Simply Wall St

The Canadian market has been experiencing a period of sideways consolidation, which may be acting as a corrective force against potential pullbacks. In such conditions, diversification and balance become crucial strategies for investors looking to navigate volatility. Penny stocks, though an older term, represent growth opportunities in smaller or newer companies; when these stocks are backed by strong financials, they can offer significant returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.56 | CA$168.53M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$2.00 | CA$88.53M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.75 | CA$464.85M | ★★★★★★ |

| McCoy Global (TSX:MCB) | CA$2.75 | CA$66.05M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.06 | CA$36.92M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.66 | CA$613.99M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.05 | CA$3.21B | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$30.89M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$307.96M | ★★★★★☆ |

Click here to see the full list of 932 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Solaris Resources (TSX:SLS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Solaris Resources Inc. is involved in the exploration of mineral properties and has a market cap of CA$791.15 million.

Operations: Solaris Resources Inc. does not report any revenue segments as it is primarily focused on the exploration of mineral properties.

Market Cap: CA$791.15M

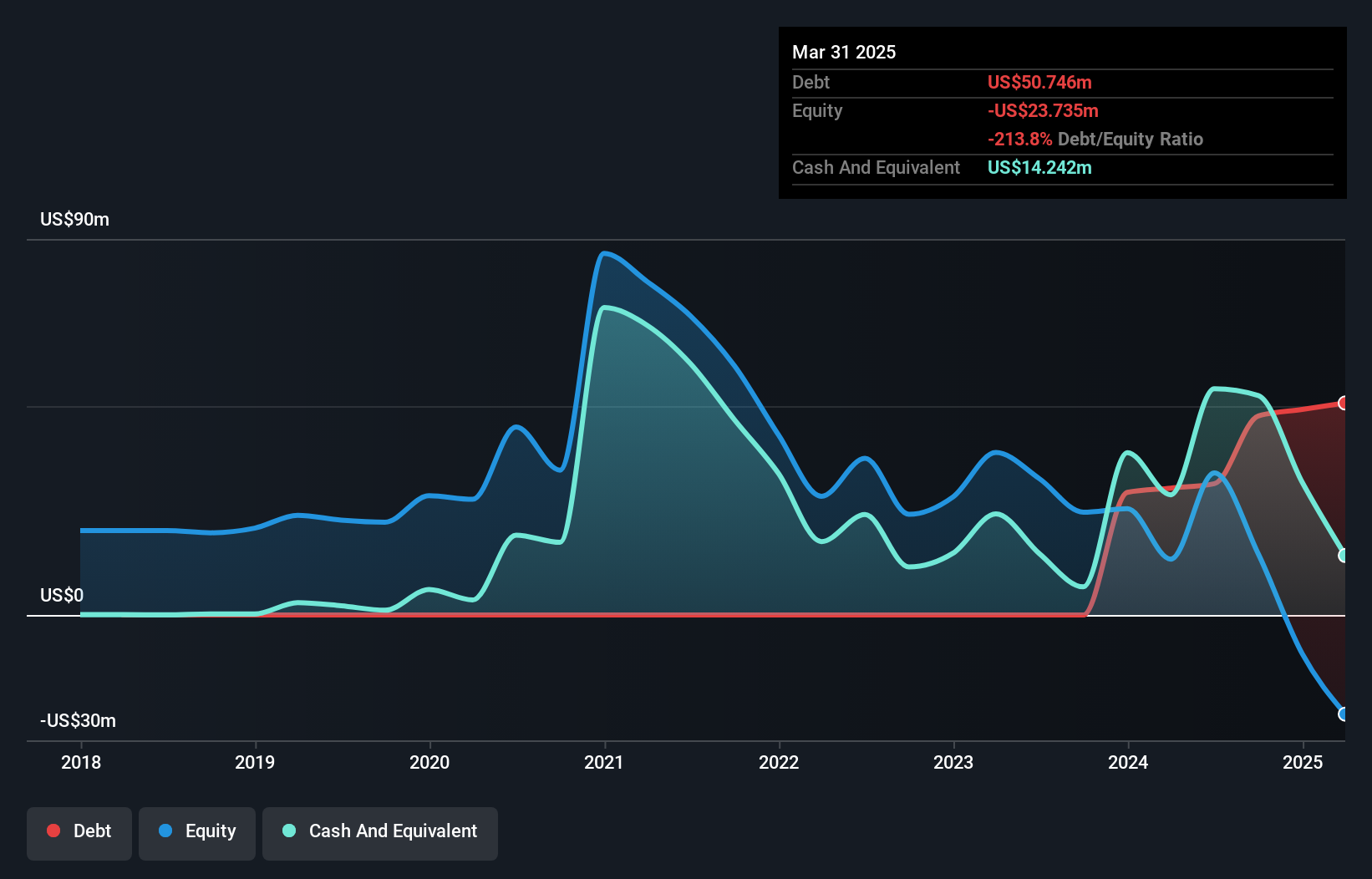

Solaris Resources, with a market cap of CA$791.15 million, remains pre-revenue as it focuses on mineral exploration. Recent strategic developments include forming an Inter-Institutional working group with Ecuadorian stakeholders and concluding an infill drilling program to update its Mineral Resource Estimate by mid-2025. Despite a negative return on equity and increasing debt levels, short-term assets exceed liabilities, providing some financial stability. The company's management and board are relatively new but strengthened by the appointment of Richard Hughes as CFO. A recent private placement aims to bolster capital reserves amid ongoing cash flow challenges.

- Click here to discover the nuances of Solaris Resources with our detailed analytical financial health report.

- Learn about Solaris Resources' future growth trajectory here.

Aldebaran Resources (TSXV:ALDE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aldebaran Resources Inc. is involved in the acquisition, exploration, and evaluation of mineral properties in Canada and Argentina, with a market cap of CA$333.03 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$333.03M

Aldebaran Resources, with a market cap of CA$333.03 million, is pre-revenue and debt-free, providing some financial stability despite reporting a net loss of CA$0.71 million for the recent quarter. The company has improved its financial position by reducing losses compared to the previous year and maintaining short-term assets (CA$14.3M) that exceed both short-term (CA$8.4M) and long-term liabilities (CA$2.2M). Recently added to the S&P/TSX Venture Composite Index, Aldebaran's management team is experienced with an average tenure of 6.8 years, while analysts anticipate potential stock price growth by 49%.

- Unlock comprehensive insights into our analysis of Aldebaran Resources stock in this financial health report.

- Review our historical performance report to gain insights into Aldebaran Resources' track record.

Doubleview Gold (TSXV:DBG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Doubleview Gold Corp. is a Canadian company focused on acquiring, exploring, and developing mineral resource properties, with a market cap of CA$129.03 million.

Operations: No revenue segments have been reported for this Canadian company focused on mineral resource properties.

Market Cap: CA$129.03M

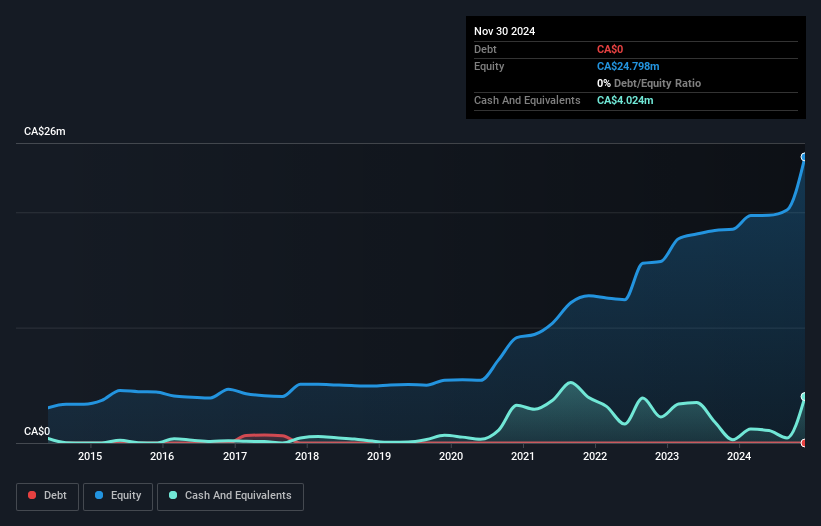

Doubleview Gold Corp., with a market cap of CA$129.03 million, is a pre-revenue company focused on mineral exploration, highlighting its speculative nature typical of penny stocks. Recent drilling at the Hat Polymetallic Deposit in British Columbia revealed significant copper and gold mineralization, suggesting robust resource potential. Despite being unprofitable and experiencing increased losses over five years, Doubleview remains debt-free with sufficient short-term assets to cover liabilities. The company's share price has been volatile but stable recently, while recent capital raises have extended its cash runway to 12 months. Management's seasoned tenure adds operational stability amidst financial uncertainty.

- Jump into the full analysis health report here for a deeper understanding of Doubleview Gold.

- Assess Doubleview Gold's previous results with our detailed historical performance reports.

Next Steps

- Get an in-depth perspective on all 932 TSX Penny Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:DBG

Doubleview Gold

Engages in the acquisition, exploration, and development of mineral resource properties in Canada.

Moderate with adequate balance sheet.

Market Insights

Community Narratives