- Canada

- /

- Metals and Mining

- /

- TSXV:ALDE

TSX Penny Stocks Spotlight: Aldebaran Resources And 2 More To Consider

Reviewed by Simply Wall St

Despite rising tariff rates, the Canadian market has shown resilience with inflation and economic data remaining stable. For those interested in smaller or newer companies, penny stocks—despite their somewhat outdated label—can still offer intriguing opportunities. These stocks often represent a blend of affordability and potential growth when backed by strong financials, making them worth considering for investors seeking under-the-radar companies with long-term promise.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Foraco International (TSX:FAR) | CA$1.77 | CA$173.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.77 | CA$515.61M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.92 | CA$19.82M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.62 | CA$179.67M | ✅ 2 ⚠️ 1 View Analysis > |

| Avino Silver & Gold Mines (TSX:ASM) | CA$4.85 | CA$717.31M | ✅ 3 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.86 | CA$163.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$185.15M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.60 | CA$9.42M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 457 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Aldebaran Resources (TSXV:ALDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aldebaran Resources Inc. focuses on the acquisition, exploration, and evaluation of mineral properties in Canada and Argentina, with a market cap of CA$402.70 million.

Operations: Aldebaran Resources Inc. currently does not report any revenue segments.

Market Cap: CA$402.7M

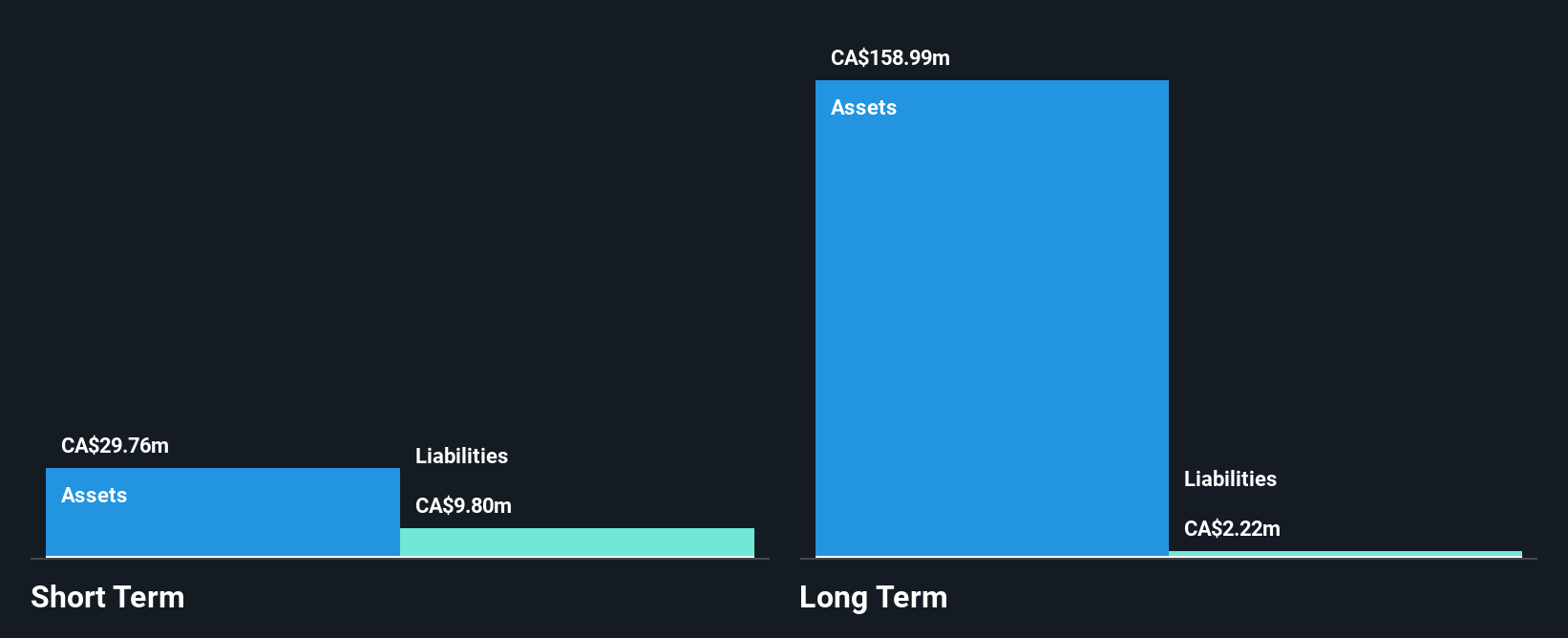

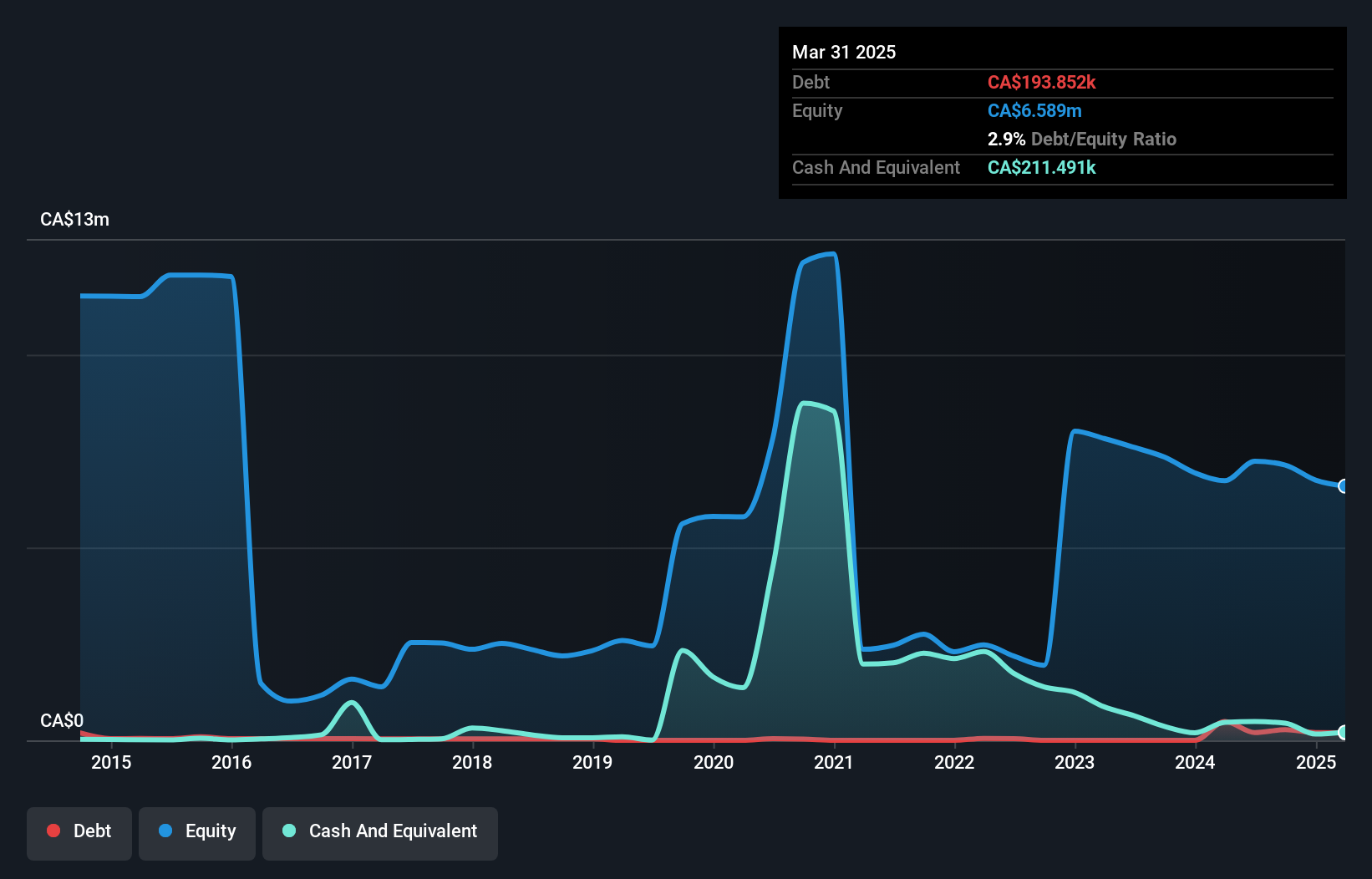

Aldebaran Resources Inc., with a market cap of CA$402.70 million, is pre-revenue and focuses on mineral exploration in Canada and Argentina. Recent drilling at its Altar project aims to upgrade resource classifications, highlighting the potential for future development. Despite being unprofitable, Aldebaran has reduced losses by 5.1% annually over five years and maintains a strong financial position with short-term assets exceeding liabilities. The company is debt-free, minimizing financial risk, but it faces challenges with limited cash runway under current conditions. Its experienced management team adds credibility to its strategic endeavors in the mining sector.

- Jump into the full analysis health report here for a deeper understanding of Aldebaran Resources.

- Evaluate Aldebaran Resources' prospects by accessing our earnings growth report.

American Creek Resources (TSXV:AMK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: American Creek Resources Ltd. is a company focused on acquiring and exploring mineral properties in Canada, with a market cap of CA$57.00 million.

Operations: American Creek Resources Ltd. does not report any specific revenue segments.

Market Cap: CA$57M

American Creek Resources Ltd., with a market cap of CA$57 million, is pre-revenue and focuses on mineral exploration in Canada. The company recently announced significant progress at its Treaty Creek Project, aiming to expand high-grade gold discoveries through an extensive drilling program. Despite being unprofitable and having increased losses over the past five years, American Creek has secured additional capital to extend its short cash runway. The planned acquisition by Tudor Gold Corp., valued at approximately CA$62.7 million, could impact shareholders significantly as they are set to own about 30% of the combined entity post-transaction completion expected by August 2025.

- Dive into the specifics of American Creek Resources here with our thorough balance sheet health report.

- Explore historical data to track American Creek Resources' performance over time in our past results report.

EMX Royalty (TSXV:EMX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EMX Royalty Corporation focuses on exploring and generating royalties from metals and minerals properties, with a market cap of CA$449.25 million.

Operations: The company's revenue segment consists of $29.63 million from acquiring, managing, and generating royalties on metals and minerals properties.

Market Cap: CA$449.25M

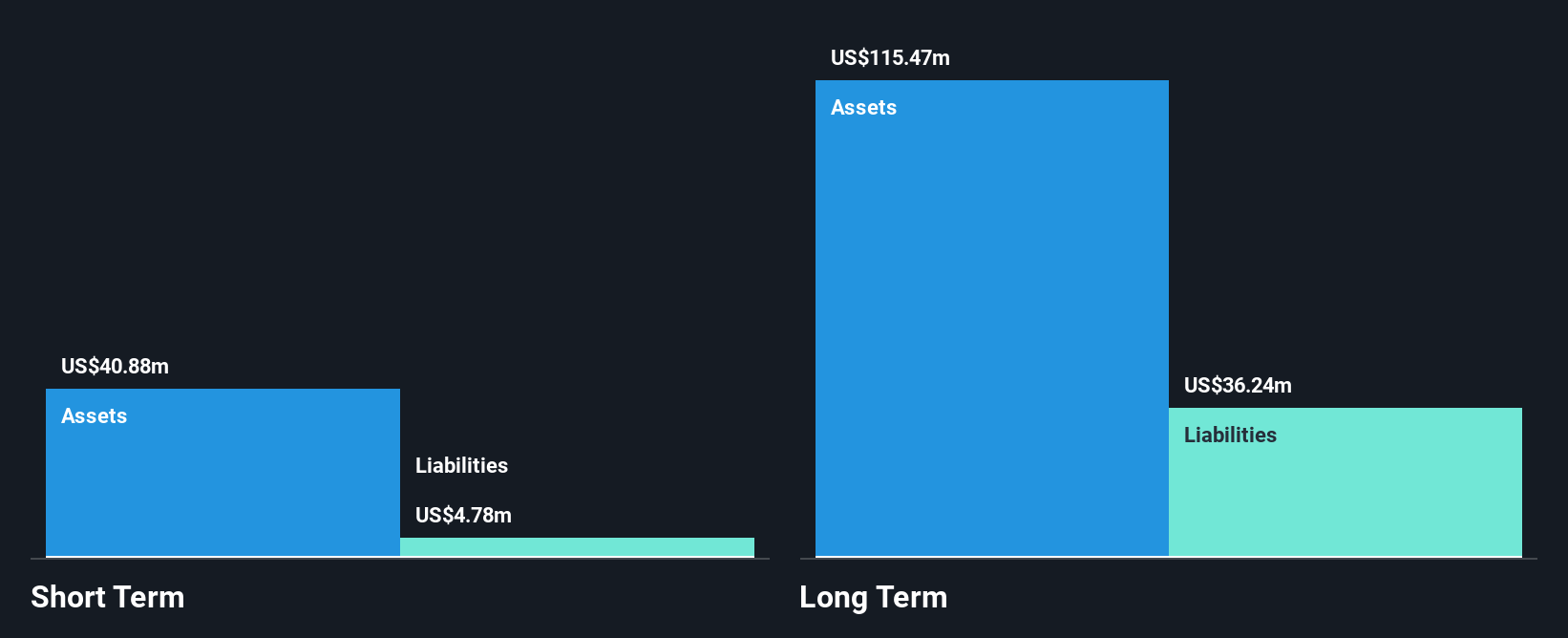

EMX Royalty Corporation, with a market cap of CA$449.25 million, has shown a positive shift by becoming profitable recently, reporting US$8.42 million in sales for Q1 2025 and a net income of US$1.26 million. The company’s strategic alliance with Avesoro Morocco LTD enhances its exploration prospects in Morocco's promising mineral belts, fully funded by Avesoro. Despite stable weekly volatility and satisfactory net debt to equity ratio (7.5%), EMX's interest payments are not well covered by EBIT (0.9x). However, its seasoned management team and robust short-term assets position it favorably within the penny stock landscape.

- Take a closer look at EMX Royalty's potential here in our financial health report.

- Learn about EMX Royalty's future growth trajectory here.

Make It Happen

- Embark on your investment journey to our 457 TSX Penny Stocks selection here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ALDE

Aldebaran Resources

Engages in the acquisition, exploration, and evaluation of mineral properties in Canada and Argentina.

Excellent balance sheet and fair value.

Market Insights

Community Narratives