As the Canadian market navigates near-record highs, investors are keeping a close eye on central banks' cautious stance following recent rate cuts and easing trade tensions between major economies. In this environment, identifying stocks that are priced below their estimated value can offer potential opportunities for those looking to capitalize on market adjustments and resilient corporate earnings.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vitalhub (TSX:VHI) | CA$10.39 | CA$18.34 | 43.4% |

| Topicus.com (TSXV:TOI) | CA$136.03 | CA$205.07 | 33.7% |

| Savaria (TSX:SIS) | CA$21.62 | CA$40.35 | 46.4% |

| Kinaxis (TSX:KXS) | CA$168.08 | CA$284.90 | 41% |

| Haivision Systems (TSX:HAI) | CA$5.07 | CA$8.56 | 40.8% |

| GURU Organic Energy (TSX:GURU) | CA$5.60 | CA$8.97 | 37.5% |

| Boyd Group Services (TSX:BYD) | CA$223.50 | CA$403.91 | 44.7% |

| Artemis Gold (TSXV:ARTG) | CA$32.64 | CA$59.77 | 45.4% |

| Americas Gold and Silver (TSX:USA) | CA$5.08 | CA$8.81 | 42.3% |

| 5N Plus (TSX:VNP) | CA$19.45 | CA$29.91 | 35% |

Here we highlight a subset of our preferred stocks from the screener.

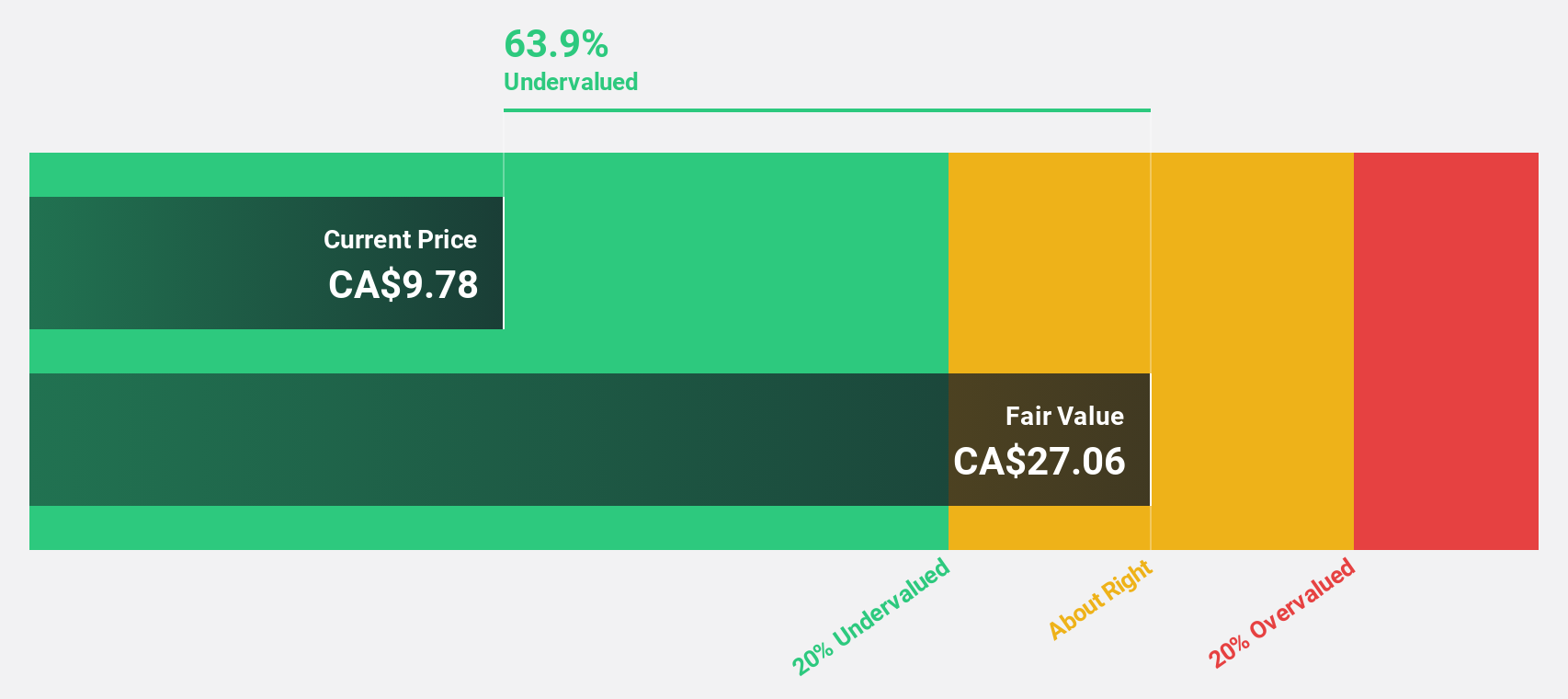

Savaria (TSX:SIS)

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally, with a market cap of CA$1.58 billion.

Operations: The company's revenue segments include Patient Care, which generated CA$197.05 million, and Segment Adjustment, amounting to CA$686.90 million.

Estimated Discount To Fair Value: 46.4%

Savaria is trading at CA$21.62, significantly below its estimated fair value of CA$40.35, suggesting it may be undervalued based on cash flows. The company reported strong earnings growth of 18% over the past year and forecasts suggest earnings will grow by 31.32% annually, outpacing the Canadian market's expected growth of 12.1%. Despite recent insider selling, its reliable dividend yield and anticipated revenue growth further enhance its investment appeal.

- Upon reviewing our latest growth report, Savaria's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Savaria.

Alphamin Resources (TSXV:AFM)

Overview: Alphamin Resources Corp. is involved in the production and sale of tin concentrate, with a market cap of CA$1.36 billion.

Operations: Alphamin Resources Corp. generates its revenue through the production and sale of tin concentrate.

Estimated Discount To Fair Value: 11.6%

Alphamin Resources is trading at CA$1.04, slightly below its estimated fair value of CA$1.18, indicating potential undervaluation based on cash flows. The company reported a net income increase to US$35.08 million for Q3 2025 and forecasts suggest earnings growth of 23.5% annually, surpassing the Canadian market's expected rate. However, its dividend track record is unstable despite recent payouts totaling approximately US$37 million in aggregate dividends for fiscal 2025.

- In light of our recent growth report, it seems possible that Alphamin Resources' financial performance will exceed current levels.

- Get an in-depth perspective on Alphamin Resources' balance sheet by reading our health report here.

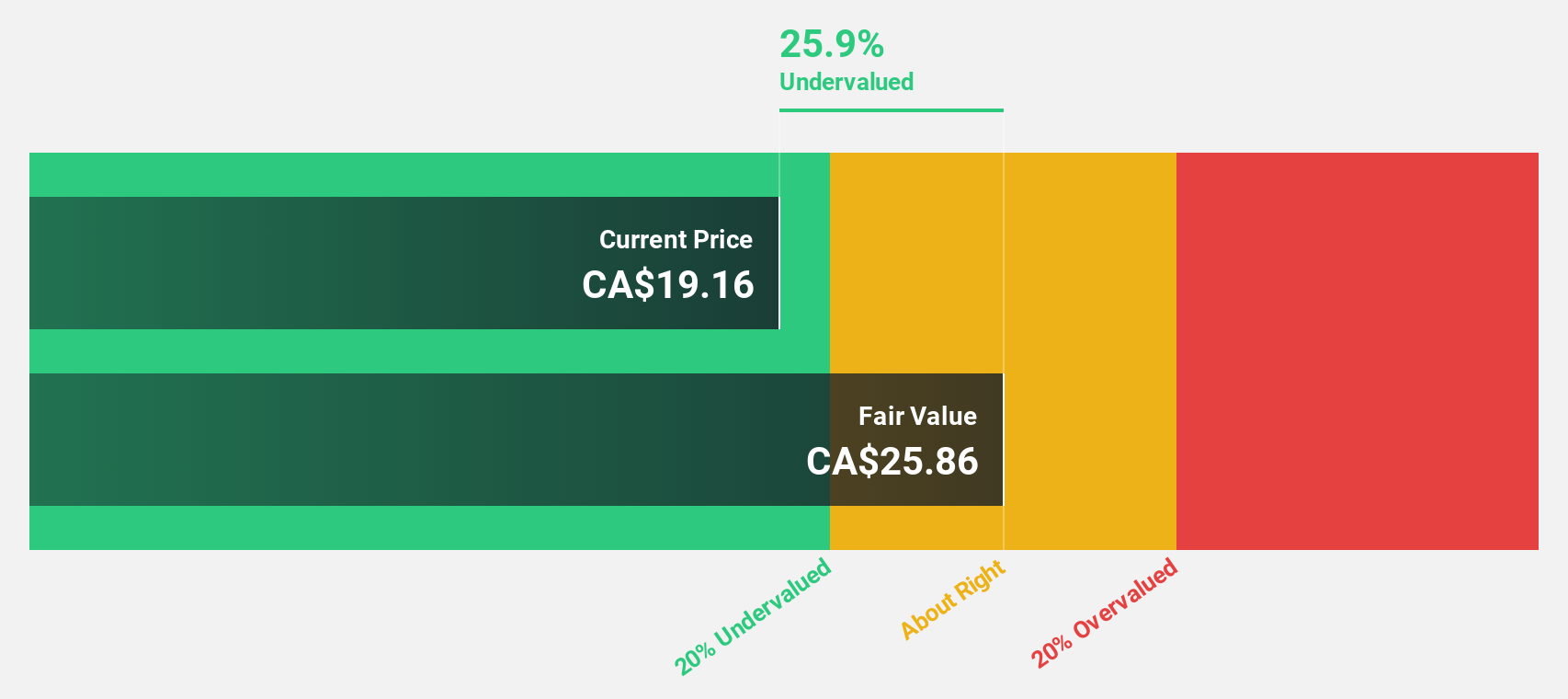

5N Plus (TSX:VNP)

Overview: 5N Plus Inc. is a company that produces and sells specialty semiconductors and performance materials across the Americas, Europe, Asia, and internationally, with a market capitalization of approximately CA$1.85 billion.

Operations: 5N Plus Inc.'s revenue is derived from its operations in specialty semiconductors and performance materials across various regions, including the Americas, Europe, Asia, and other international markets.

Estimated Discount To Fair Value: 35%

5N Plus is trading at CA$19.45, significantly below its estimated fair value of CA$29.91, highlighting potential undervaluation based on cash flows. Recent earnings show a net income rise to US$18.18 million for Q3 2025 from US$6.37 million a year earlier, with forecasts suggesting annual earnings growth of 15.52%, outpacing the Canadian market's rate. The company secured an expanded supply agreement with First Solar, enhancing its semiconductor material production commitments through 2028.

- Our earnings growth report unveils the potential for significant increases in 5N Plus' future results.

- Navigate through the intricacies of 5N Plus with our comprehensive financial health report here.

Taking Advantage

- Click through to start exploring the rest of the 19 Undervalued TSX Stocks Based On Cash Flows now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VNP

5N Plus

Produces and sells specialty semiconductors and performance materials in the Americas, Europe, Asia, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives