- Canada

- /

- Metals and Mining

- /

- TSXV:AFM

Alphamin Resources (TSXV:AFM) Margin Surge Reinforces Bullish Narrative on Profit Growth

Reviewed by Simply Wall St

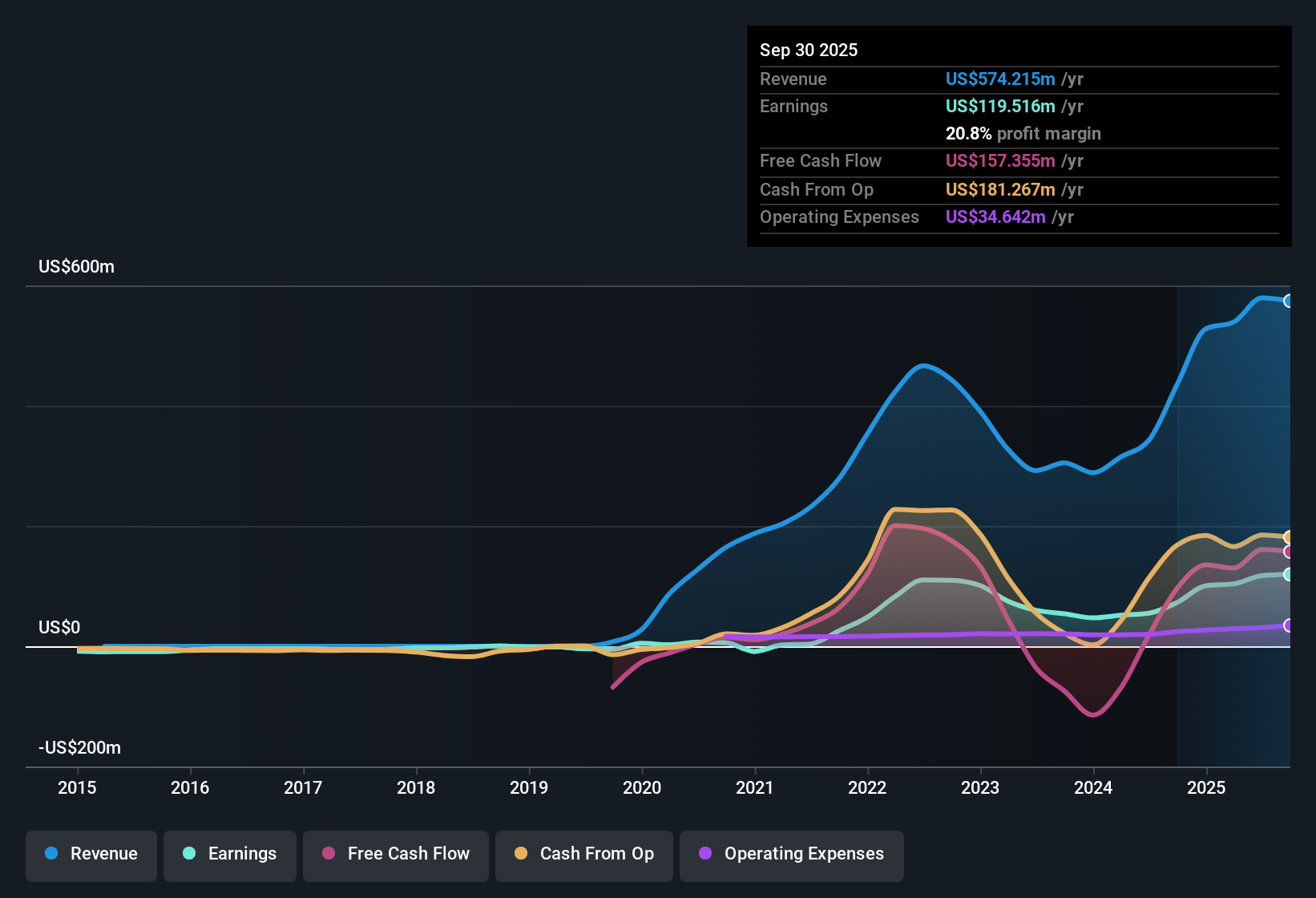

Alphamin Resources (TSXV:AFM) turned in another strong performance, with net profit margins climbing to 20.8% from 16.7% last year and earnings up an impressive 63.4% year-over-year. With forecasts calling for earnings to grow 23.5% per year and revenue growth of 5.3% per year, the company’s momentum stands out within the Canadian market. Investors are seeing improved profitability and value signals, especially with Alphamin trading below its estimated fair value and sporting a price-to-earnings ratio notably under industry peers.

See our full analysis for Alphamin Resources.Next, we will see how these headline numbers stack up against the dominant narratives investors are following. Sometimes the story matches the stats, but surprises can emerge at the margins.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Hits Five-Year High

- Net profit margin stands at 20.8%, now above the company’s five-year average growth rate of 29.1% for earnings, highlighting consistent improvement rather than a one-off spike.

- What is unusual is how this sustained margin advance aligns with growing global tin demand. Market coverage has emphasized Alphamin’s operational transparency and its status as a major supplier to tech supply chains.

- Recent news highlights that tighter global tin supply and project milestones appear to reinforce robust profitability.

- While commodity-sector volatility is always a risk, current execution is drawing positive attention from both market analysts and retail investors focused on strategic metals.

Earnings Growth Rate Outpaces Sector

- Earnings are forecast to grow at 23.5% per year, nearly double the Canadian market average of 11.8%. This pace is also well ahead of sector trends among metals companies.

- This kind of growth heavily supports optimism about Alphamin’s positioning, since growing faster than the broader market suggests real competitive advantages.

- For example, production updates and earnings acceleration have been received well by the market because these are viewed as signs of a strategic edge amid global tin shortages.

- Nevertheless, with such a high bar set for future growth, sustained execution will be watched closely given typical commodity price swings.

Valuation Still at a Deep Discount

- Alphamin’s price-to-earnings ratio of 7.9x is less than half the industry average of 20.7x and well below the peer mean of 39.5x, while shares currently trade at $1.04 compared to a DCF fair value of $1.18.

- Despite improved profitability and sector momentum, the company’s steep discount challenges the idea that rapid growth and margin strength are already priced in.

- A history of profit growth and positive value signals suggest the market may be underestimating the sustainability of Alphamin’s earnings trajectory.

- On the other hand, risks like dividend sustainability and typical commodity volatility are likely factors keeping the valuation from moving higher despite sector tailwinds.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Alphamin Resources's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Alphamin’s impressive growth and profitability, uncertainty around dividend sustainability and exposure to commodity price fluctuations may limit future investor confidence.

If you want dependable payouts from sturdier businesses, check out these 1978 dividend stocks with yields > 3% to discover companies with yields above 3% and sustainable dividend track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AFM

Alphamin Resources

Engages in the production and sale of tin concentrate.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion