- Canada

- /

- Metals and Mining

- /

- TSXV:AFM

3 TSX Dividend Stocks Yielding Up To 9.3%

Reviewed by Simply Wall St

As the Canadian market navigates potential changes in U.S. tax policies and fluctuating bond yields, investors are increasingly focused on stable income sources like dividend stocks. In this environment, selecting stocks with strong dividend yields can provide a reliable income stream while potentially offering some insulation from broader market volatility.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.10% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.69% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.03% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.08% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.33% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.76% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.82% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.52% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.48% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 3.96% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top TSX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

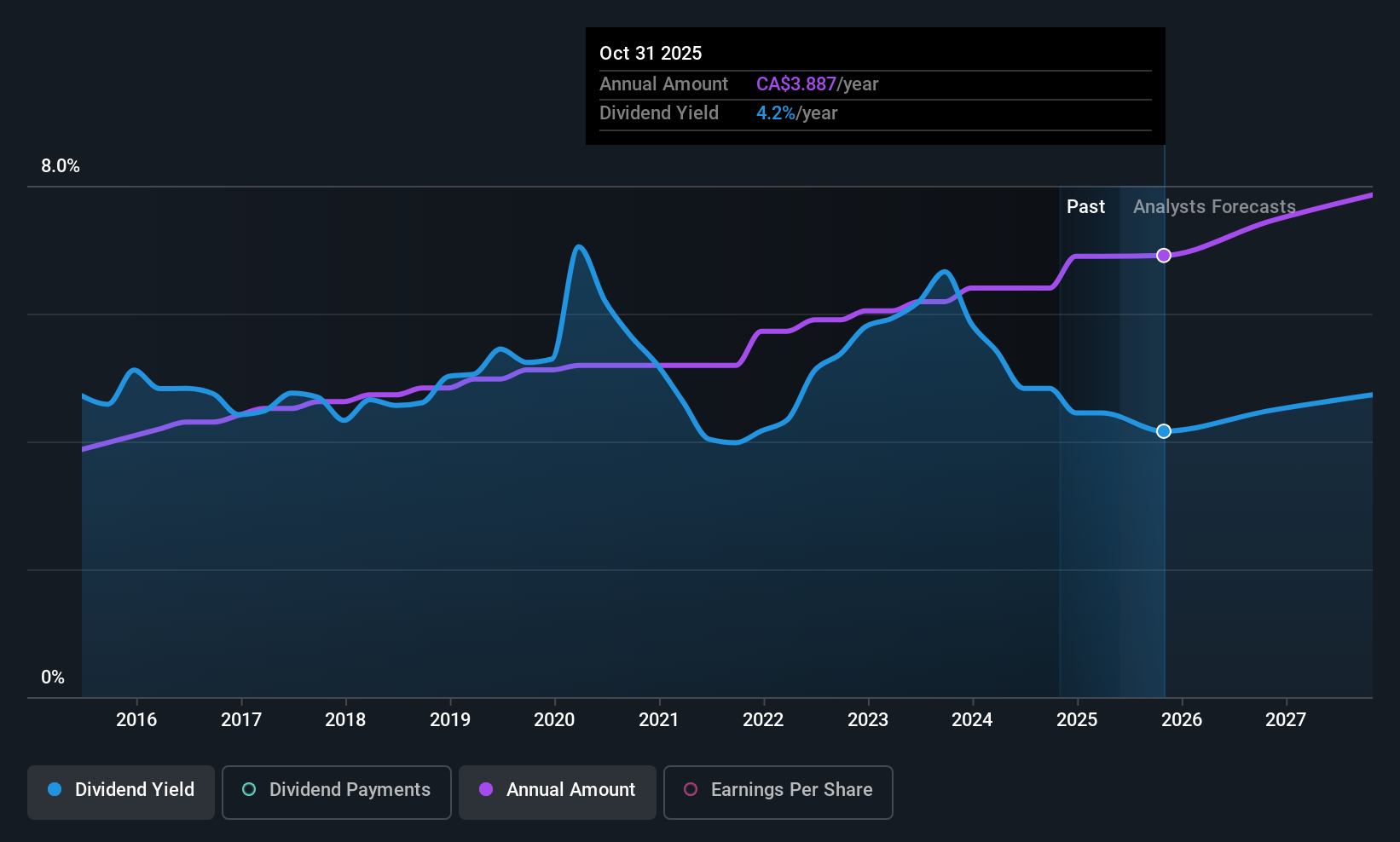

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce is a diversified financial institution offering a range of financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally, with a market cap of CA$88.29 billion.

Operations: Canadian Imperial Bank of Commerce generates revenue from several segments, including Canadian Personal and Business Banking (CA$8.97 billion), Capital Markets (CA$6.12 billion), Canadian Commercial Banking and Wealth Management (CA$5.69 billion), and U.S. Commercial Banking and Wealth Management (CA$2.37 billion).

Dividend Yield: 4.1%

Canadian Imperial Bank of Commerce offers a stable dividend with a yield of 4.1%, supported by a low payout ratio of 47.5%, indicating sustainability. The bank's dividends have been reliable and steadily increasing over the past decade, though its yield falls short compared to the top Canadian dividend payers. Recent developments include the launch of CIBC AI, enhancing productivity, and innovative financial products like the CIBC Adapta Mastercard, reflecting strategic growth initiatives that may bolster future earnings capacity.

- Delve into the full analysis dividend report here for a deeper understanding of Canadian Imperial Bank of Commerce.

- Our expertly prepared valuation report Canadian Imperial Bank of Commerce implies its share price may be lower than expected.

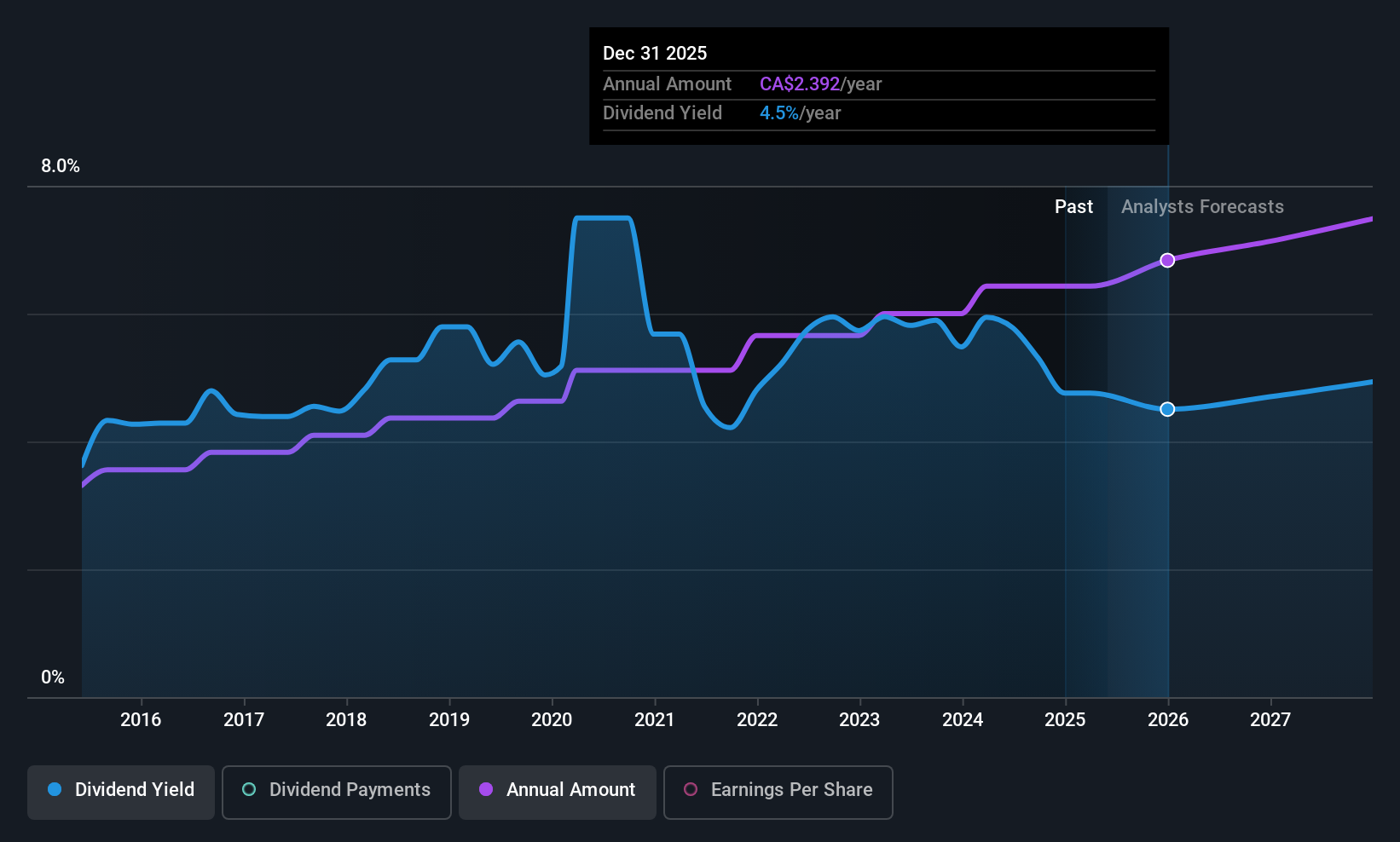

Power Corporation of Canada (TSX:POW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada is an international management and holding company offering financial services across North America, Europe, and Asia with a market cap of CA$32.45 billion.

Operations: Power Corporation of Canada's revenue segments include CA$3.56 billion from IGM, CA$31.02 billion from Lifeco, and CA$2.39 billion from Alternative Asset Investment Platforms.

Dividend Yield: 4.8%

Power Corporation of Canada provides a reliable dividend, currently yielding 4.82%, with a sustainable payout ratio of 53.4%. The dividend is well covered by cash flows, evidenced by a cash payout ratio of 35.2%. Recent affirmations confirm the quarterly dividend at CAD 0.6125 per share, payable August 1, 2025. Despite being below the top tier of Canadian dividend payers, the company's dividends have shown stability and growth over the past decade, supported by strategic share buybacks totaling CAD 68 million recently completed.

- Navigate through the intricacies of Power Corporation of Canada with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Power Corporation of Canada's share price might be too pessimistic.

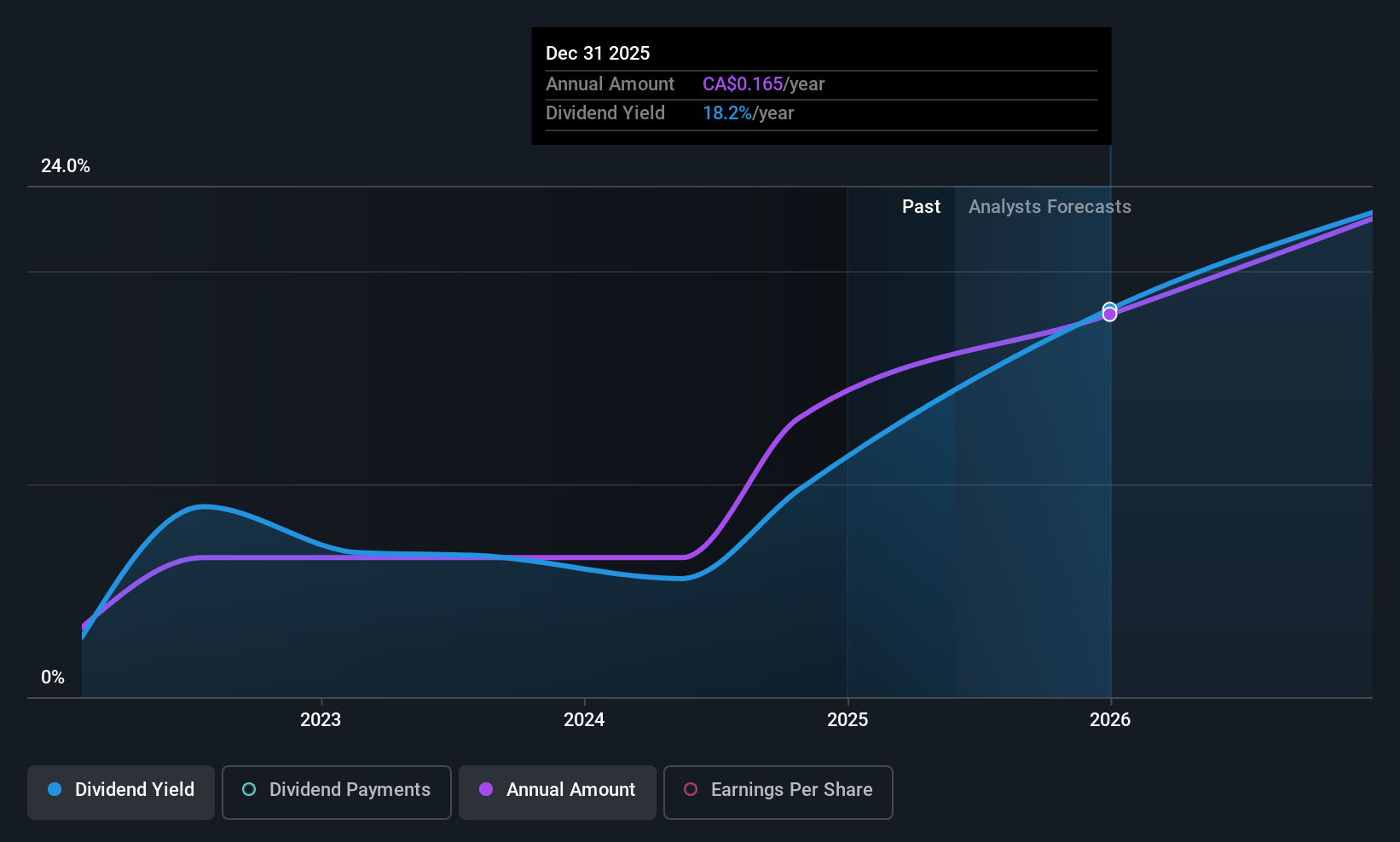

Alphamin Resources (TSXV:AFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alphamin Resources Corp., along with its subsidiaries, is involved in the production and sale of tin concentrate, with a market cap of approximately CA$1.23 billion.

Operations: Alphamin Resources Corp.'s revenue is primarily derived from the production and sale of tin from its Bisie Tin Mine, generating approximately $539.16 million.

Dividend Yield: 9.4%

Alphamin Resources' dividend yield of 9.36% is among the top 25% in Canada, yet its track record is unstable with recent volatility. Despite a reasonable cash payout ratio of 63.3%, dividends were not declared for fiscal year 2024 due to operational disruptions and security concerns at its Bisie tin mine. Earnings have grown significantly, but the company's going concern doubts and reduced production guidance highlight risks for dividend sustainability amidst ongoing geopolitical challenges in the DRC.

- Get an in-depth perspective on Alphamin Resources' performance by reading our dividend report here.

- The valuation report we've compiled suggests that Alphamin Resources' current price could be quite moderate.

Seize The Opportunity

- Discover the full array of 27 Top TSX Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AFM

Alphamin Resources

Engages in the production and sale of tin concentrate.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion