- Canada

- /

- Metals and Mining

- /

- TSX:BSX

Irving Resources Leads Our Trio Of TSX Penny Stock Picks

Reviewed by Simply Wall St

As we head into the second half of 2025, the Canadian market is closely monitoring trade negotiations, particularly between the U.S. and China, which could influence economic growth and inflation. In such a climate, investors often seek opportunities in smaller or newer companies that offer potential for growth at lower price points. Penny stocks may be an outdated term, but they remain relevant as investment options when backed by strong financials and solid fundamentals—qualities that can make them appealing choices for those looking to uncover hidden gems with long-term potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.69 | CA$624.3M | ✅ 3 ⚠️ 4 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.41 | CA$743.85M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.52 | CA$190.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.6M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.81 | CA$538.89M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.90 | CA$17.84M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.20 | CA$93.91M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.12 | CA$121.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$186.9M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.95 | CA$5.42M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 882 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Irving Resources (CNSX:IRV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Irving Resources Inc. is a junior exploration stage company focused on acquiring and exploring mineral properties in Canada and Japan, with a market cap of CA$20.71 million.

Operations: Irving Resources Inc. has not reported any revenue segments.

Market Cap: CA$20.71M

Irving Resources Inc., a pre-revenue junior exploration company, has demonstrated financial prudence by maintaining a debt-free status and covering both short and long-term liabilities with its CA$5.7 million in short-term assets. Despite its unprofitability, the company has reduced losses over five years. Recent private placements raised CA$1.33 million, indicating investor confidence, including participation from Crescat Capital LLC and insiders. The management team is seasoned with an average tenure of 5.4 years, complemented by new CFO Queenie Kuang's extensive financial expertise. Noteworthy drilling results at Omui suggest potential for significant mineral resource development in Japan.

- Click here and access our complete financial health analysis report to understand the dynamics of Irving Resources.

- Gain insights into Irving Resources' past trends and performance with our report on the company's historical track record.

Belo Sun Mining (TSX:BSX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Belo Sun Mining Corp, with a market cap of CA$94.96 million, operates through its subsidiaries as a gold exploration and development company in Brazil.

Operations: Currently, Belo Sun Mining Corp does not report any revenue segments.

Market Cap: CA$94.96M

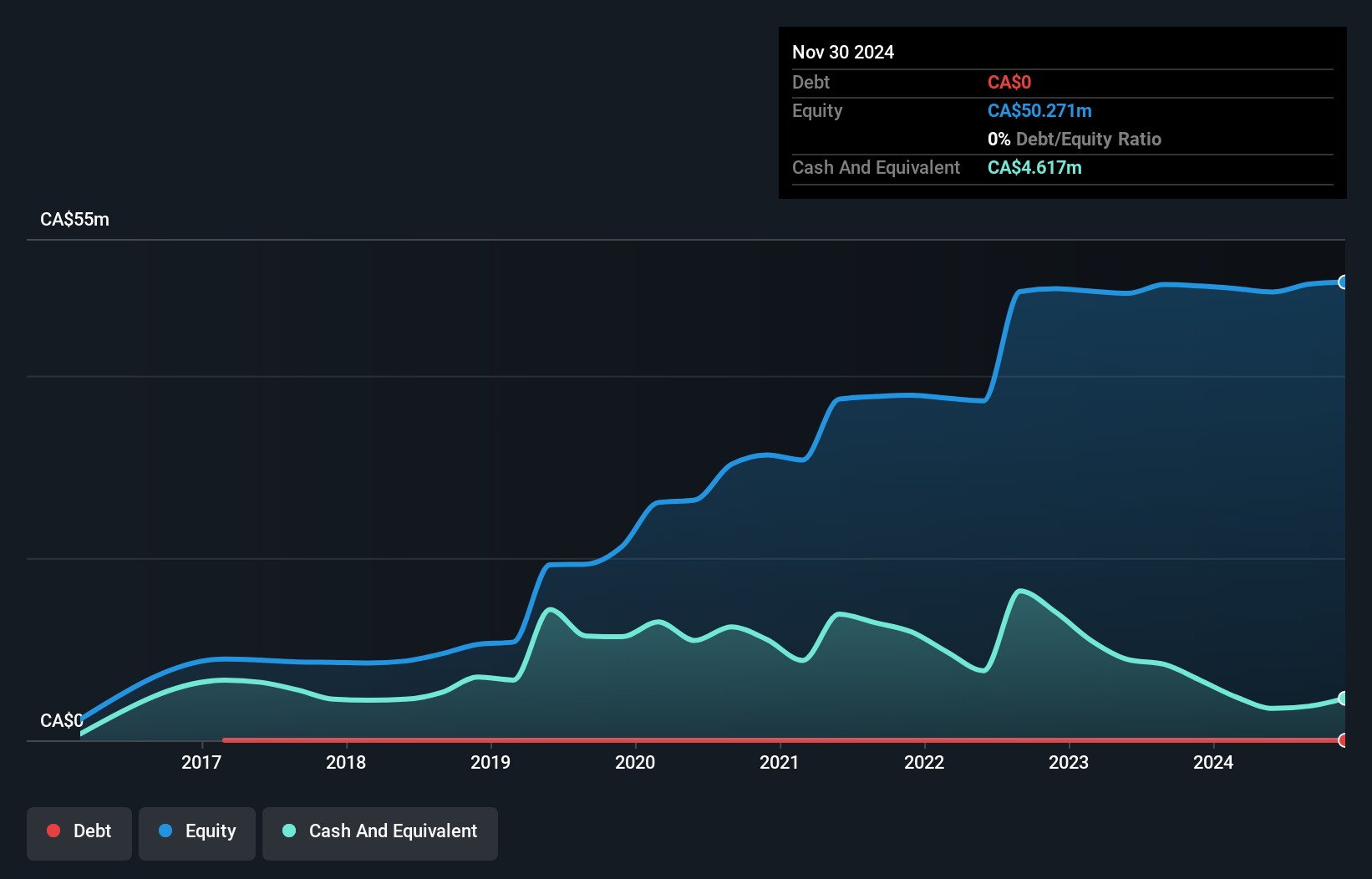

Belo Sun Mining Corp, a pre-revenue gold exploration company in Brazil, remains debt-free with short-term assets of CA$10.1 million exceeding liabilities of CA$3.1 million. The seasoned management team averages 10.3 years of tenure, and the board is experienced as well. Despite unprofitability and increasing losses over five years at 12.4% annually, the company maintains a cash runway exceeding one year based on current free cash flow trends. Recent earnings show a net loss increase to CA$3.06 million for Q1 2025 compared to the previous year, underscoring ongoing financial challenges amidst exploration efforts.

- Get an in-depth perspective on Belo Sun Mining's performance by reading our balance sheet health report here.

- Evaluate Belo Sun Mining's historical performance by accessing our past performance report.

Yorbeau Resources (TSX:YRB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yorbeau Resources Inc. is involved in the acquisition, development, and exploration of mineral properties in Canada with a market cap of CA$20.77 million.

Operations: The company generates revenue from its mining exploration activities, amounting to CA$0.05 million.

Market Cap: CA$20.77M

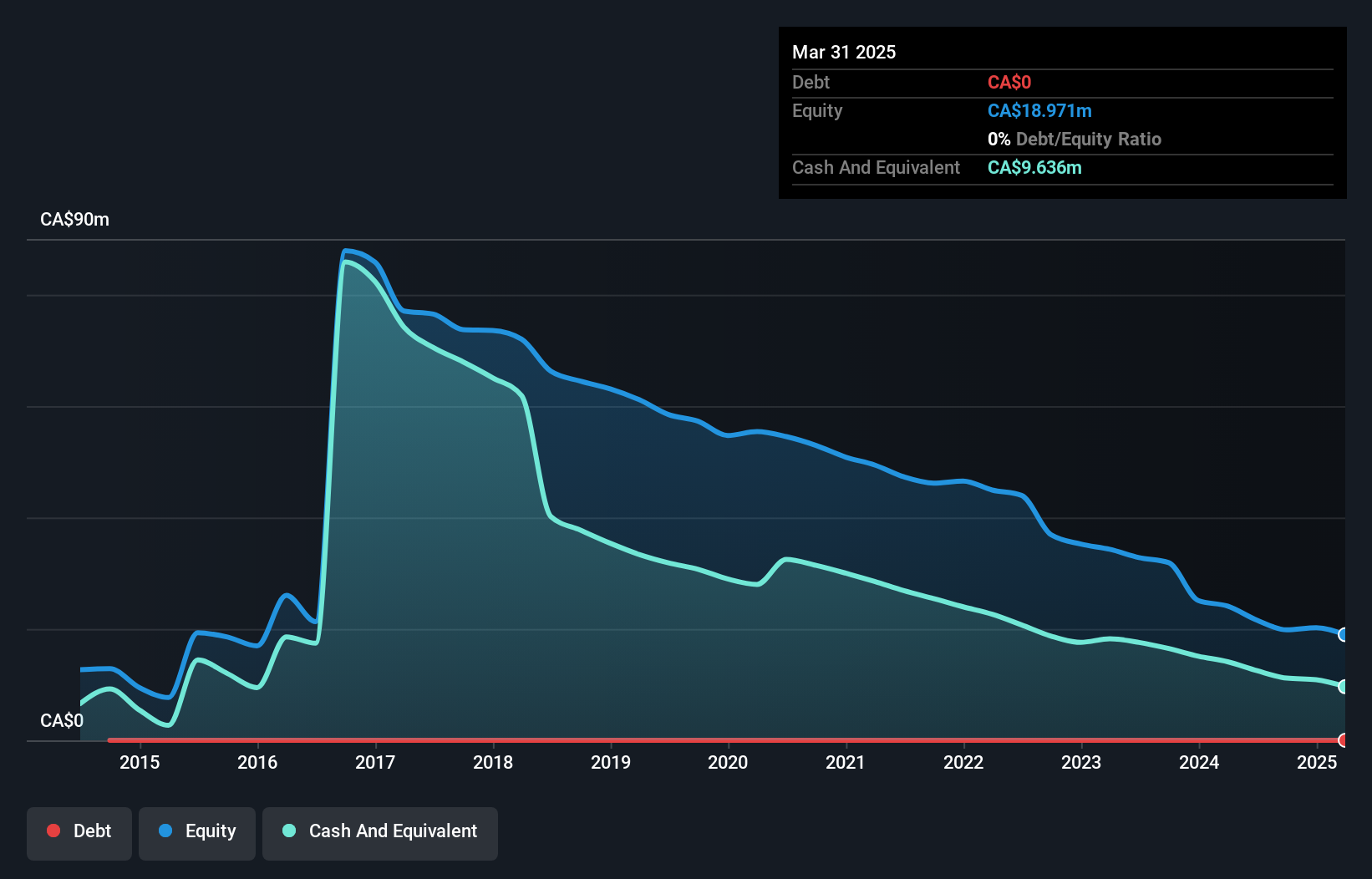

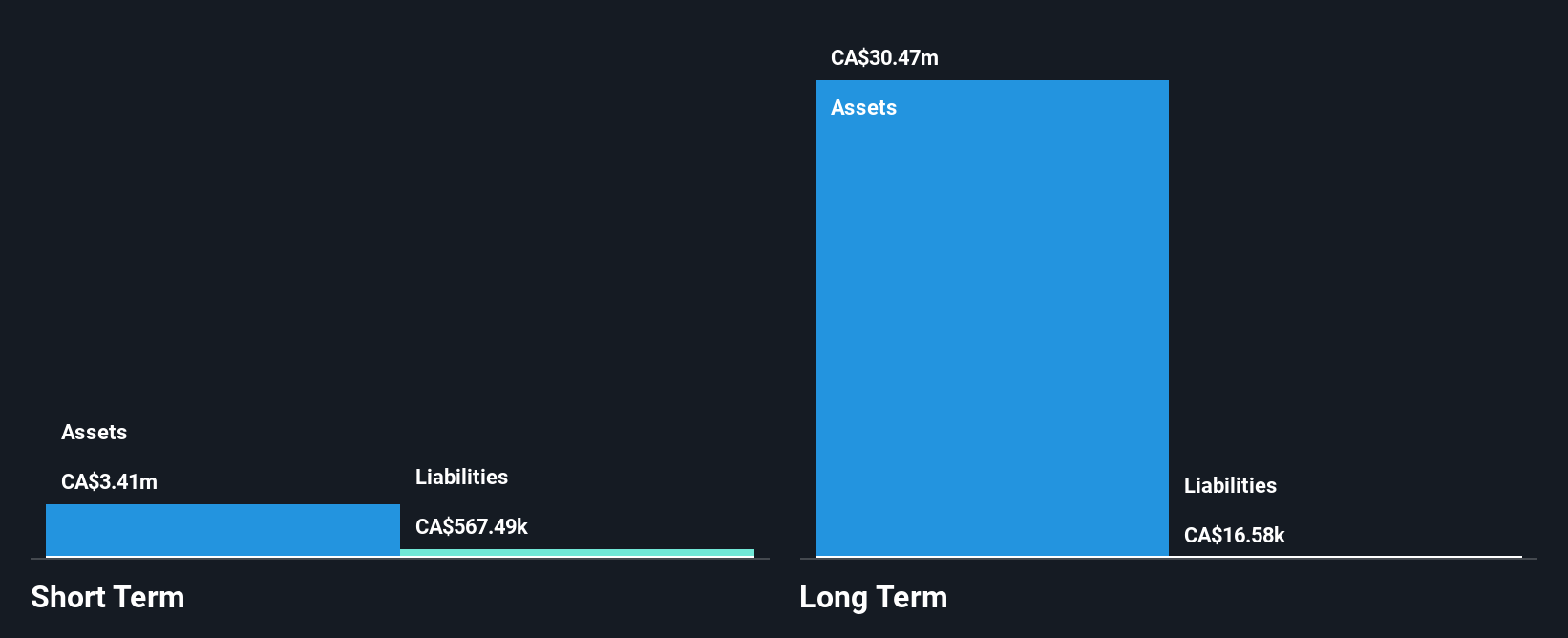

Yorbeau Resources Inc., a pre-revenue mining exploration company, has recently achieved profitability with net income of CA$8.02 million for 2024, reversing a prior loss. Despite its small revenue base (CA$0.42 million in 2024), the company maintains a robust financial position with no debt and short-term assets of CA$3.4 million exceeding liabilities significantly. The management team and board are both experienced, averaging over five years in tenure each. However, high share price volatility and auditor concerns about the company's ability to continue as a going concern present notable risks for investors considering this stock.

- Click to explore a detailed breakdown of our findings in Yorbeau Resources' financial health report.

- Assess Yorbeau Resources' previous results with our detailed historical performance reports.

Where To Now?

- Take a closer look at our TSX Penny Stocks list of 882 companies by clicking here.

- Ready For A Different Approach? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Belo Sun Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BSX

Belo Sun Mining

Through its subsidiaries, operates as a gold exploration and development company in Brazil.

Adequate balance sheet with low risk.

Market Insights

Community Narratives