- Canada

- /

- Metals and Mining

- /

- TSX:WPM

Wheaton Precious Metals (TSX:WPM) Declares USD 0.155 Q4 Dividend Amid Strong Financial Performance

Reviewed by Simply Wall St

Wheaton Precious Metals (TSX:WPM) has recently declared a USD 0.155 per share dividend for Q4 2024, reinforcing its commitment to shareholder returns and showcasing its financial health and debt-free status. There has been a slight decline in net profit margins and a return on equity below industry expectations, yet Wheaton remains strategically poised for growth with plans to expand in Asia and South America, along with a significant production forecast set to increase by 2028. Readers can expect an in-depth discussion on Wheaton's financial performance, strategic initiatives, and potential risks impacting its future success.

Take a closer look at Wheaton Precious Metals's potential here.

Key Assets Propelling Wheaton Precious Metals Forward

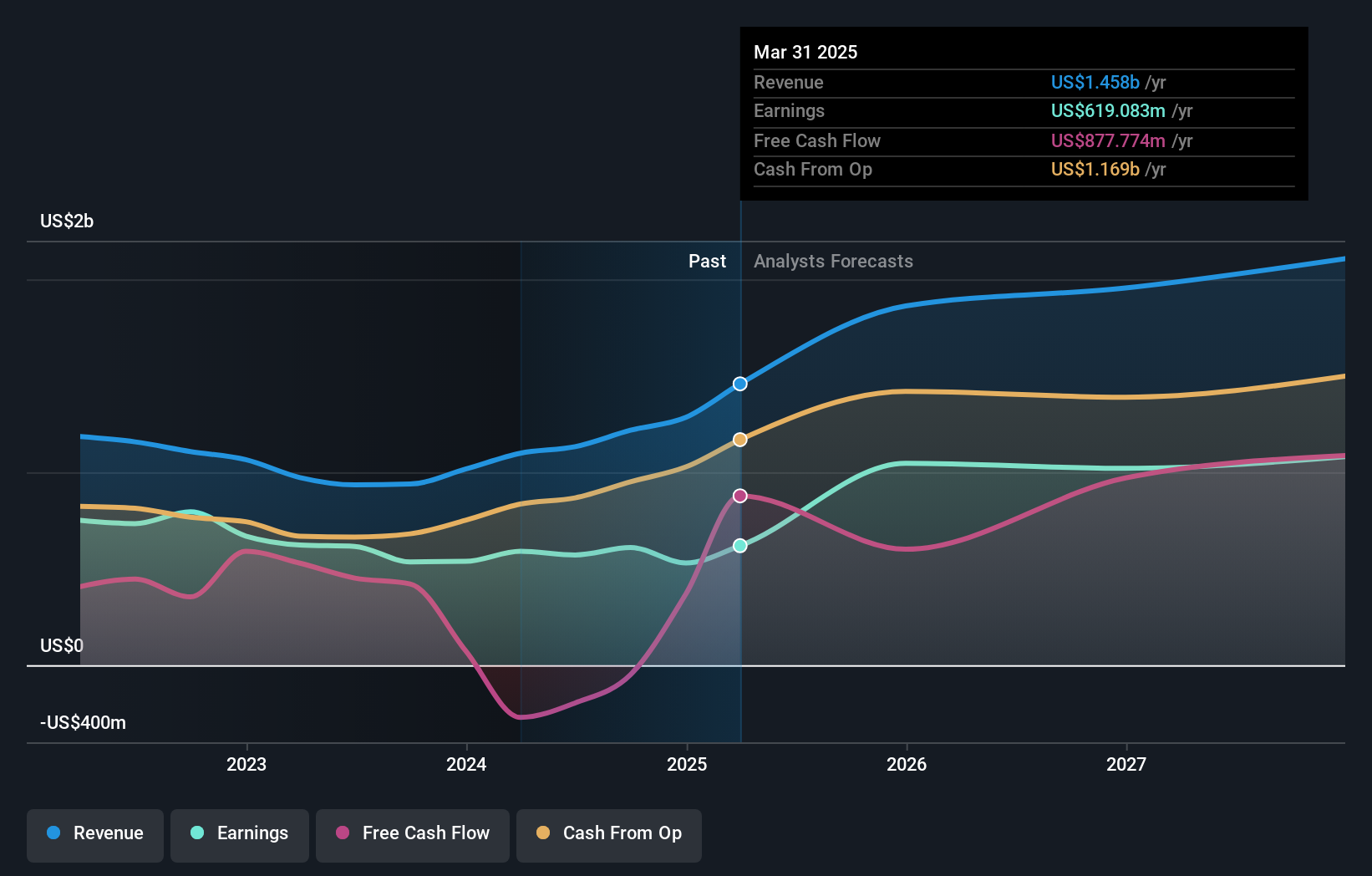

Wheaton Precious Metals has demonstrated strong financial health, with earnings growing by 16.8% annually over the past five years. This growth is supported by a forecasted 11% annual revenue increase, outpacing the Canadian market's 6.9%. The company maintains a debt-free status, highlighting its financial position. Additionally, Wheaton's dividend payments have consistently risen over the past decade, with a payout ratio of 44.6%, indicating dividends are well-covered by earnings. The company's recent announcement of a USD 0.155 per share dividend for Q4 2024 further underlines its commitment to shareholder returns.

Challenges Constraining Wheaton Precious Metals's Potential

Wheaton faces challenges such as a decrease in net profit margins from 57% to 50.1% year-over-year. Its earnings growth of 13.8% in the past year lagged behind the Metals and Mining industry average of 25.2%. Furthermore, the return on equity stands at 8.4%, which is below the generally accepted 20% threshold. These factors highlight areas where operational efficiencies could be improved to enhance profitability. The company's high Price-To-Earnings Ratio of 48.3x, compared to peers, suggests potential overvaluation concerns.

Potential Strategies for Leveraging Growth and Competitive Advantage

Wheaton is strategically positioned to capitalize on emerging opportunities, particularly through market expansion in Asia and South America. The company's focus on digital transformation is expected to streamline operations and enhance customer engagement. Recent regulatory changes present new avenues for growth, especially in the renewable energy sector. The company's production guidance, with a forecasted increase to over 800,000 GEOs by 2028, underscores its growth potential.

Key Risks and Challenges That Could Impact Wheaton Precious Metals's Success

Economic fluctuations pose a risk to Wheaton's revenue growth and profit margins. The company is aware of potential supply chain disruptions, which could affect production timelines. Additionally, navigating complex regulatory environments remains a challenge that could impact operational agility. Despite these threats, the management's proactive approach to mitigating risks and exploring new growth avenues reflects a comprehensive understanding of the market dynamics.

Conclusion

Wheaton Precious Metals is in a strong financial position, with its consistent earnings growth and debt-free status supporting a promising outlook. Challenges like declining profit margins and a lower-than-industry-average return on equity exist, yet the company's strategic initiatives in digital transformation and market expansion position it well for future growth. The current trading price of CA$90.23, below the estimated fair value of CA$93.26, suggests that the market may not fully recognize Wheaton's growth potential and strategic advantages. This discrepancy, coupled with proactive risk management and a commitment to shareholder returns, indicates a positive trajectory for future performance.

Where To Now?

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wheaton Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:WPM

Wheaton Precious Metals

Sells precious metals in North America, Europe, Africa, and South America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion