- Canada

- /

- Metals and Mining

- /

- TSX:WPM

The Wheaton Precious Metals Corp. (TSE:WPM) Third-Quarter Results Are Out And Analysts Have Published New Forecasts

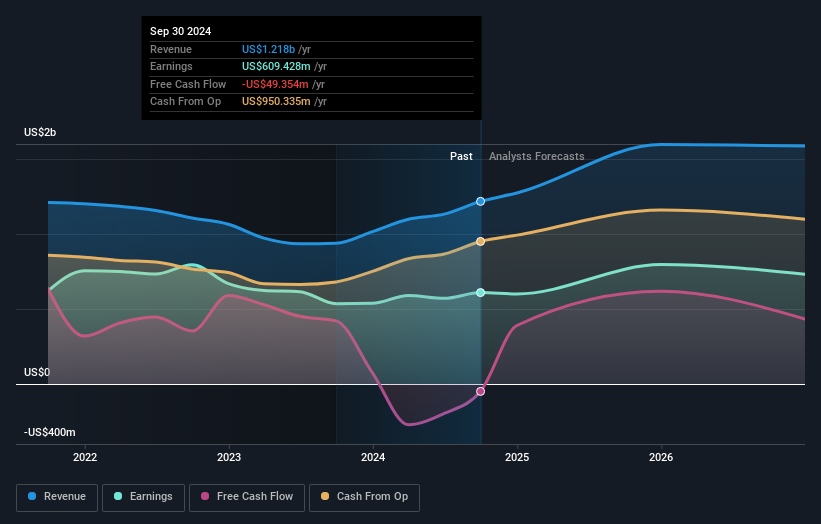

Last week saw the newest quarterly earnings release from Wheaton Precious Metals Corp. (TSE:WPM), an important milestone in the company's journey to build a stronger business. It was a credible result overall, with revenues of US$308m and statutory earnings per share of US$0.34 both in line with analyst estimates, showing that Wheaton Precious Metals is executing in line with expectations. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Wheaton Precious Metals after the latest results.

See our latest analysis for Wheaton Precious Metals

Taking into account the latest results, the consensus forecast from Wheaton Precious Metals' 14 analysts is for revenues of US$1.60b in 2025. This reflects a substantial 31% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to soar 32% to US$1.77. In the lead-up to this report, the analysts had been modelling revenues of US$1.62b and earnings per share (EPS) of US$1.72 in 2025. The analysts seems to have become more bullish on the business, judging by their new earnings per share estimates.

The consensus price target was unchanged at CA$103, implying that the improved earnings outlook is not expected to have a long term impact on value creation for shareholders. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Wheaton Precious Metals analyst has a price target of CA$110 per share, while the most pessimistic values it at CA$91.22. This is a very narrow spread of estimates, implying either that Wheaton Precious Metals is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Wheaton Precious Metals' past performance and to peers in the same industry. It's clear from the latest estimates that Wheaton Precious Metals' rate of growth is expected to accelerate meaningfully, with the forecast 24% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 2.7% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 16% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Wheaton Precious Metals to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Wheaton Precious Metals' earnings potential next year. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Wheaton Precious Metals. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Wheaton Precious Metals going out to 2026, and you can see them free on our platform here..

You can also see our analysis of Wheaton Precious Metals' Board and CEO remuneration and experience, and whether company insiders have been buying stock.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wheaton Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WPM

Wheaton Precious Metals

Sells precious metals in North America, Europe, Africa, and South America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion