Winpak (TSX:WPK) Margin Contraction Challenges Optimistic Growth Narrative

Reviewed by Simply Wall St

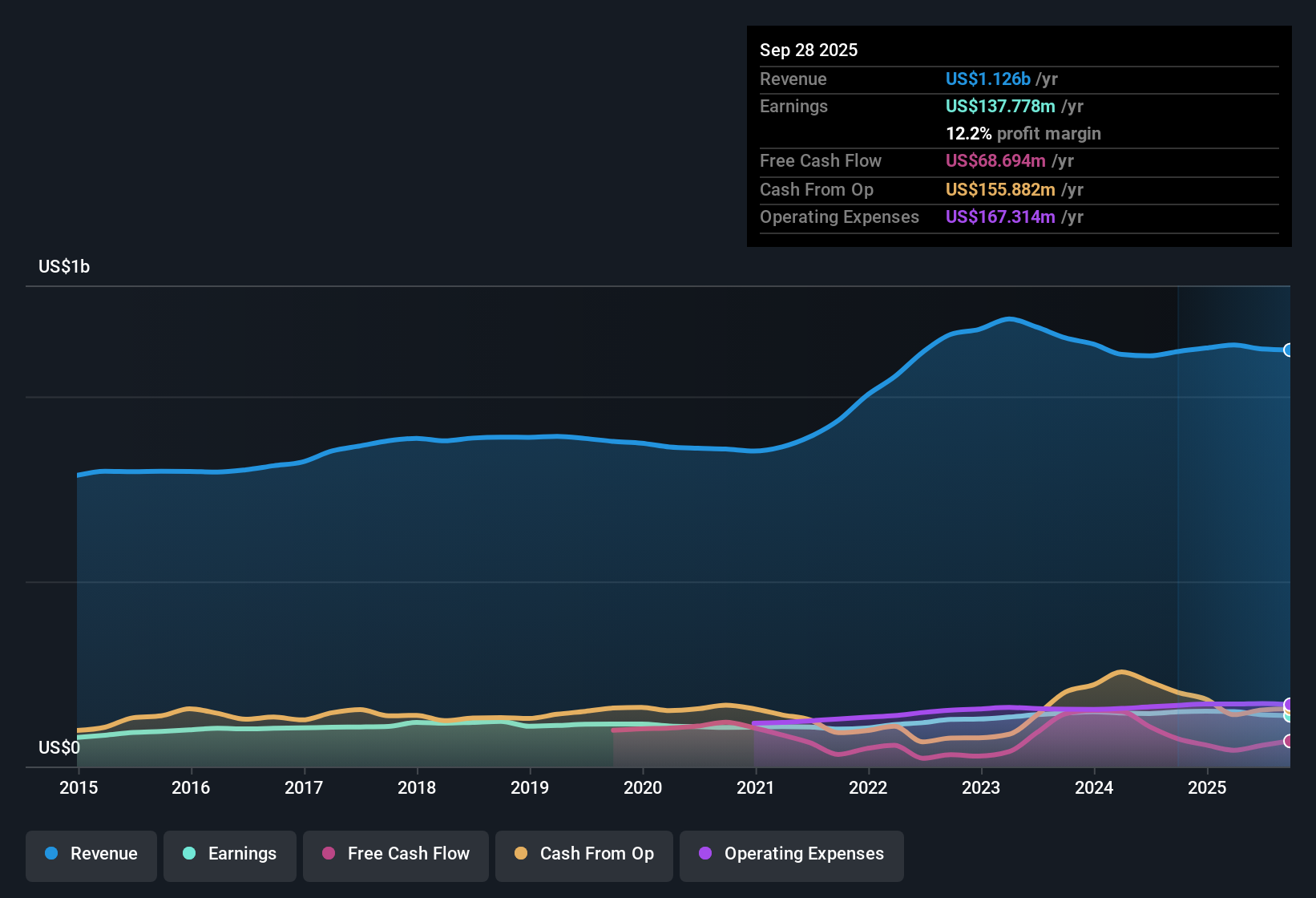

Winpak (TSX:WPK) delivered another year of robust earnings growth, with profits rising at an average rate of 8% per year over the past five years. Looking ahead, analysts forecast annual earnings growth of 7.07% and revenue growth of 6.8%, both comfortably outpacing the broader Canadian market’s 4.9% average. While current net profit margins of 12.2% are down from last year's 13.2%, Winpak’s strong profit and revenue trends, combined with its favorable Price-to-Earnings Ratio of 13.9x, position it as a growth leader in the packaging sector.

See our full analysis for Winpak.Now, let's see how these headline results hold up against the widely discussed narratives that shape investor sentiment around Winpak.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Dip but Stay Above 12%

- Net profit margins declined to 12.2%, down from 13.2% in the previous year, which marks a notable contraction but keeps profitability on the higher end for the sector.

- What’s striking, according to the prevailing market view, is that despite thinner margins, investors are still seeing Winpak as a steady performer. Ongoing sector stability and resilience in packaging demand help offset concerns.

- Even with margin compression, the company’s cash-generative operations appear to anchor its growth outlook compared to peers.

- Contraction in profit margins could invite closer scrutiny from those watching cost pressures. However, so far, no disruptive risks have surfaced in the core business.

Share Price Well Above DCF Fair Value

- Winpak’s current share price of CA$44.14 sits more than four times higher than its DCF fair value estimate of CA$10.81, revealing a large gap between market enthusiasm and model-based intrinsic value.

- The prevailing market view points out that this valuation premium may persist as long as sector momentum and stable sentiment support the stock.

- Compared to the global packaging industry average Price-to-Earnings Ratio of 16x, Winpak trades at a cheaper 13.9x. However, its absolute share price premium versus calculated fair value could cap further upside.

- Investors may need a clear catalyst or major new business win to justify paying this high a price above intrinsic value.

Five-Year Profit Growth Outpaces Market

- Winpak delivered average annual earnings growth of 8% over the past five years, easily beating the broader Canadian market’s 4.9% average growth rate.

- The prevailing market view highlights that this track record heavily supports a growth-oriented thesis. Winpak’s combination of sector-leading profit and revenue growth makes it a standout option among packaging peers.

- Since forecast annual earnings growth of 7.07% remains above the Canadian average, expectations are for this outperformance to continue barring major negative developments.

- Analysts and investors are likely to keep rewarding Winpak with premium valuation multiples as long as these growth rates stay strong and consistent.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Winpak's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Winpak’s persistent valuation premium over its fair value suggests investors may be paying up, even as the company faces recent margin contraction and slower profit growth.

If you prefer stocks trading closer to intrinsic value, check out these 877 undervalued stocks based on cash flows and discover companies where the numbers make more sense for long-term upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winpak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WPK

Winpak

Manufactures and distributes packaging materials and related packaging machines in the United States, Canada, and Mexico.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives