Winpak Ltd.'s (TSE:WPK) CEO Will Probably Struggle To See A Pay Rise This Year

The disappointing performance at Winpak Ltd. (TSE:WPK) will make some shareholders rather disheartened. The next AGM coming up on 23 June 2021 will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. From our analysis below, we think CEO compensation looks appropriate for now.

See our latest analysis for Winpak

How Does Total Compensation For Olivier Muggli Compare With Other Companies In The Industry?

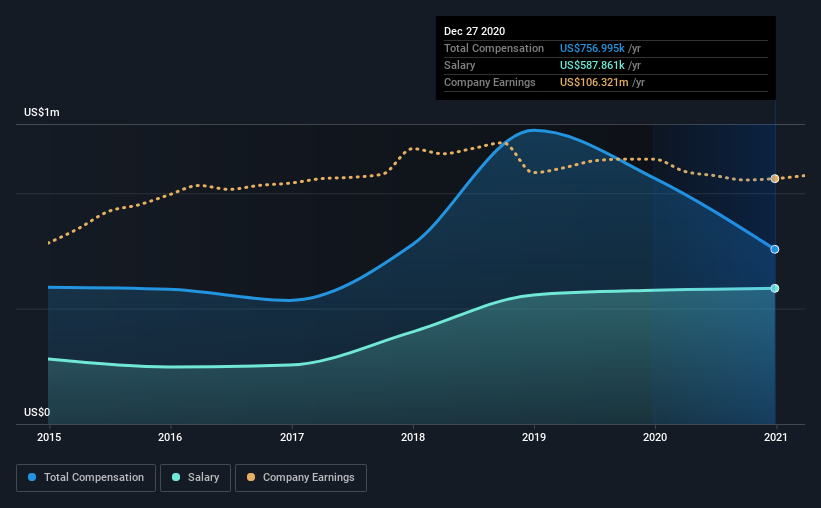

Our data indicates that Winpak Ltd. has a market capitalization of CA$2.7b, and total annual CEO compensation was reported as US$757k for the year to December 2020. We note that's a decrease of 29% compared to last year. In particular, the salary of US$587.9k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between CA$1.2b and CA$3.9b had a median total CEO compensation of US$1.5m. That is to say, Olivier Muggli is paid under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$588k | US$579k | 78% |

| Other | US$169k | US$485k | 22% |

| Total Compensation | US$757k | US$1.1m | 100% |

Talking in terms of the industry, salary represented approximately 24% of total compensation out of all the companies we analyzed, while other remuneration made up 76% of the pie. According to our research, Winpak has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Winpak Ltd.'s Growth

Over the last three years, Winpak Ltd. has shrunk its earnings per share by 2.8% per year. The trailing twelve months of revenue was pretty much the same as the prior period.

A lack of EPS improvement is not good to see. And the flat revenue is seriously uninspiring. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Winpak Ltd. Been A Good Investment?

Since shareholders would have lost about 7.2% over three years, some Winpak Ltd. investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Winpak.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Winpak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:WPK

Winpak

Manufactures and distributes packaging materials and related packaging machines in the United States, Canada, and Mexico.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives