- Canada

- /

- Paper and Forestry Products

- /

- TSX:WFG

What Does West Fraser Timber Co. Ltd.'s (TSE:WFG) Share Price Indicate?

West Fraser Timber Co. Ltd. (TSE:WFG), might not be a large cap stock, but it received a lot of attention from a substantial price movement on the TSX over the last few months, increasing to CA$114 at one point, and dropping to the lows of CA$96.19. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether West Fraser Timber's current trading price of CA$98.96 reflective of the actual value of the mid-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at West Fraser Timber’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

View our latest analysis for West Fraser Timber

Is West Fraser Timber Still Cheap?

According to my price multiple model, which makes a comparison between the company's price-to-earnings ratio and the industry average, the stock price seems to be justfied. In this instance, I’ve used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock’s cash flows. I find that West Fraser Timber’s ratio of 2.53x is trading slightly below its industry peers’ ratio of 4.54x, which means if you buy West Fraser Timber today, you’d be paying a reasonable price for it. And if you believe West Fraser Timber should be trading in this range, then there isn’t much room for the share price to grow beyond the levels of other industry peers over the long-term. So, is there another chance to buy low in the future? Given that West Fraser Timber’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us an opportunity to buy later on. This is based on its high beta, which is a good indicator for share price volatility.

What kind of growth will West Fraser Timber generate?

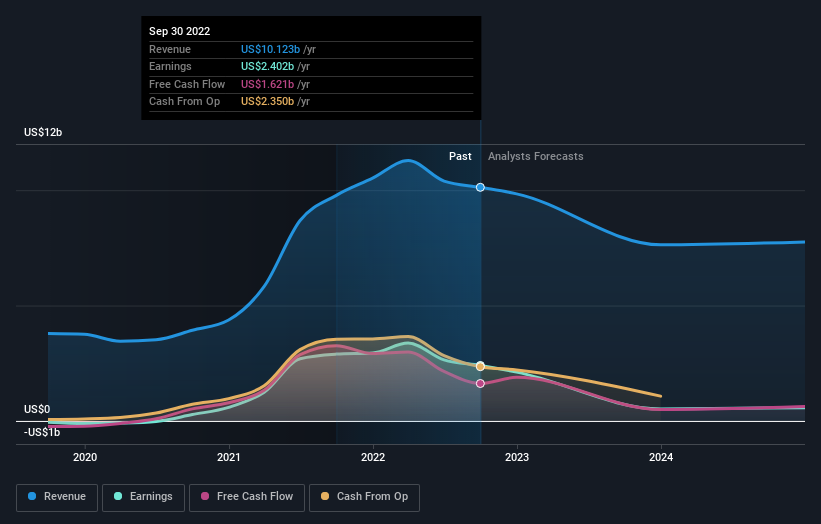

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. However, with an extremely negative double-digit change in profit expected over the next couple of years, near-term growth is certainly not a driver of a buy decision. It seems like high uncertainty is on the cards for West Fraser Timber, at least in the near future.

What This Means For You

Are you a shareholder? WFG seems priced close to industry peers right now, but given the uncertainty from negative returns in the future, this could be the right time to de-risk your portfolio. Is your current exposure to the stock optimal for your total portfolio? And is the opportunity cost of holding a negative-outlook stock too high? Before you make a decision on WFG, take a look at whether its fundamentals have changed.

Are you a potential investor? If you’ve been keeping an eye on WFG for a while, now may not be the most optimal time to buy, given it is trading around industry price multiples. This means there’s less benefit from mispricing. In addition to this, the negative growth outlook increases the risk of holding the stock. However, there are also other important factors we haven’t considered today, which can help gel your views on WFG should the price fluctuate below the industry PE ratio.

If you'd like to know more about West Fraser Timber as a business, it's important to be aware of any risks it's facing. Every company has risks, and we've spotted 1 warning sign for West Fraser Timber you should know about.

If you are no longer interested in West Fraser Timber, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Valuation is complex, but we're here to simplify it.

Discover if West Fraser Timber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WFG

West Fraser Timber

A diversified wood products company, engages in manufacturing, selling, marketing, and distributing lumber, engineered wood products, pulp, newsprint, wood chips, and other residuals and renewable energy.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives