- Canada

- /

- Paper and Forestry Products

- /

- TSX:WFG

The Bull Case For West Fraser Timber (TSX:WFG) Could Change Following Major Mill Closures and Restructuring Moves

Reviewed by Sasha Jovanovic

- West Fraser Timber announced in early November 2025 that it will permanently close its Augusta, Georgia and 100 Mile House, British Columbia lumber mills, as well as make prior curtailments in Arkansas and Florida permanent, citing timber supply constraints and soft lumber markets.

- This significant restructuring effort also includes opening a new mill in Texas and is expected to result in restructuring and impairment charges in late 2025.

- We'll examine how West Fraser Timber's decision to close multiple mills to address supply and demand challenges may reshape its investment outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

West Fraser Timber Investment Narrative Recap

Shareholders in West Fraser Timber need to believe in the long-term recovery of the North American housing market and the firm's ability to adapt through capacity management, innovation, and disciplined capital allocation. The announcement of multiple permanent mill closures signals intensified supply challenges and pressures from soft lumber markets, which may weigh on the short-term outlook and magnify existing risks, especially around compressed margins and capital efficiency. However, these restructurings do not appear to materially impact the most immediate catalyst: the company's operational cost improvements and positioning for a medium-term demand rebound.

Among West Fraser's recent announcements, the start-up of the new Henderson, Texas mill stands out as directly relevant to these closures. While older facilities are exiting, the Texas investment supports cost efficiencies and a more flexible footprint, aligning with the catalyst of margin expansion once market conditions stabilize.

But with sector pressures mounting, investors should be aware that persistent soft demand and higher tariffs could...

Read the full narrative on West Fraser Timber (it's free!)

West Fraser Timber is projected to reach $6.7 billion in revenue and $653.7 million in earnings by 2028. This outlook assumes a 4.9% annual revenue growth rate and an increase in earnings of $779.7 million from the current level of -$126.0 million.

Uncover how West Fraser Timber's forecasts yield a CA$113.12 fair value, a 34% upside to its current price.

Exploring Other Perspectives

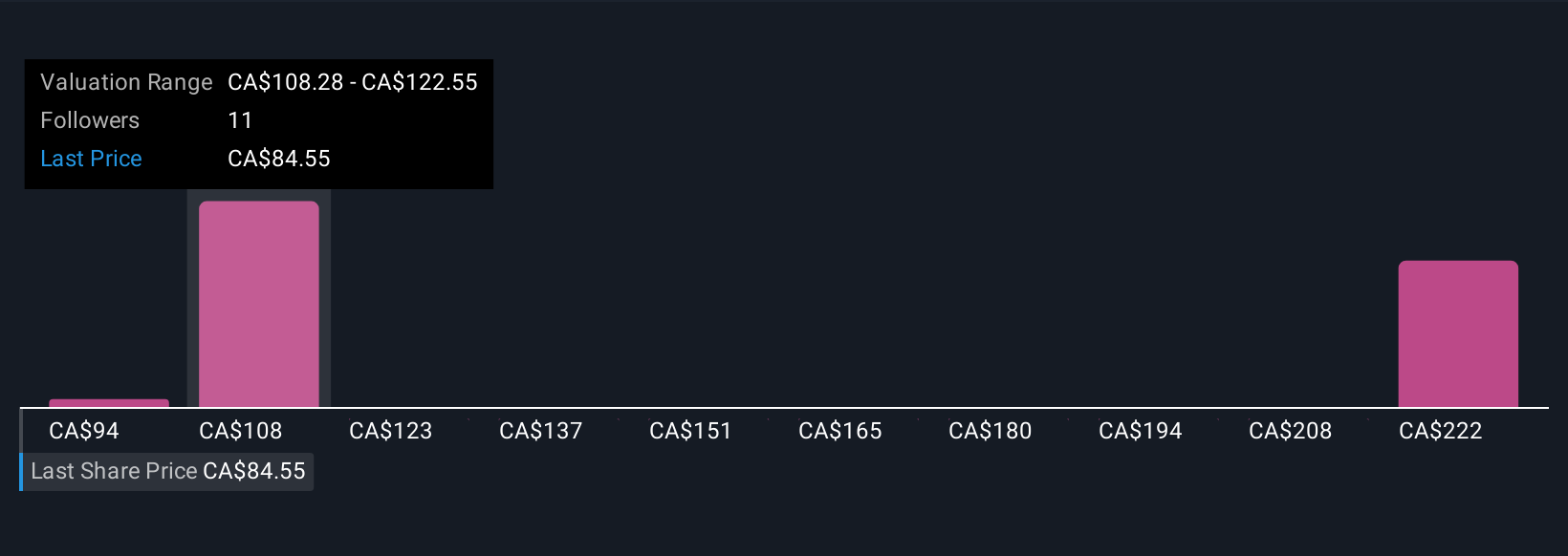

Community members on Simply Wall St estimate West Fraser Timber’s fair value between CA$94 and CA$236, with four distinct perspectives. Persistent softwood lumber demand weakness highlights why these differences matter when comparing market risks and recovery scenarios, see how your outlook compares.

Explore 4 other fair value estimates on West Fraser Timber - why the stock might be worth over 2x more than the current price!

Build Your Own West Fraser Timber Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your West Fraser Timber research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free West Fraser Timber research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate West Fraser Timber's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Fraser Timber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WFG

West Fraser Timber

A diversified wood products company, engages in manufacturing, selling, marketing, and distributing lumber, engineered wood products, pulp, newsprint, wood chips, and other residuals and renewable energy.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives