- Canada

- /

- Paper and Forestry Products

- /

- TSX:WFG

Should You Reconsider West Fraser Timber After Its 26% Slide in 2024?

Reviewed by Bailey Pemberton

If you’re debating what to do with West Fraser Timber stock right now, you’re not alone. The company’s share price hasn’t exactly been a beacon of optimism in 2024, sliding 26.4% year-to-date and leaving investors wondering if the lumber giant still holds hidden potential. Even with a 4.4% dip over the past month, it’s easy to see why there are some nerves, especially as the stock’s one-year return sits at -30.9%.

What’s behind the recent moves? A mix of industry dynamics and company-specific headlines, such as West Fraser’s ongoing adaptation to housing market shifts and its recent initiatives to tighten up operations. Investors have noticed the company’s push to streamline production and improve efficiency, which management says should cushion some of the volatility in lumber demand. While none of these headlines have created major surges, they do help frame the narrative around risk and recovery potential.

Despite the rough patches, the longer-term story is less gloomy. West Fraser Timber is actually up 59.9% over the last five years, which hints that there’s more to this investment than recent stumbles. And when it comes to value, this stock scores a solid 4 out of 6 on our undervaluation checklist, suggesting it deserves a closer look if fundamentals matter to you.

But how do those valuation marks really stack up? Next, I’ll walk you through the different approaches used to judge whether West Fraser Timber is truly a bargain right now, before revealing one angle that’s even more telling than the rest.

Why West Fraser Timber is lagging behind its peers

Approach 1: West Fraser Timber Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation tool that estimates a company’s intrinsic worth by projecting its future free cash flows and discounting them back to today’s dollars. This approach aims to determine what those future cash flows are really worth in present terms, helping investors see whether the stock is trading below or above its estimated value.

For West Fraser Timber, the model looks at current Free Cash Flow of $14.76 Million and projects strong growth ahead. Analysts provide estimates up to five years, with Simply Wall St extrapolating further into the future. The company’s free cash flow is projected to jump from about $200.43 Million in 2026 to $913.76 Million by 2035. That growth path highlights an optimistic future, even though recent years have been challenging.

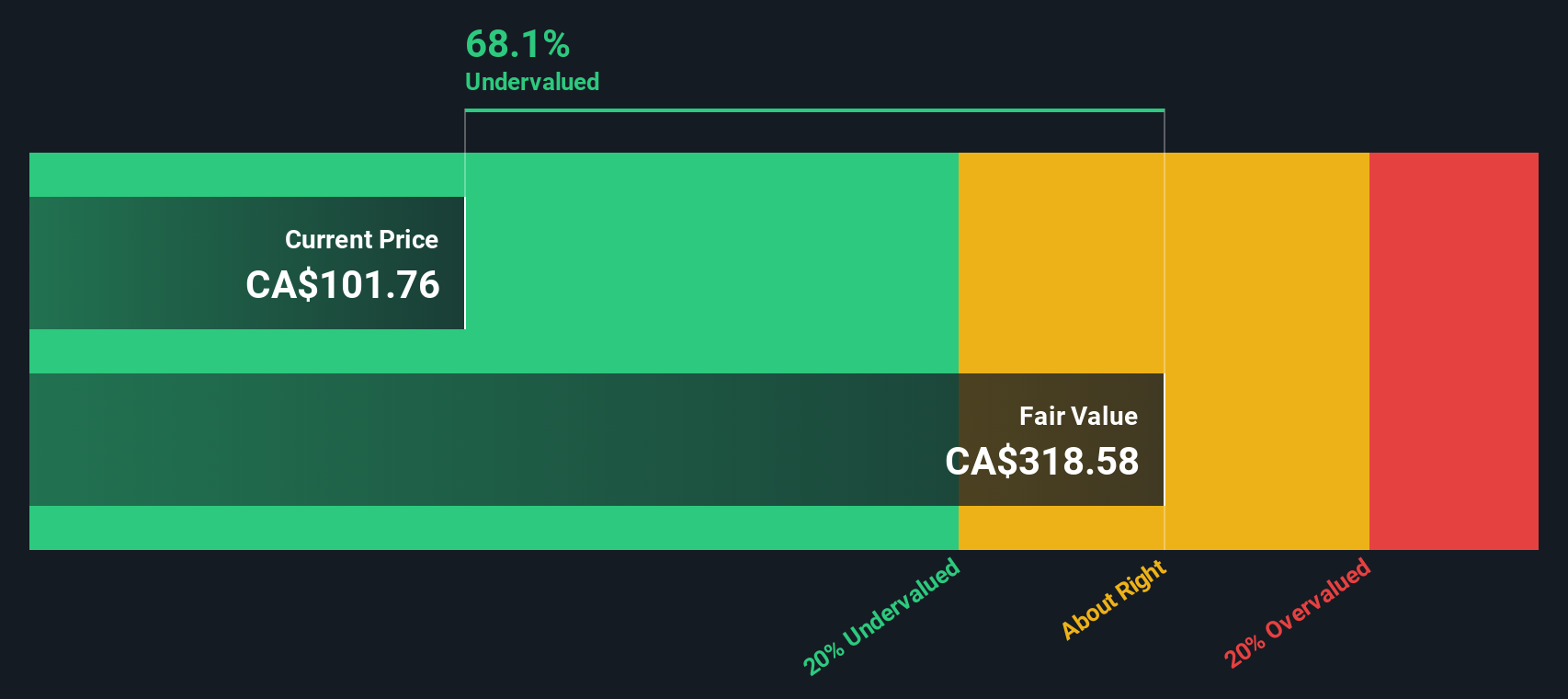

According to the DCF analysis, West Fraser Timber’s intrinsic value comes out to $240.52 per share, implying the stock is trading at a significant 61.7% discount relative to its fair value. That kind of undervaluation is rarely seen in stable sectors, suggesting there might be meaningful upside for investors willing to weather some volatility.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests West Fraser Timber is undervalued by 61.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

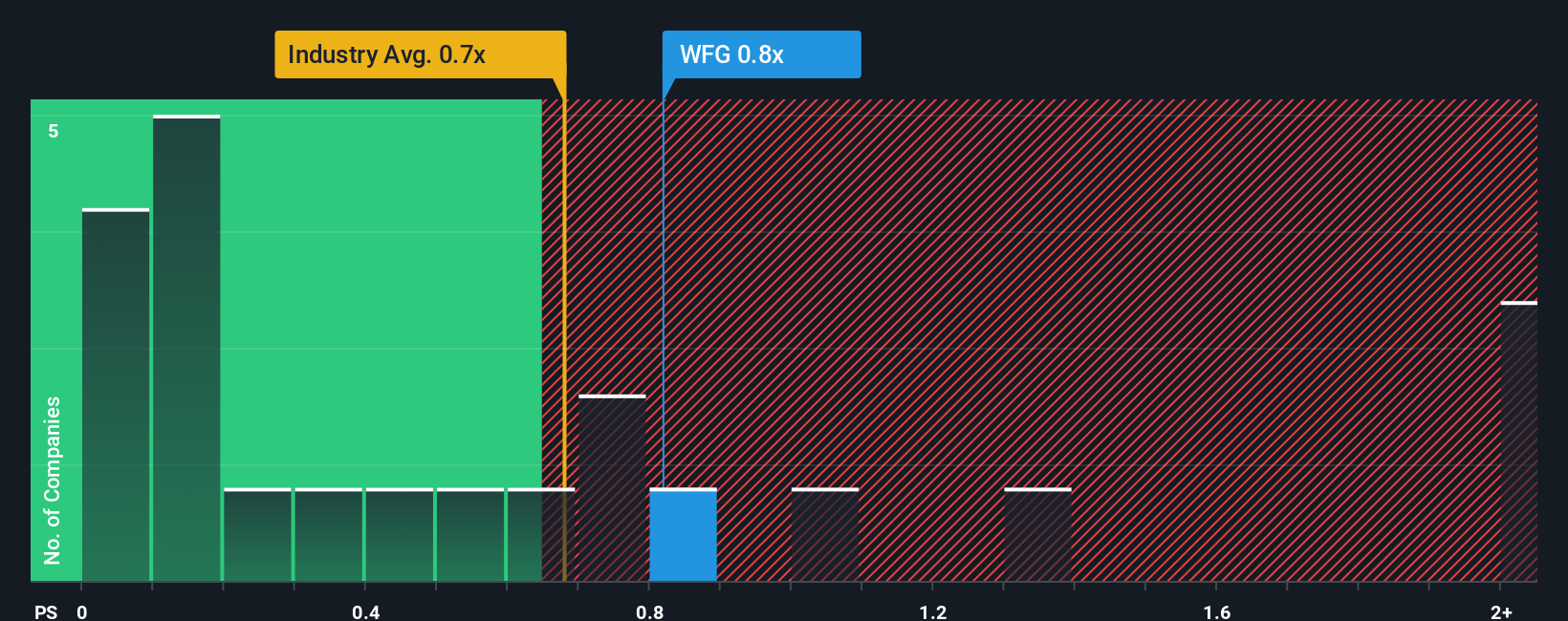

Approach 2: West Fraser Timber Price vs Sales (P/S)

The Price-to-Sales (P/S) ratio is a well-regarded valuation tool, particularly for companies where earnings may be volatile but revenues provide a more stable indication of business health. It is especially suitable for West Fraser Timber since commodity producers can face wide swings in profitability due to fluctuating prices, while sales remain a solid baseline for analysis.

In general, companies with higher revenue growth or lower risk merit a higher P/S ratio, whereas cyclical or low-growth businesses usually trade at a discount. Looking at West Fraser Timber, the current P/S ratio sits at 0.90x. By contrast, the forestry industry average is 0.69x, and direct peer companies average 1.21x. This initially suggests the stock trades at a slight premium to its industry but below its closest competitors.

To fine-tune the analysis, Simply Wall St calculates a “Fair Ratio” for each stock, going beyond simple averages. This Fair Ratio, set at 1.51x for West Fraser Timber, factors in not just sales but also the company’s profit margin, growth outlook, size, and sector-specific risks. It is a more holistic measure than a straight industry or peer comparison, as it reflects the company’s unique profile and operating context.

With the current P/S ratio of 0.90x well below its Fair Ratio of 1.51x, this suggests the market is undervaluing West Fraser Timber relative to the fundamentals and growth forecast captured by the Fair Ratio.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your West Fraser Timber Narrative

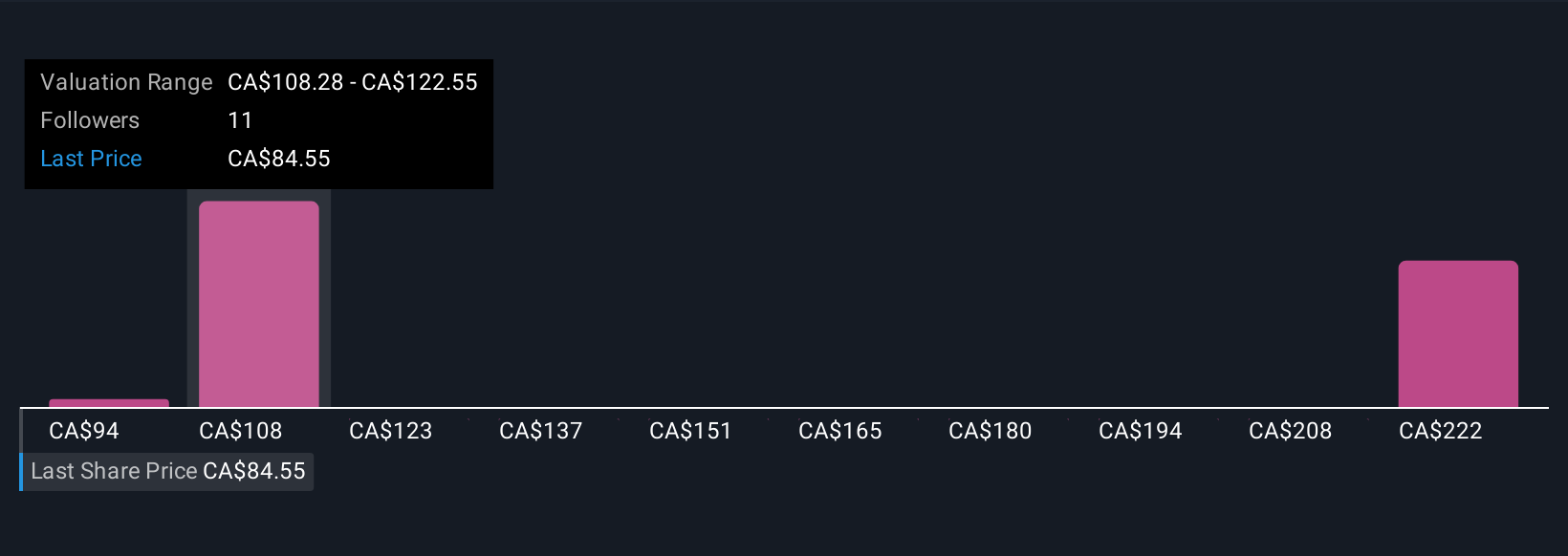

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story behind the numbers, a way to connect what you believe about West Fraser Timber’s future with the financial forecasts and assumptions that drive fair value. Put simply, Narratives help you link your view of where the business is headed (like revenue growth or profit margins) directly to a valuation, making your investment thinking both clearer and more actionable.

Narratives are accessible to everyone on the Simply Wall St platform’s Community page, where millions of investors share perspectives, forecasts, and targets for stocks like West Fraser Timber. They allow you to compare your fair value estimate against current market prices, so you can decide when a stock looks like a buy or a sell based on your own convictions, not just consensus or historic data. And because Narratives update dynamically whenever new information arrives, your outlook adapts in real time as earnings results or news hit the market.

For example, when it comes to West Fraser Timber, some investors expect earnings to reach as high as $653.7 million by 2028 and set fair values above CA$119, while more cautious investors see earnings as low as $450 million and set lower targets. This demonstrates just how personal and powerful your Narrative can be.

Do you think there's more to the story for West Fraser Timber? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if West Fraser Timber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WFG

West Fraser Timber

A diversified wood products company, engages in manufacturing, selling, marketing, and distributing lumber, engineered wood products, pulp, newsprint, wood chips, and other residuals and renewable energy.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion