- Canada

- /

- Metals and Mining

- /

- TSX:VZLA

Vizsla Silver (TSX:VZLA): Assessing Valuation After Major Capital Raise and Convertible Notes Issuance

Reviewed by Simply Wall St

Vizsla Silver (TSX:VZLA) just wrapped up a significant private placement, raising about $286 million through senior unsecured convertible notes. This injection of capital has sparked discussion about the company's future strategy and development capacity.

See our latest analysis for Vizsla Silver.

After news broke of Vizsla Silver’s sizeable funding round and note issuance, buyers pushed the latest share price to $6.52. Building on the momentum from this capital raise, the company’s shares logged an eye-catching 34% share price return over the last 90 days and an impressive 155% year-to-date gain. On a longer-term horizon, total shareholder return stands at 163% for one year and 356% over five years, highlighting sustained outperformance and growing investor confidence in Vizsla’s trajectory.

If you’re watching how fresh capital can supercharge a stock’s story, it’s also worth broadening your search and discovering fast growing stocks with high insider ownership

With impressive returns and a flood of new capital, the big question remains: Is Vizsla Silver still trading below its true potential, or has the recent rally already priced in all the expected future growth for investors?

Price-to-Book of 3.7x: Is it justified?

Vizsla Silver currently trades at a price-to-book ratio of 3.7x, noticeably below the peer average of 4.9x. At the last close of CA$6.52, the stock stands out in terms of relative value when compared to industry peers.

The price-to-book ratio compares a company’s market price to its book value and represents what investors are willing to pay for every dollar of net assets. In the metals and mining sector, this multiple highlights both growth expectations and perceived underlying asset quality. For an emerging resource company like Vizsla Silver, a higher price-to-book may signal optimism around future development, resource conversion, and operational execution.

Compared to the broader peer group, Vizsla Silver’s price-to-book ratio is comfortably lower. This suggests the market gives a modest discount relative to similar companies. However, when compared to the Canadian metals and mining industry average of 2.6x, Vizsla’s multiple appears more expensive. This may reflect either higher anticipated growth or confidence in its assets versus the typical peer.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book ratio of 3.7x (UNDERVALUED vs. peers, OVERVALUED vs. industry)

However, there are still risks. Continued negative net income and dependency on successful exploration could challenge Vizsla Silver’s growth story going forward.

Find out about the key risks to this Vizsla Silver narrative.

Another View: Discounted Cash Flow Tells a Different Story

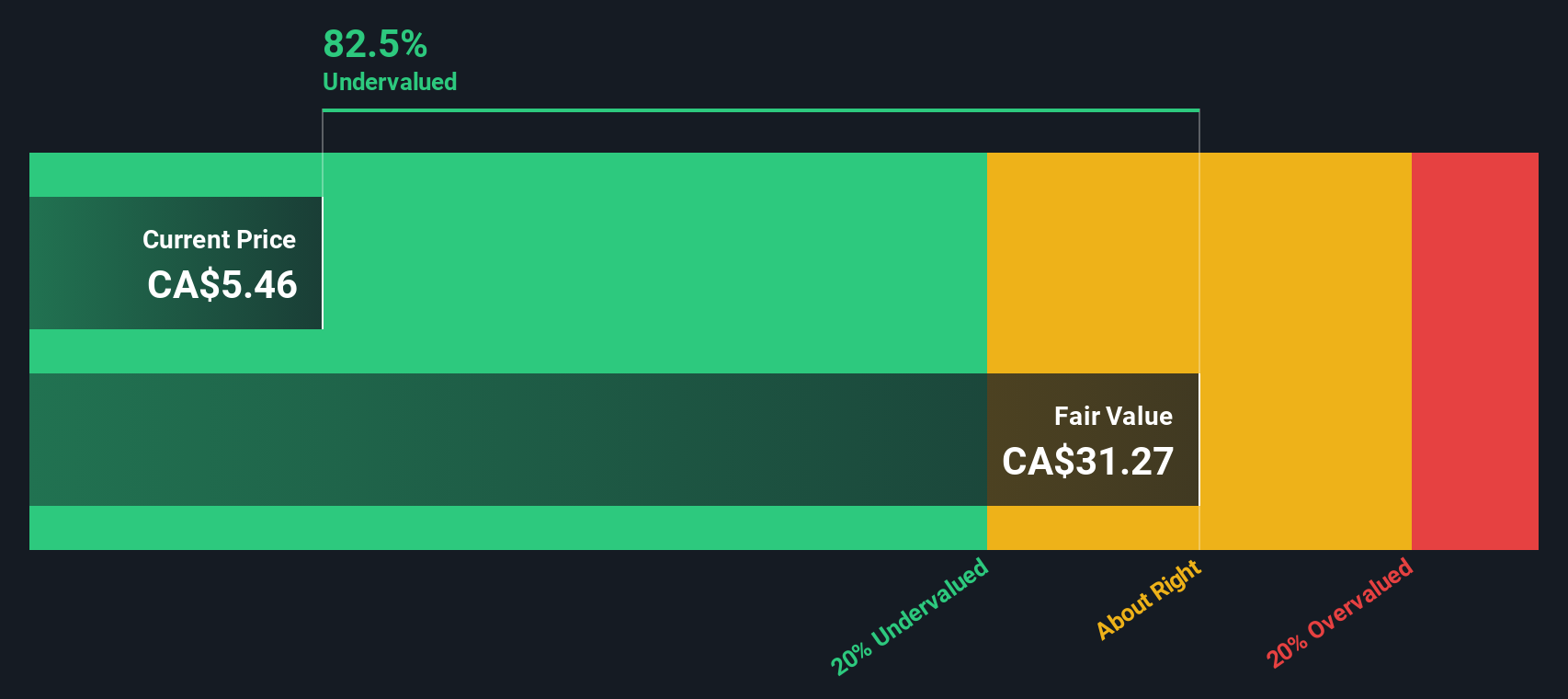

While Vizsla Silver appears undervalued by price-to-book compared to its peers, our SWS DCF model estimates its fair value at CA$25.16, which is far above the latest trading price of CA$6.52. This suggests a significant potential upside that is not reflected in the multiples. Could the market be overlooking long-term growth potential, or is there too much optimism in the model?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vizsla Silver for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vizsla Silver Narrative

If you see things differently or would rather shape your own perspective, you can dive into the numbers and build your case in just a few minutes. Do it your way.

A great starting point for your Vizsla Silver research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t miss your chance to spot high-potential stocks and new trends before the crowd. Level up your investment strategy by checking out these handpicked ideas:

- Capture the excitement of fast-growing sectors by targeting these 25 AI penny stocks as they push the boundaries of artificial intelligence.

- Tap into steady income streams with these 15 dividend stocks with yields > 3% known for impressive yields and reliable performance.

- Capitalize on companies currently trading below their intrinsic value by checking out these 926 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VZLA

Vizsla Silver

Engages in the acquisition, exploration, and development of mineral resource properties in Canada and Mexico.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success