- Canada

- /

- Metals and Mining

- /

- TSX:VZLA

Is It Too Late To Consider Vizsla Silver After Its 188% Surge And Panuco Progress?

Reviewed by Bailey Pemberton

- If you are wondering whether Vizsla Silver still offers value after its run, you are not alone, and this is exactly the kind of setup where a deeper valuation check can really pay off.

- The stock has cooled slightly in the last week with a -4.9% move, but that comes after a strong 11.4% gain over 30 days and a 187.8% return over the last year. This hints that the market is rapidly rethinking its prospects.

- Recent news flow has focused on Vizsla Silver advancing its flagship Panuco project in Mexico and reporting high grade drill results that have expanded mineralized zones, reinforcing a growth narrative around future production potential. At the same time, commentary around silver prices and broader precious metals sentiment has added fuel to the move, as investors look for leveraged plays on a possible sustained upswing in the metal.

- Right now, Vizsla Silver scores a 4/6 valuation check score, suggesting the market may still be underestimating parts of the story. Next, we will unpack what that means across different valuation approaches, before finishing with a framework that can help you judge value even better than any single model.

Approach 1: Vizsla Silver Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes estimates of the cash a company could generate in the future and discounts them back to today, aiming to arrive at a fair value per share in today’s money.

For Vizsla Silver, the latest twelve month Free Cash Flow (FCF) is negative at about CA$45.0 million, reflecting the heavy investment phase typical of early stage mining developers. Analysts see this turning around meaningfully, with FCF projected to rise into positive territory and reach roughly CA$466.9 million by 2035, based on a mix of explicit analyst forecasts out to 2030 and then extrapolated estimates by Simply Wall St for the years beyond.

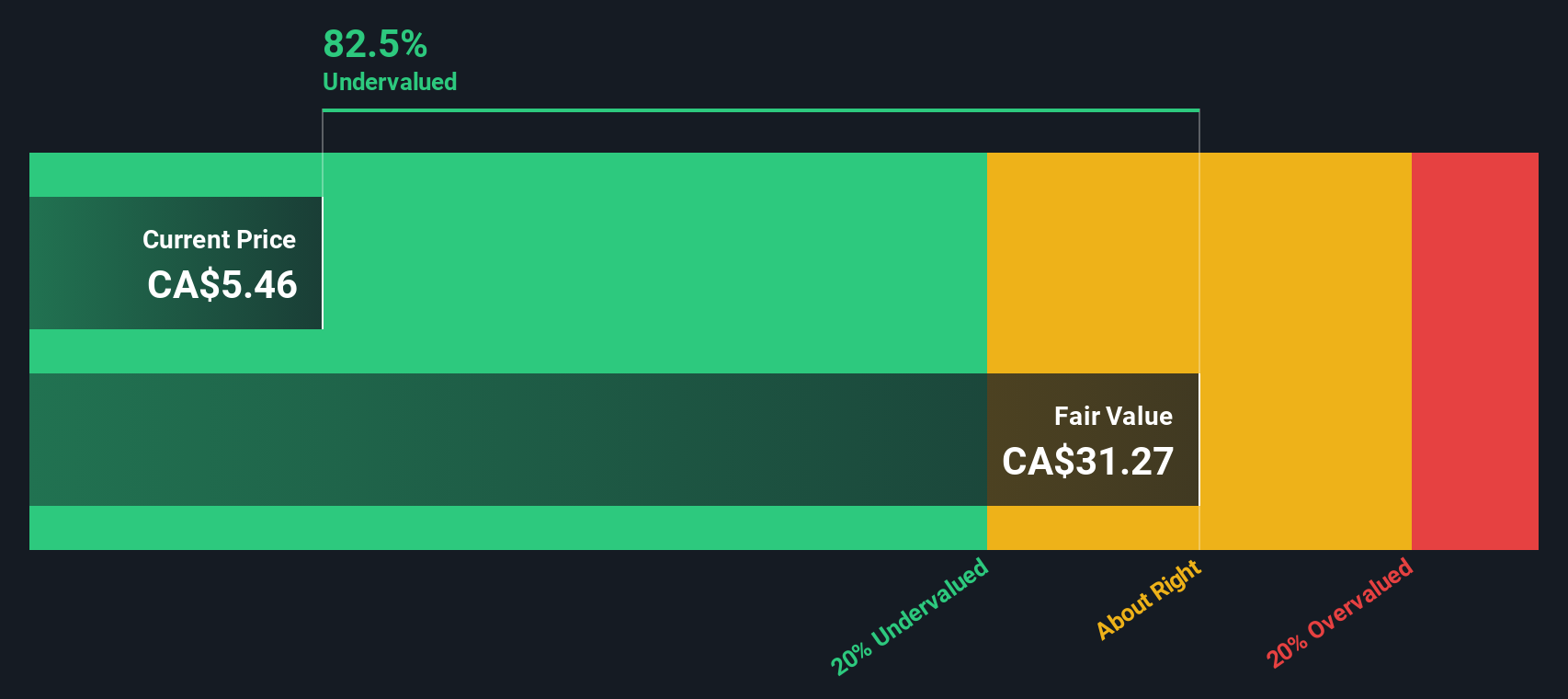

Rolling these projected cash flows into a 2 Stage Free Cash Flow to Equity model produces an estimated intrinsic value of around CA$25.07 per share. With the DCF implying the shares trade at a 71.9% discount to this estimate, the model is signaling that the market may be heavily underpricing Vizsla’s long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vizsla Silver is undervalued by 71.9%. Track this in your watchlist or portfolio, or discover 916 more undervalued stocks based on cash flows.

Approach 2: Vizsla Silver Price vs Book

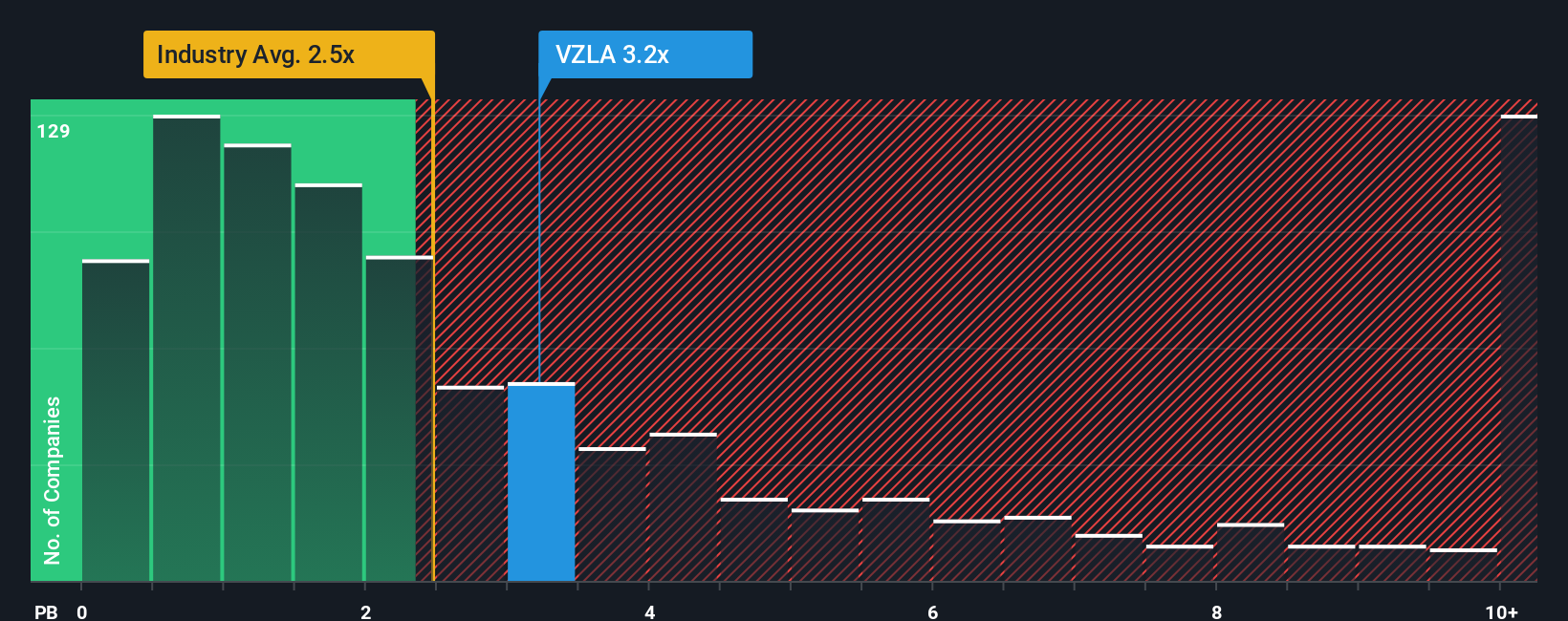

For companies that are still moving toward steady profitability, price to book is often a more practical yardstick than earnings based ratios. This is because it compares the share price with the value of the assets that underpin future production.

In general, faster growth and lower risk justify a higher multiple, while slower growth and higher risk tend to cap what investors are willing to pay for each dollar of book value. Against that backdrop, Vizsla Silver currently trades at about 3.96x book value, which is above the broader Metals and Mining industry average of roughly 2.77x, but still well below the peer group average of around 13.74x.

Simply Wall St’s Fair Ratio metric goes a step further by estimating the multiple a company should trade on after adjusting for its specific growth outlook, risk profile, profitability, industry and market cap. Because it is tailored to Vizsla’s own characteristics rather than broad groupings, it is a more targeted gauge of value than simple peer or industry comparisons. On this view, Vizsla’s current price to book appears meaningfully below its Fair Ratio, which suggests the shares may be undervalued on an asset based lens.

Result: UNDERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vizsla Silver Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Vizsla Silver’s future with the numbers behind it.

A Narrative is your story about the company, where you spell out what you think will happen to its revenue, earnings and margins, and then link that story to a clear financial forecast and a fair value estimate.

On Simply Wall St’s Community page, used by millions of investors, Narratives turn those assumptions into an easy to read fair value that you can compare directly with today’s share price. This can help you judge whether it is time to buy, hold or sell, and they automatically update when fresh information like drill results, project updates or earnings land.

For Vizsla Silver, one investor’s Narrative might assume rapid production ramp up and a high fair value, while another might expect slower progress and a much lower fair value. This shows how different perspectives on the same company can coexist and be tracked side by side.

Do you think there's more to the story for Vizsla Silver? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VZLA

Vizsla Silver

Engages in the acquisition, exploration, and development of mineral resource properties in Canada and Mexico.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion