- Canada

- /

- Metals and Mining

- /

- TSX:VZLA

A Look at Vizsla Silver (TSX:VZLA) Valuation Following Strong Panuco Feasibility Study Results

Reviewed by Simply Wall St

Vizsla Silver (TSX:VZLA) is drawing attention after announcing strong results from an independent Feasibility Study for its Panuco project in Mexico. The findings point to substantial economic potential, with high returns and quick payback.

See our latest analysis for Vizsla Silver.

Vizsla Silver’s recent feasibility study sent the shares sharply higher, capping off a run that has seen the 7-day share price return reach 17.24 percent and the year-to-date share price gain rise to 152.34 percent. This momentum builds on an impressive 170.29 percent total shareholder return over the past year and highlights growing optimism about the company’s long-term growth potential.

If you’re inspired by Vizsla’s rapid progress, now is a great moment to expand your horizons and discover fast growing stocks with high insider ownership

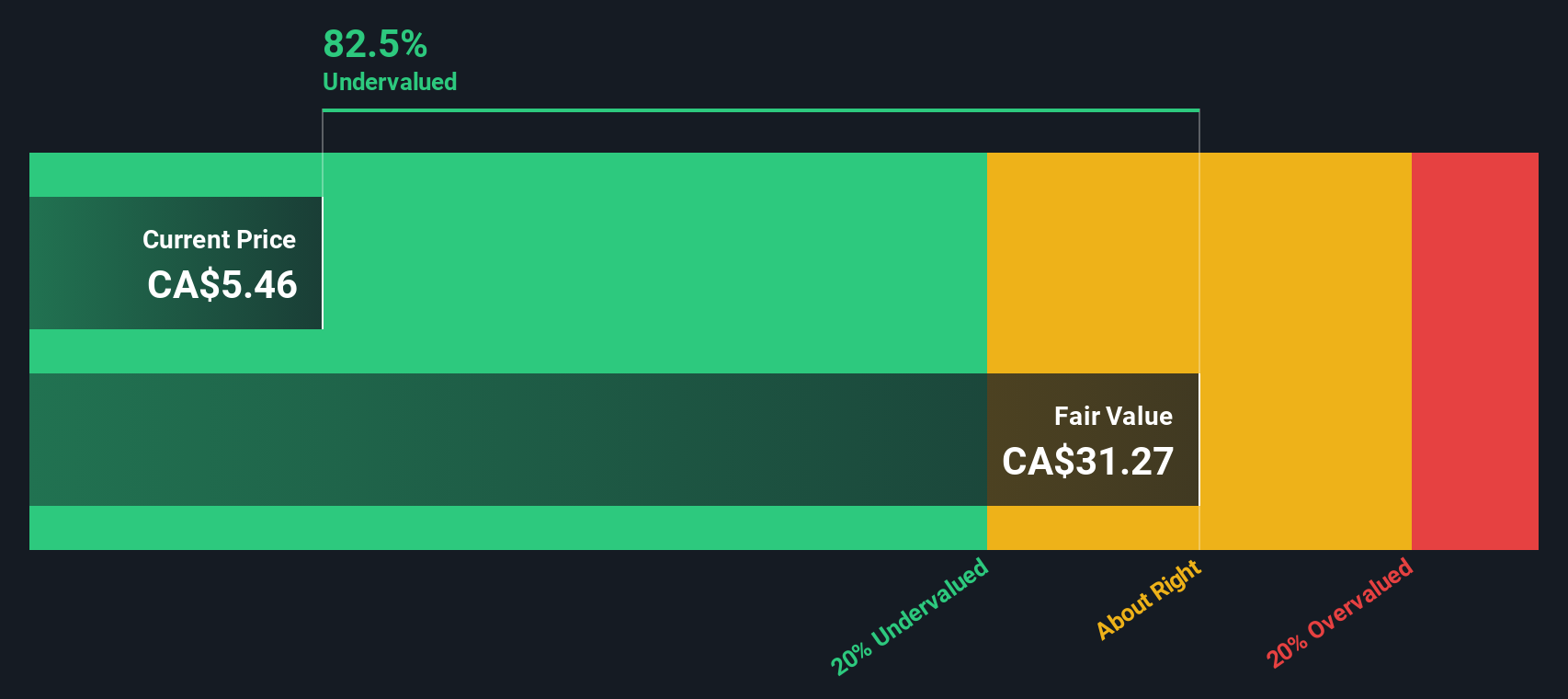

After such a dramatic rally on the back of the Panuco feasibility study, investors may be wondering whether Vizsla Silver remains undervalued or if the exciting prospects are now fully reflected in the share price. Is there still a buying opportunity here, or has the market already priced in all the future growth?

Price-to-Book Ratio of 3.7x: Is it justified?

Vizsla Silver’s shares currently trade at a price-to-book ratio of 3.7x, which is above the Canadian Metals and Mining industry average of 2.6x. This higher ratio suggests the market is pricing in notable future growth, likely reflecting optimism after the positive feasibility study.

The price-to-book ratio compares a company’s market value with its net asset value. For mining companies, this metric can highlight whether investors expect projects and resources to deliver above-average returns in the future.

While Vizsla trades at a premium to the industry, its ratio is actually below the peer group average of 4.6x. The market is willing to pay more than the sector average but less than close peers, indicating ongoing confidence in Panuco’s prospects along with some caution as the company remains unprofitable.

There is insufficient data to calculate Vizsla Silver’s Price-To-Book Fair Ratio, so we can’t benchmark exactly where the ratio could trend. For a more detailed look at how valuation breaks down across different frameworks and metrics, See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3.7x (ABOUT RIGHT)

However, Vizsla Silver remains unprofitable and relies on future project success. Any production setbacks or commodity price drops could quickly dampen enthusiasm.

Find out about the key risks to this Vizsla Silver narrative.

Another View: The SWS DCF Model

Taking a different approach, our DCF model estimates Vizsla Silver’s fair value at CA$25.95 per share, which is far above the recent price of CA$6.46. This implies the stock is trading at a steep 75.1% discount. Could the market be underestimating the future rewards, or is it simply more cautious than the numbers suggest?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vizsla Silver for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vizsla Silver Narrative

If you see things differently or want to dive into the details yourself, you can explore the data and craft your own narrative in just a few minutes. Do it your way

A great starting point for your Vizsla Silver research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

Don’t let a great opportunity slip by. Use the Simply Wall Street Screener today to find proven winning stocks that match your strategy and goals.

- Spot tomorrow's best bargains by tapping into these 879 undervalued stocks based on cash flows, which is based on real cash flow potential for outsized returns.

- Capitalize on explosive tech breakthroughs with these 25 AI penny stocks, where high-growth AI innovators are transforming entire industries.

- Unlock reliable income streams and beat inflation by targeting these 16 dividend stocks with yields > 3%, offering generous yields and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VZLA

Vizsla Silver

Engages in the acquisition, exploration, and development of mineral resource properties in Canada and Mexico.

Excellent balance sheet and good value.

Market Insights

Community Narratives