Can 5N Plus (TSX:VNP) Sustain Its Strategic Focus Amid Leadership Transition Plans?

Reviewed by Sasha Jovanovic

- 5N Plus Inc. recently announced that Richard Perron will assume the role of President effective November 1, 2025, as part of a CEO succession plan under which he will become President and CEO on May 31, 2026 while current CEO Gervais Jacques transitions to Executive Chairman of the Board.

- This leadership transition is poised to bring changes to the company's strategic direction as it continues to serve global markets in specialty semiconductors and performance materials.

- With Richard Perron moving into executive leadership, we'll examine how this planned transition could reshape 5N Plus's growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

5N Plus Investment Narrative Recap

To be a shareholder in 5N Plus, you need to believe that continued strong demand for specialty semiconductors and performance materials, especially through key clients like First Solar, will underpin multi-year growth in revenue and earnings. The recent CEO succession announcement signals continued leadership stability but does not materially impact the most important near-term catalyst, which remains the ramp-up of product volumes under the expanded First Solar agreement; customer concentration risk is still the primary challenge to watch. The upcoming third quarter earnings release, scheduled for November 3, 2025, stands out as the most relevant recent announcement in context of this leadership change, as it will provide a clearer view on the financial progress tied to new supply agreements and growth investments, factors central to current catalysts for the stock. In contrast, investors should be mindful that increased reliance on key customers such as First Solar exposes the business to revenue volatility if those relationships change...

Read the full narrative on 5N Plus (it's free!)

5N Plus' narrative projects $509.7 million revenue and $59.2 million earnings by 2028. This requires 15.1% yearly revenue growth and a $27 million earnings increase from $32.2 million today.

Uncover how 5N Plus' forecasts yield a CA$21.47 fair value, a 7% upside to its current price.

Exploring Other Perspectives

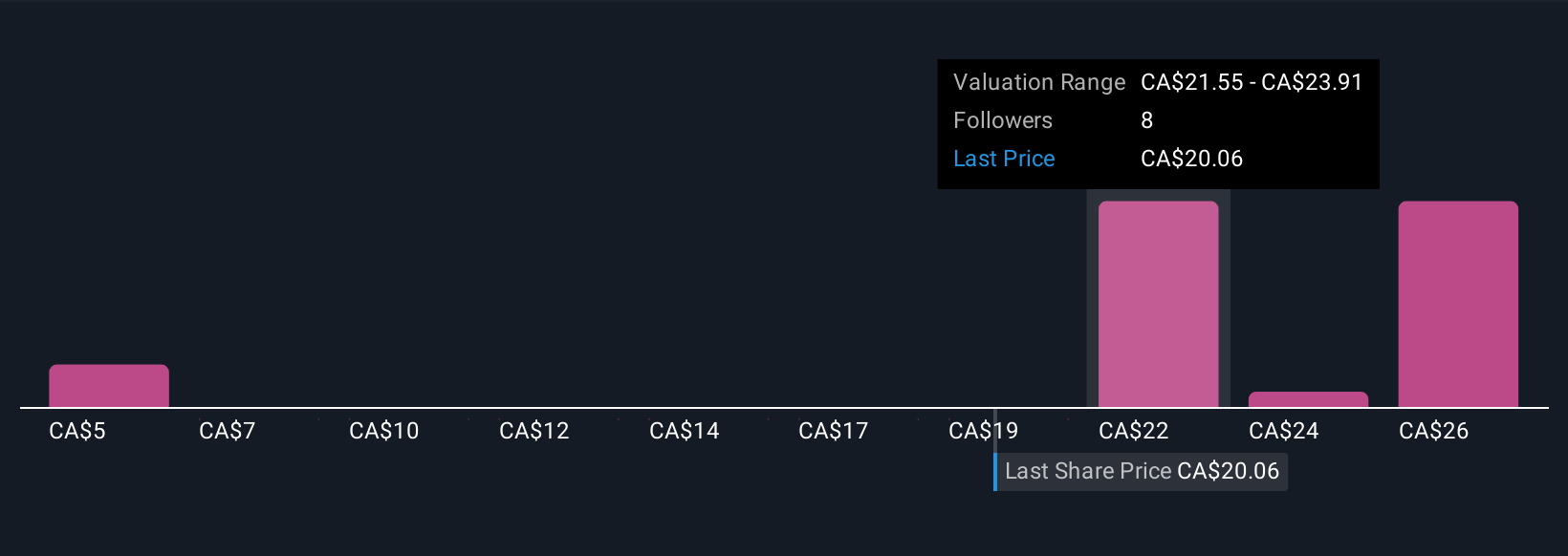

With 5 different fair value estimates from the Simply Wall St Community ranging from CA$5.00 to CA$28.38, opinions about 5N Plus’s worth vary widely. Against these differing views, the expanded First Solar partnership remains a central factor influencing the company’s growth trajectory that readers are encouraged to examine further.

Explore 5 other fair value estimates on 5N Plus - why the stock might be worth as much as 42% more than the current price!

Build Your Own 5N Plus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 5N Plus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free 5N Plus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 5N Plus' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VNP

5N Plus

Produces and sells specialty semiconductors and performance materials in the Americas, Europe, Asia, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives