- Canada

- /

- Metals and Mining

- /

- TSX:VGCX

Victoria Gold Corp.'s (TSE:VGCX) P/E Is Still On The Mark Following 27% Share Price Bounce

Those holding Victoria Gold Corp. (TSE:VGCX) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 28% in the last twelve months.

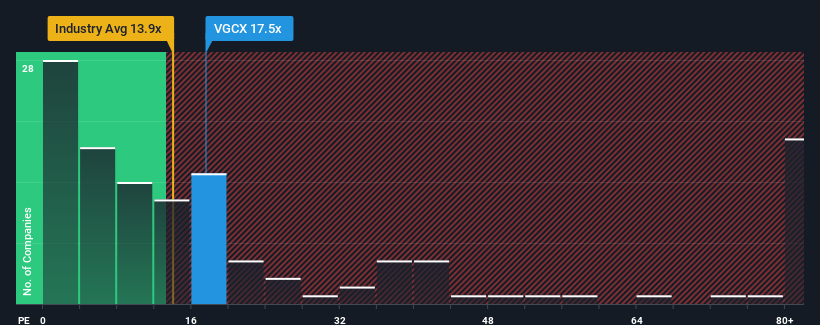

Following the firm bounce in price, Victoria Gold's price-to-earnings (or "P/E") ratio of 17.5x might make it look like a sell right now compared to the market in Canada, where around half of the companies have P/E ratios below 13x and even P/E's below 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Victoria Gold has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Victoria Gold

Does Growth Match The High P/E?

In order to justify its P/E ratio, Victoria Gold would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 48% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 53% per annum over the next three years. That's shaping up to be materially higher than the 9.0% per year growth forecast for the broader market.

In light of this, it's understandable that Victoria Gold's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Victoria Gold shares have received a push in the right direction, but its P/E is elevated too. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Victoria Gold maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Victoria Gold that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:VGCX

Victoria Gold

Acquires, explores, and operates mineral properties in Canada and the United States.

Good value with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026