- Canada

- /

- Metals and Mining

- /

- TSX:TXG

Is Torex Gold Resources Still Attractive After a 104% Jump and Project Milestones in 2025?

Reviewed by Bailey Pemberton

- Wondering whether Torex Gold Resources is a hidden gem or already priced for perfection? You are not alone. Let us dig into what the latest valuation signals reveal.

- The stock has jumped an impressive 104.0% year-to-date and is up 101.4% in the past year, fueling curiosity about what is driving this major run and whether further upside is on the cards.

- Big moves like these often follow company-specific developments. Torex Gold Resources recently made headlines with its successful project milestones and ongoing exploration progress in Mexico. Investors are paying close attention as the company strengthens its mining footprint and reveals new resource updates.

- Right now, the company has a 4 out of 6 valuation score on our checklist, suggesting that key metrics are pointing to attractive pricing. Before you draw any conclusions, we will break down the different valuation methods and, at the end, share a smarter way to find true value.

Approach 1: Torex Gold Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) valuation model estimates a company's true worth by projecting its future free cash flows and discounting those values back to today. This approach looks beyond simple earnings to evaluate Torex Gold Resources’ ability to generate real cash for its shareholders.

Currently, Torex Gold Resources has a free cash flow (FCF) of -$159.96 Million, with analysts expecting significant improvement over the coming years. According to projections, FCF is anticipated to reach around $499.37 Million by 2029. Since analyst estimates typically extend only five years, projections beyond that are generated using established financial models. This provides a full ten-year picture of growth potential.

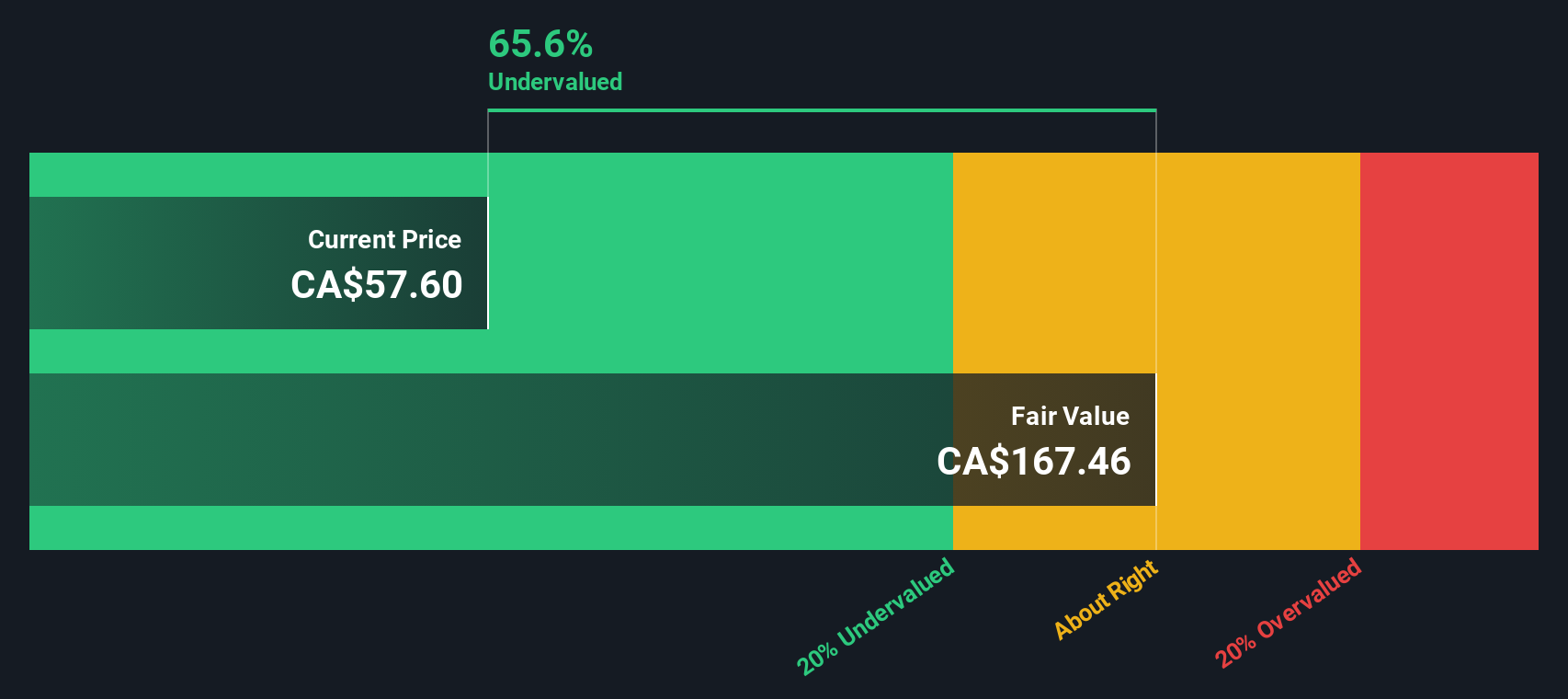

Using these cash flow estimates, the DCF model calculates an intrinsic value for the stock of $134 per share. This value suggests Torex Gold Resources is trading at a 55.3% discount compared to its calculated worth, indicating considerable undervaluation based on future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Torex Gold Resources is undervalued by 55.3%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

Approach 2: Torex Gold Resources Price vs Earnings (PE)

For companies posting consistent profits, the Price-to-Earnings (PE) ratio is often the go-to valuation measure. It helps investors gauge how much they are paying for each dollar of earnings. This metric is especially relevant when judging profitable resource companies like Torex Gold Resources because it directly connects a company's market value to its earnings power.

The "normal" or "fair" PE ratio for a stock will depend on expectations for future growth and the level of risk associated with those earnings. In general, the higher the expected growth and the more stable the earnings, the greater the premium investors are willing to pay, resulting in a higher PE ratio.

As of now, Torex Gold Resources trades at a PE ratio of 13.8x. This is below the Metals and Mining industry average of 20.5x, and also compares favorably against key peers, which can highlight an attractive entry point if earnings are stable.

To take this further, the "Fair Ratio" developed by Simply Wall St estimates the most appropriate PE for a stock, considering factors such as earnings growth, profit margins, the company’s market size, and business risks. Unlike basic peer or industry comparisons, this proprietary metric offers a fuller picture by accounting for unique company characteristics, not just averages.

Comparing Torex Gold Resources’ current PE of 13.8x with its Fair Ratio reveals a close alignment, indicating the market price is factoring in the right expectations for growth, risk, and profitability.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Torex Gold Resources Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple, powerful tool that lets you link your perspective about a company—your story—to a clear financial forecast and an estimated fair value, making it much easier to see how your view translates into a concrete investment decision.

Rather than relying solely on ratios or analyst scores, building a Narrative lets you clearly state what you believe about Torex Gold Resources: how much you think its revenue, profits, and margins will grow in the years ahead, and how those numbers support your own fair value estimate. Narratives are at the heart of the Community page on Simply Wall St, where millions of investors compare ideas, create custom forecasts, and see how different assumptions stack up, all in just a few clicks.

This approach is especially useful when deciding when to buy or sell. Each Narrative compares its fair value to the current price, so you can see how your unique story leads to a clear action. Even better, Narratives are kept up to date automatically as new company news or earnings are released, so your view always reflects the latest developments.

For instance, one Narrative values Torex Gold Resources at nearly CA$97, viewing it as an underappreciated gold growth play in volatile markets, while another is more conservative with a CA$52 target, highlighting potential risks from rising costs and project delays.

Do you think there's more to the story for Torex Gold Resources? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Torex Gold Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TXG

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives