Tree Island Steel Ltd. (TSE:TSL) has announced that it will pay a dividend of CA$0.03 per share on the 15th of January. Based on this payment, the dividend yield on the company's stock will be 4.3%, which is an attractive boost to shareholder returns.

View our latest analysis for Tree Island Steel

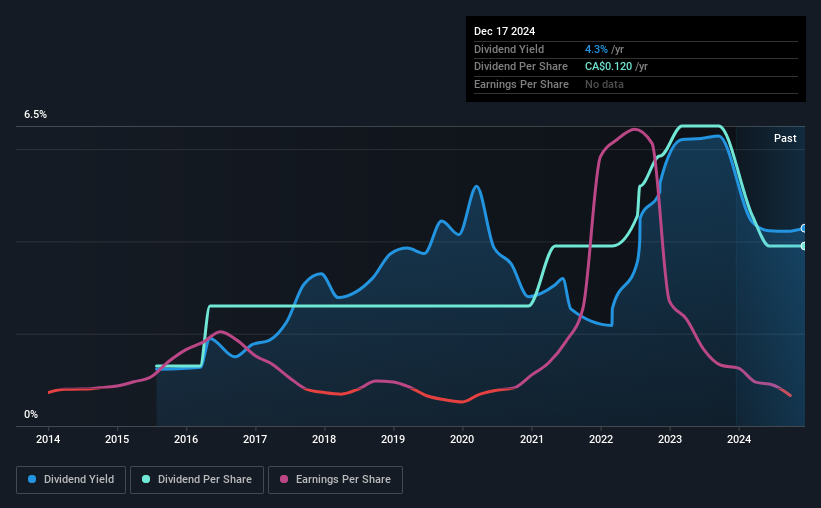

Tree Island Steel's Distributions May Be Difficult To Sustain

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Even though Tree Island Steel is not generating a profit, it is still paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

If the trend of the last few years continues, EPS will grow by 10.3% over the next 12 months. This is the right direction to be moving, but it is probably not enough to achieve profitability. Unless this happens fairly soon, the dividend could start to come under pressure.

Tree Island Steel's Dividend Has Lacked Consistency

Tree Island Steel has been paying dividends for a while, but the track record isn't stellar. This makes us cautious about the consistency of the dividend over a full economic cycle. Since 2015, the annual payment back then was CA$0.04, compared to the most recent full-year payment of CA$0.12. This works out to be a compound annual growth rate (CAGR) of approximately 13% a year over that time. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

The Company Could Face Some Challenges Growing The Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Tree Island Steel has impressed us by growing EPS at 10% per year over the past five years. It's not an ideal situation that the company isn't turning a profit but the growth recently is a positive sign. Assuming the company can post positive net income numbers soon, it could has the potential to be a decent dividend payer.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. To that end, Tree Island Steel has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Tree Island Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TSL

Tree Island Steel

Manufactures and sells steel wire and fabricated steel wire products in Canada, the United States, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026