- Canada

- /

- Metals and Mining

- /

- TSX:TKO

Taseko Mines (TSX:TKO) Valuation Insights Following Major Insider Share Sale

Reviewed by Kshitija Bhandaru

Taseko Mines (TSX:TKO) drew attention after Robert Allan Dickinson, a Senior Officer and Director, sold 200,000 common shares, reducing his stake by 25%. Large insider sales like this often prompt investors to reassess company outlook and valuation.

See our latest analysis for Taseko Mines.

After steady gains through much of the past year, Taseko Mines’ share price has held up, with recent momentum reflecting only minor shifts in risk appetite. Its one-year total shareholder return stands at 0.6%, and the latest share price is CA$5.79.

If executive moves have you thinking about leadership trends or fresh ideas, it’s worth broadening your scope and discovering fast growing stocks with high insider ownership

But with the stock delivering modest returns and recent executive moves raising questions, investors may be wondering if Taseko Mines is trading below its true worth or if the market is already factoring in all its future growth potential.

Most Popular Narrative: Fairly Valued

At CA$5.79, Taseko Mines trades just shy of the widely watched narrative fair value estimate of CA$5.76. This suggests expectations are highly in sync with current pricing. This close relationship between the consensus view and the latest share price puts the company in an intriguing position for investors who follow fundamental projections closely.

“Operational improvements and access to higher-grade ore at the Gibraltar mine are expected to lead to a step-change in copper production volumes and lower unit cash costs in the second half of 2025 and into 2026, which should boost both revenues and operating margins.”

Think the real numbers are hiding in plain sight? The valuation hangs on transformative growth, margin expansion, and a dramatic shift in profitability. Discover the full story and see what future scenario justifies this razor-thin fair value calculation.

Result: Fair Value of $5.76 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory barriers and copper price volatility remain real risks that could quickly challenge the current fair value outlook for Taseko Mines.

Find out about the key risks to this Taseko Mines narrative.

Another View: What Does the DCF Say?

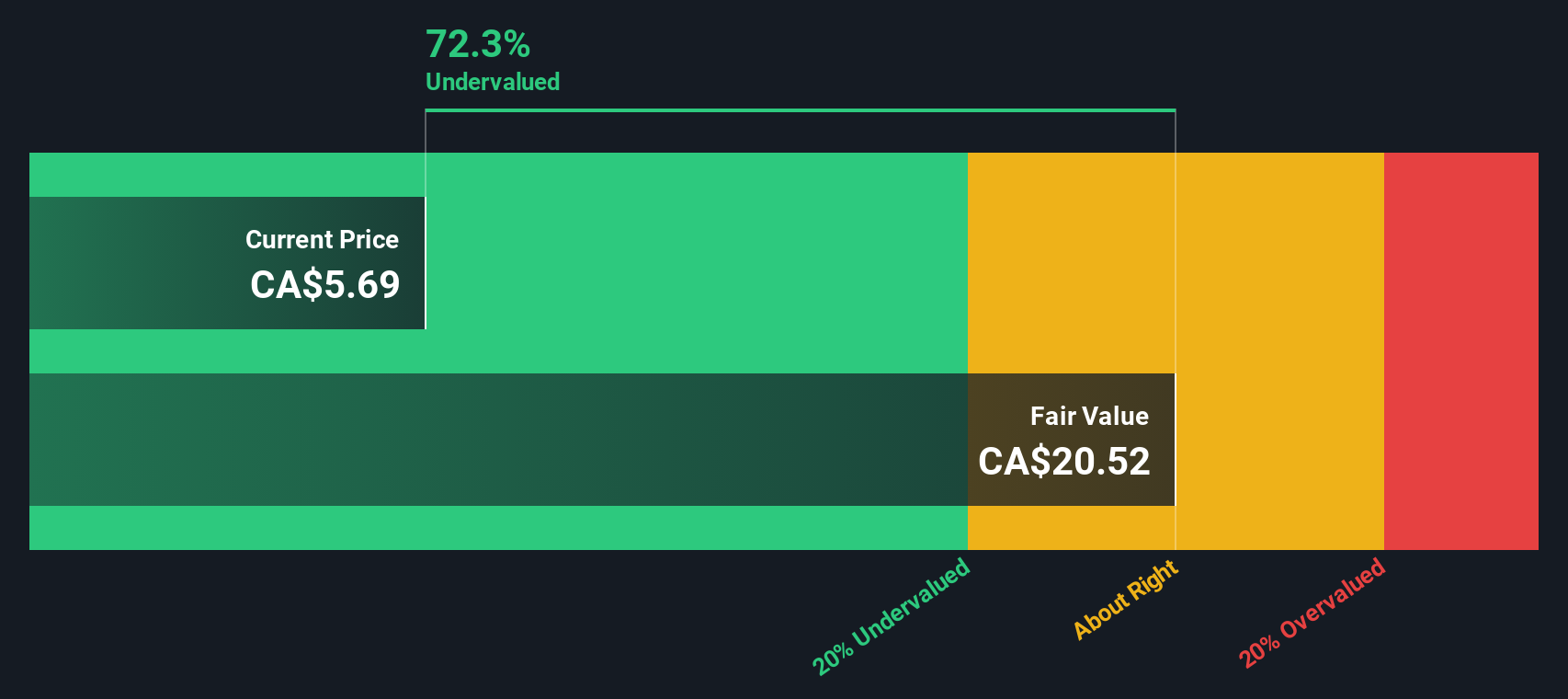

While the fair value narrative has the current price and target in near lockstep, the SWS DCF model presents a very different picture. Using this method, Taseko Mines appears to be deeply undervalued relative to its projected future cash flows. This gap could indicate a hidden opportunity waiting to be realized, or it may reflect the market’s skepticism around risk.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Taseko Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Taseko Mines Narrative

If you see the data differently or want to chart your own path, you can build a unique narrative using our tools in just minutes. Go ahead and Do it your way.

A great starting point for your Taseko Mines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know opportunities do not last forever. If you want to get ahead of the pack, check these unique stock ideas tailored for different strategies:

- Capture steady income by tapping into these 19 dividend stocks with yields > 3%, which offers yields above 3% and demonstrates consistency in weathering market swings.

- Explore the potential of emerging tech with these 26 quantum computing stocks, powering tomorrow’s breakthroughs in computing and innovation.

- Consider the long-term growth story by targeting these 887 undervalued stocks based on cash flows, which shows promising upside based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taseko Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TKO

Taseko Mines

A mining company, acquires, develops, and operates mineral properties.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives