- Canada

- /

- Metals and Mining

- /

- TSX:TFPM

Triple Flag Precious Metals (TSX:TFPM): Exploring Valuation Ahead of Q3 2025 Earnings and Upward Estimate Revisions

Reviewed by Simply Wall St

Triple Flag Precious Metals (TSX:TFPM) is drawing attention as it prepares to announce its Q3 2025 earnings. Upward revisions to revenue and earnings estimates for both 2025 and 2026 have increased investor anticipation ahead of the release.

See our latest analysis for Triple Flag Precious Metals.

Triple Flag Precious Metals hasn’t just made headlines with its earnings momentum, but also with its strong share price return. The stock is up 79% year-to-date and its 1-year total shareholder return clocks in at 67%, which is evidence that optimism is building after recent estimate upgrades and last quarter’s earnings beat. Even after a brief dip in the past month, the three-year total return stands at an impressive 173%, suggesting renewed confidence among both new and long-term shareholders.

If solid returns and upward momentum have you looking for what else might be gaining traction, now’s the perfect moment to expand your research and discover fast growing stocks with high insider ownership

With stellar returns and upgraded estimates fueling optimism, the key question now is whether Triple Flag Precious Metals remains undervalued or if the market has already accounted for all of its potential upside. Could there still be a buying opportunity here?

Most Popular Narrative: 22% Undervalued

Triple Flag Precious Metals' most popular narrative prices the stock at CA$50.68, a healthy premium to its recent close of CA$39.43. This substantial gap spotlights a market that has not yet caught up to the narrative's optimistic outlook, setting the stage for debate over what could bridge the difference.

Secular growth in demand for electrification metals (copper, silver) is expanding Triple Flag's pipeline and revenue diversification, evidenced by recent copper and silver royalty deals. This is positioning the company to capture additional top-line growth as energy transition trends accelerate.

Curious how this narrative reaches such a bullish number? Hint: it hinges on aggressive forecasts about future profitability and the company's role in a rapidly evolving metals market. Wonder what projections underlie this confidence? The answer may surprise you. Dive in to uncover the foundation of this headline-grabbing fair value.

Result: Fair Value of $50.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining production at key assets and increased reliance on acquisitions could pressure future earnings and test the optimistic narrative that supports Triple Flag’s outlook.

Find out about the key risks to this Triple Flag Precious Metals narrative.

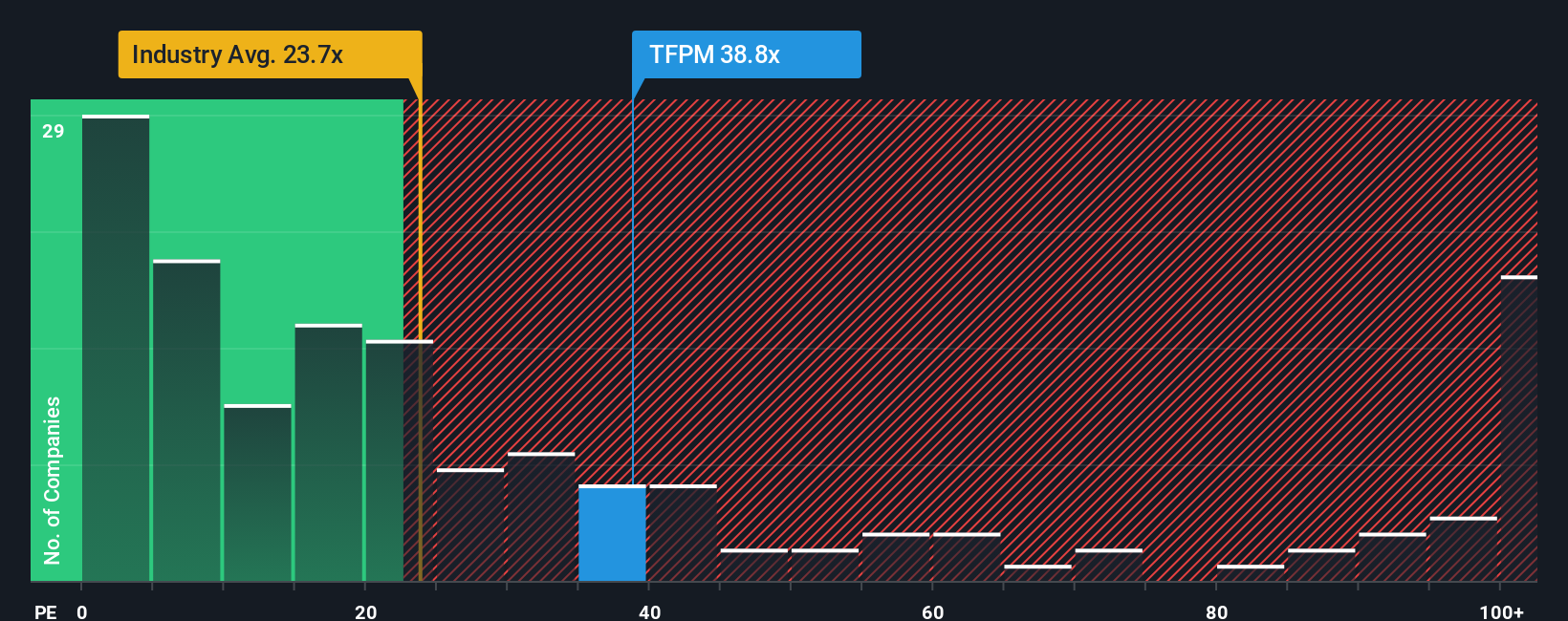

Another View: Share Price and Earnings Ratios

Looking at valuation from a different angle, the company's current share price is trading at a price-to-earnings ratio of 33.7x, which is significantly higher than both its industry peers (21.1x) and the fair ratio of 18x that the market could revert to. This premium suggests that much optimism is priced in, and any shift toward industry or fair ratios could change the value outlook dramatically. What does this risk mean for the stock's future?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Triple Flag Precious Metals Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own perspective on Triple Flag in just a few minutes. Do it your way

A great starting point for your Triple Flag Precious Metals research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunity never waits. If you’re serious about building an outstanding portfolio, check out these sharp strategies before the next trend takes off.

- Pinpoint overlooked opportunities and elevate your returns with these 843 undervalued stocks based on cash flows, selected because of their strong fundamentals and impressive price potential.

- Unleash the power of rapid innovation by tapping into these 26 AI penny stocks, making waves at the intersection of artificial intelligence and high-growth technology.

- Capture steady income by targeting these 18 dividend stocks with yields > 3%, which deliver attractive yields and could anchor long-term wealth building.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triple Flag Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TFPM

Triple Flag Precious Metals

A precious metals streaming and royalty company, engages in acquiring and managing precious metals, streams, royalties, and other mineral interests in Australia, Canada, Colombia, Cote d’Ivoire, Honduras, Mexico, Mongolia, Peru, South Africa, and the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives