- Canada

- /

- Metals and Mining

- /

- TSX:TECK.B

Teck Resources (TSX:TECK.B) Turns Profitable, Challenging Bearish Narratives on Margins

Reviewed by Simply Wall St

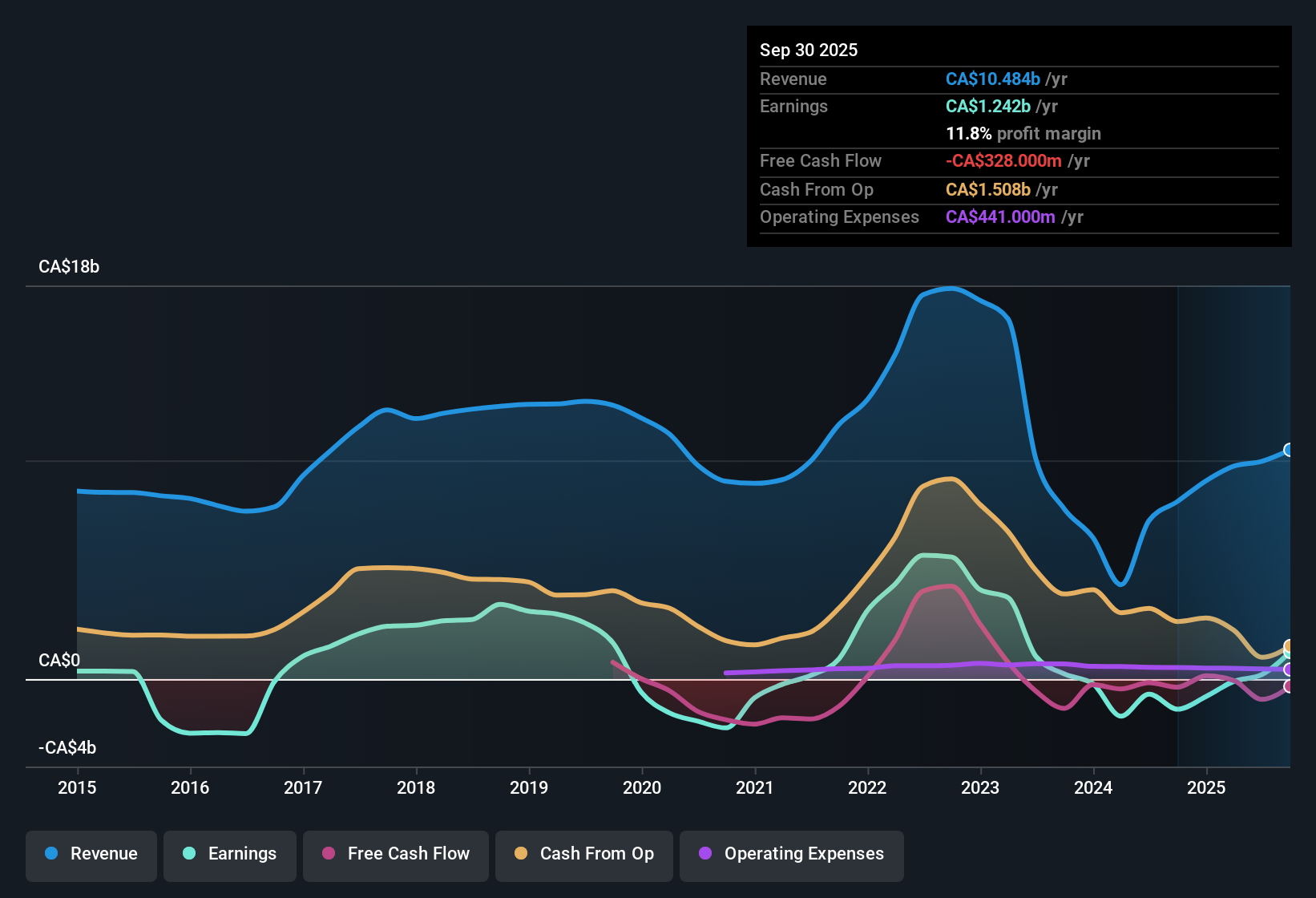

Teck Resources (TSX:TECK.B) has recently moved into profitability, with evidence of improved net profit margins over the last year. Over the past five years, annual earnings growth averaged -14.1%, making historical comparisons less meaningful now that the company has turned the corner. With no flagged risks and the company trading below an estimated fair value, investors are likely zeroing in on the recent profit turnaround and the perceived value opportunity. However, muted growth forecasts and premium price multiples could moderate expectations.

See our full analysis for Teck Resources.Up next, we’re putting these headline results side by side with the broader market narrative to see where the numbers support the story and where they might challenge consensus views.

See what the community is saying about Teck Resources

Margin Expansion: Profit Margins Expected to Climb from 2.1% to 9.5%

- Analysts expect profit margins to more than quadruple, rising from 2.1% today to 9.5% within three years. This would represent one of the strongest margin lifts in Teck's history if achieved.

- According to the analysts' consensus view, this anticipated profitability boost is heavily attributed to strategic copper expansion projects and improved efficiency:

- The Highland Valley Copper Mine Life Extension and debottlenecking efforts at QB are forecast to double copper output by the end of the decade. These initiatives could position Teck ahead of peers for volume and earnings growth.

- Analysts highlight the company's strong balance sheet and $8.9 billion in liquidity as key enablers for these large-scale investments and sustained earnings gains over competitors.

- Building on these forecasts, analysts argue that the company’s ability to execute on its copper pipeline is critical to justifying both the margin outlook and price targets.

📈 Read the full Teck Resources Consensus Narrative.

Growth Forecasts: Revenue Trails Canadian Market at 2.5% per Year

- Teck’s projected annual revenue growth of 2.5% lags the Canadian market’s 4.9%, signaling a more moderate top line outlook even amidst major project ramp-ups.

- Analysts' consensus narrative points out that, while Teck’s copper projects are expected to support future growth, ongoing risks could weigh on these ambitions:

- Delays and cost inflation at projects such as QB2 and Highland Valley, along with regulatory and permitting hurdles, could limit Teck’s ability to match or outpace broader market growth rates.

- The consensus expects elevated capital expenditures and commodity price volatility to remain persistent variables that may challenge aggressive revenue improvement targets.

Valuation: Share Price Discounted Against DCF Fair Value and Peers

- Teck’s share price of $59.39 remains well below its DCF fair value of $121.40 and the consensus analyst price target of $62.72. This indicates a notable discount relative to intrinsic value and near-term market expectations.

- From the analysts' consensus perspective, this valuation case is nuanced:

- Despite trading below DCF value, Teck commands a higher price-to-earnings ratio than the industry average (23.3x vs. 20.3x). However, it appears more attractively valued than its direct peer group, whose average PE is 44.5x.

- Consensus acknowledges that muted growth forecasts and potential for cost overruns temper enthusiasm. This suggests investors should weigh near-term discounts against execution risks and slower revenue outlooks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Teck Resources on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these results? Shape your perspective into a personalized narrative and see where your view leads in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Teck Resources.

See What Else Is Out There

Despite Teck Resources' margin gains and discounted valuation, its muted revenue growth forecasts and project uncertainties raise concerns about sustained outperformance.

If you want steadier companies, use stable growth stocks screener (2089 results) to focus on stocks with a record of reliable revenue and earnings growth through ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Teck Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TECK.B

Teck Resources

Engages in research, exploration, development, processing, smelting, refining, and reclamation of mineral properties in Asia, the Americas, and Europe.

Fair value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion