- Canada

- /

- Metals and Mining

- /

- TSX:SVM

What Catalysts Are Changing the Story for Silvercorp Metals Now?

Reviewed by Simply Wall St

Silvercorp Metals stock has recently seen its consensus analyst price target rise from CA$8.38 to CA$8.76, reflecting a renewed sense of optimism among market watchers. This uptick is driven by expectations of production growth, leverage to stronger silver prices, and the upcoming diversification of assets. Read on to discover how you can follow these evolving developments and stay informed about Silvercorp Metals’ shifting narrative.

What Wall Street Has Been Saying

Analyst coverage of Silvercorp Metals has become noticeably more optimistic in recent months, with consensus price target increases and a broad shift toward bullishness driven by both operational performance and market dynamics. Below, we explore recent commentary from both upbeat and more cautious voices in the analyst community.

🐂 Bullish Takeaways

- Analysts are pointing to material production growth, with projections indicating output could reach 13 million silver equivalent ounces by fiscal year 2028.

- Rising silver and gold price assumptions have prompted upward revisions to analyst models, resulting in higher valuations. Canaccord Genuity, for instance, recently hiked its target price to CA$9.00, citing positive leverage to precious metals and the company's solid cost controls.

- The launch of Silvercorp’s Ecuador operation is viewed as a key catalyst for both multiple expansion and improved risk profile. This adds diversity that mitigates concentration risks.

- Strong execution, disciplined cost management, and transparent operational updates are recognized as ongoing strengths, sustaining positive momentum and analyst endorsement.

🐻 Bearish Takeaways

- While the consensus trend is positive, some analysts maintain a cautious stance, noting that elevated valuations may now reflect much of the near-term upside.

- Reservations persist around potential operational risks and short-term market volatility. Scotia Capital highlights a preference to wait for new asset production data before revising its neutral rating.

- A minority of analysts observe that certain near-term risks, such as delays in Ecuador ramp-up, could weigh on upcoming earnings if not well managed.

- No major institutions have issued downward price target revisions recently, but Morgan Stanley has kept its price target unchanged this quarter, citing existing upside largely priced in at current levels.

Overall, the prevailing sentiment among Wall Street analysts is constructive, underpinned by confidence in Silvercorp Metals’s strategy and growth visibility. However, a note of caution remains regarding valuation and operational execution as new projects come online.

Do your thoughts align with the Bull or Bear Analysts? Perhaps you think there's more to the story. Head to the Simply Wall St Community to discover more perspectives or begin writing your own Narrative!

What's in the News

- Silvercorp Metals has launched a share repurchase program, authorizing the buyback and cancellation of up to 8,747,245 shares. This amount is equal to 4 percent of its outstanding share capital and aims to increase strategic flexibility.

- The Board of Directors formally approved the buyback initiative, with 300,000 shares repurchased under the 2024 program to date for a total of $1 million. No shares were bought back between April and June 2025.

- The Constitutional Court of Ecuador unanimously rejected the final legal challenge against the environmental license for the El Domo project. This decision ensures continued project progress despite ongoing protests from anti-mining groups.

- For the first quarter of FY2026, Silvercorp Metals reported substantial operational improvements. These include increased ore processed, higher silver and gold output, stable lead production, and a modest decrease in zinc production compared to the previous year.

How This Changes the Fair Value For Silvercorp Metals

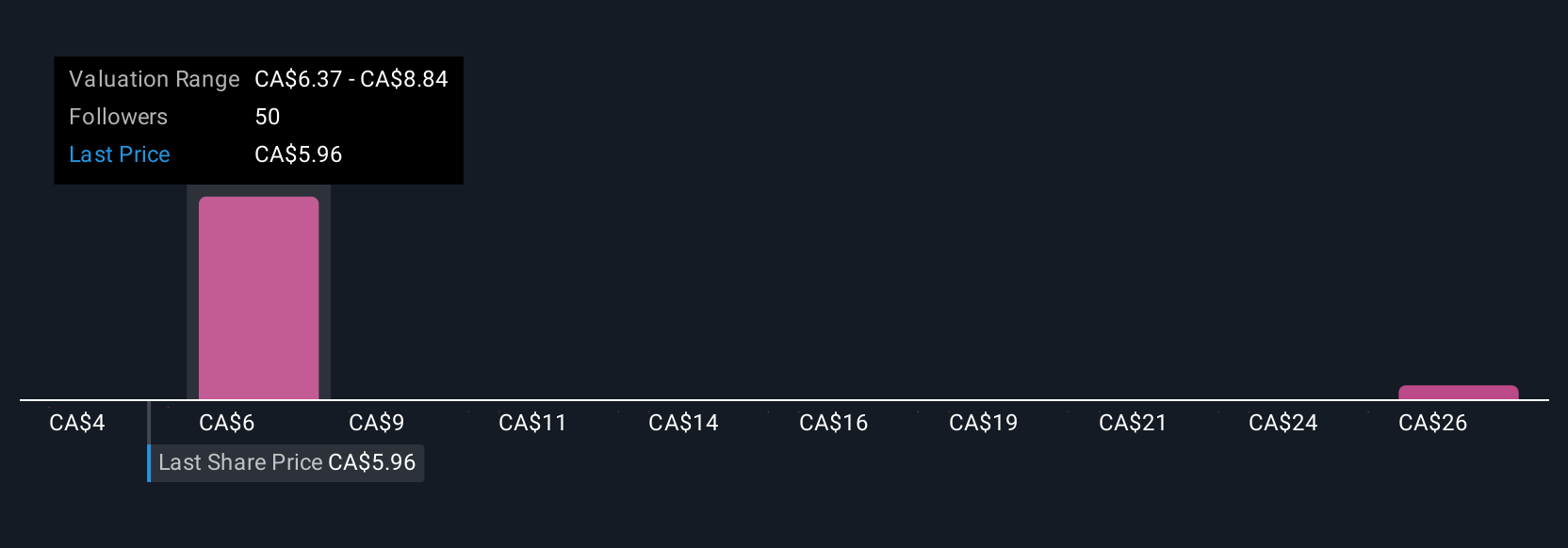

- The Consensus Analyst Price Target has risen slightly from CA$8.38 to CA$8.76.

- The Consensus Revenue Growth forecasts for Silvercorp Metals have significantly increased from 17.9% per annum to 27.4% per annum.

- The Net Profit Margin for Silvercorp Metals has increased significantly from 28.36% to 38.07%.

🔔 Never Miss an Update: Follow The Narrative

A Narrative is a powerful tool that connects a company’s real story to its future financials and fair value. On Simply Wall St, Narratives let users share their perspective behind key numbers and link company updates and forecasts directly to a price estimate. Narratives are available on the Community page and help millions of investors cut through the noise, compare Fair Value to price, and keep up as new information dynamically shapes the story.

Read the full Narrative for Silvercorp Metals to stay in sync with the evolving outlook. Here is why you should follow the narrative for Silvercorp Metals:

- Get context on how global demand for silver and new mine developments may drive higher production, support diversification, and reduce country-specific risks.

- See how strong cash flows and operational improvements give Silvercorp flexibility for growth investments and margin expansion, even as market conditions shift.

- Stay alert to the key risks and catalysts, from regulatory changes in China to expansion in Ecuador, that could impact earnings and fair value estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives