- Canada

- /

- Oil and Gas

- /

- TSX:FRU

Three Undiscovered Gems in Canada with Strong Potential

Reviewed by Simply Wall St

The Canadian market has climbed 1.1% over the last week and is up 20% over the past 12 months, with earnings expected to grow by 15% per annum over the next few years. In this promising environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding; here are three undiscovered gems in Canada that stand out.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Amerigo Resources | 12.87% | 7.49% | 12.97% | ★★★★★☆ |

| Tornado Global Hydrovacs | 14.62% | 24.52% | 64.90% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Freehold Royalties (TSX:FRU)

Simply Wall St Value Rating: ★★★★☆☆

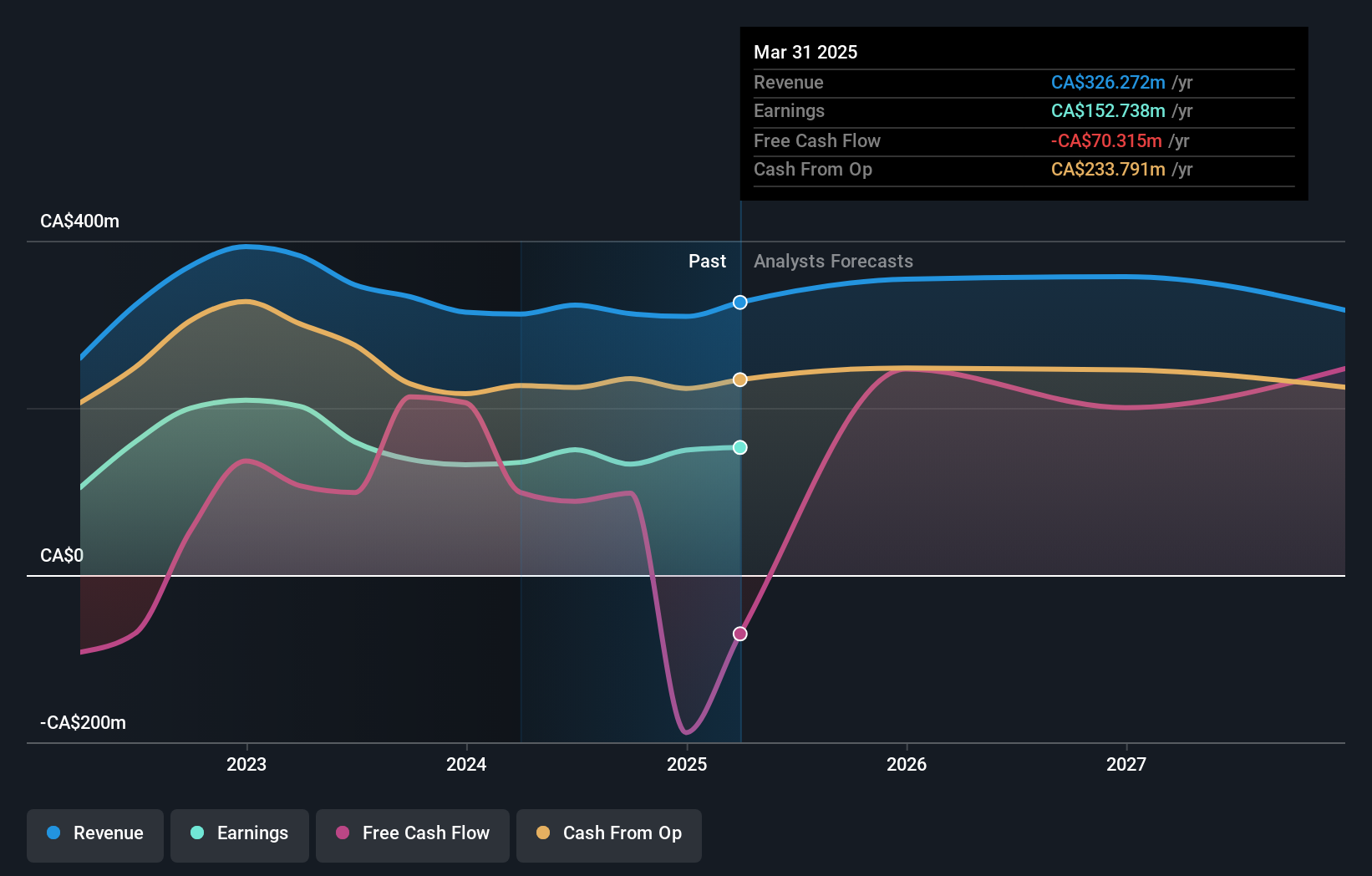

Overview: Freehold Royalties Ltd. focuses on acquiring and managing royalty interests in crude oil, natural gas, natural gas liquids, and potash properties across Western Canada and the United States, with a market cap of CA$2.16 billion.

Operations: Freehold Royalties Ltd. generated CA$323.04 million in revenue from its oil and gas exploration and production activities. The company has a market cap of CA$2.16 billion, focusing on royalty interests in various energy sectors across Western Canada and the United States.

Freehold Royalties, trading at 56.3% below its estimated fair value, boasts high-quality earnings and a net debt to equity ratio of 24.6%, which is satisfactory. Despite a -5.9% earnings growth over the past year, it outperformed the Oil and Gas industry average of -36.7%. The company reported CAD 39.3 million in net income for Q2 2024, up from CAD 24.26 million last year, with diluted EPS rising to CAD 0.26 from CAD 0.16 previously.

- Delve into the full analysis health report here for a deeper understanding of Freehold Royalties.

Explore historical data to track Freehold Royalties' performance over time in our Past section.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★★★

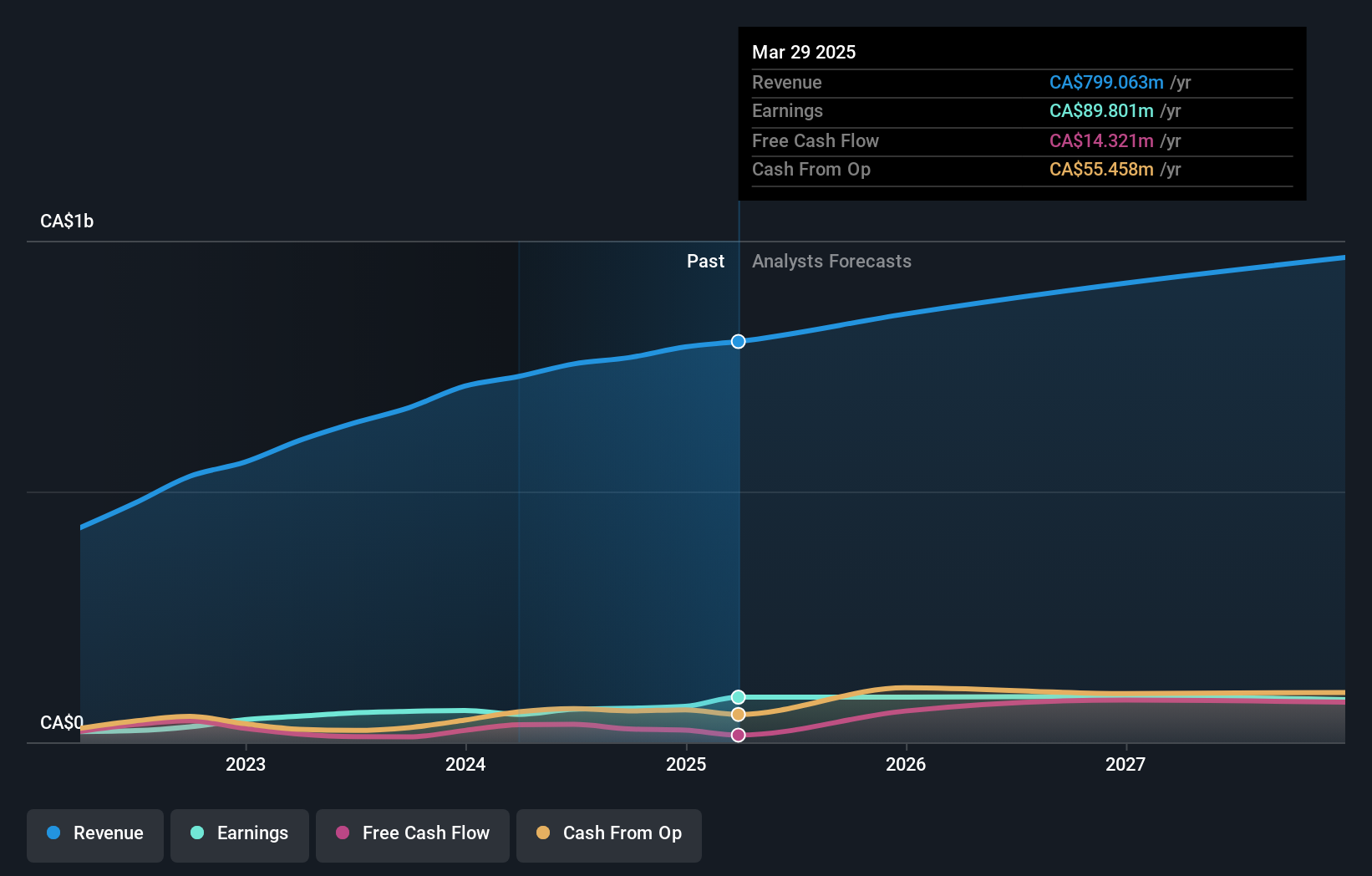

Overview: Hammond Power Solutions Inc., along with its subsidiaries, specializes in designing, manufacturing, and selling a range of transformers across Canada, the United States, Mexico, and India with a market cap of CA$1.67 billion.

Operations: HPS generates revenue from the manufacture and sale of transformers, totaling CA$754.37 million.

Hammond Power Solutions, a small cap player in the electrical industry, has shown impressive performance with a 12.3% earnings growth over the past year, outpacing the industry's 6.5%. The company's debt to equity ratio improved significantly from 27.7% to 5% in five years, and its EBIT covers interest payments by an astounding 87.6 times. Recent earnings reported CAD197 million in sales for Q2-2024 and net income of CAD23.59 million, reflecting strong financial health and potential for future growth.

- Click here to discover the nuances of Hammond Power Solutions with our detailed analytical health report.

Learn about Hammond Power Solutions' historical performance.

Silvercorp Metals (TSX:SVM)

Simply Wall St Value Rating: ★★★★★★

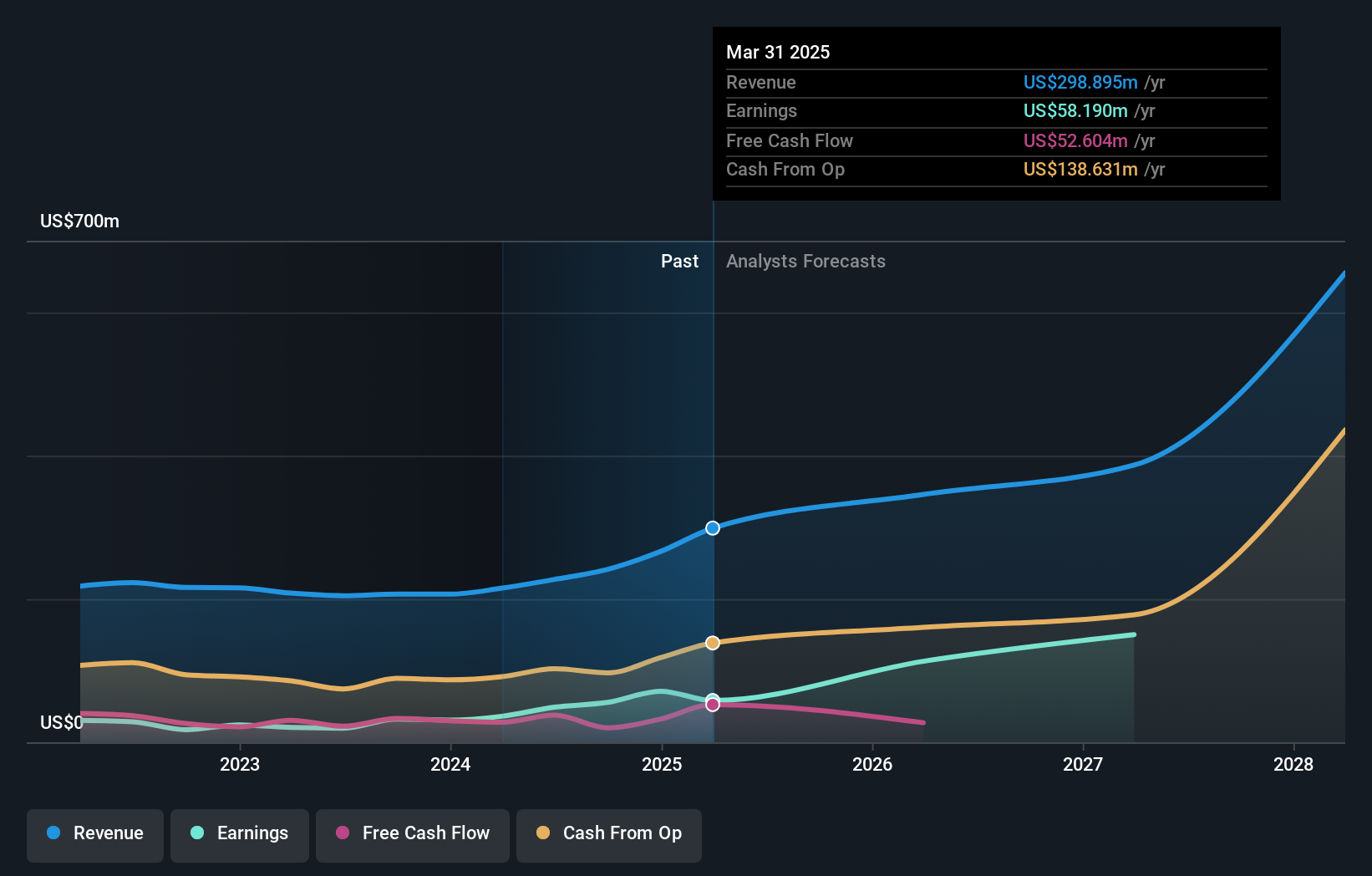

Overview: Silvercorp Metals Inc., along with its subsidiaries, focuses on the acquisition, exploration, development, and mining of mineral properties with a market cap of CA$1.20 billion.

Operations: Silvercorp Metals generates revenue primarily from its mining operations in Henan Luoning ($200 million) and Guangdong ($27.35 million). The company has a market cap of CA$1.20 billion.

Silvercorp Metals, a nimble player in the mining sector, has shown impressive earnings growth of 149.4% over the past year, outpacing its industry peers. The company is debt-free and trades at 89.9% below its estimated fair value, indicating potential undervaluation. Recent developments include a share repurchase program targeting up to 8.67 million shares and significant insider selling over the past three months. Future earnings are projected to grow by 30.53% annually, reflecting robust prospects ahead.

Key Takeaways

- Click here to access our complete index of 46 TSX Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FRU

Freehold Royalties

Engages in the acquiring and managing royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Western Canada and the United States.

Good value with adequate balance sheet.