- Canada

- /

- Metals and Mining

- /

- TSX:SVM

Silvercorp Metals (TSX:SVM): Valuation Analysis Following Strong Q2 Production and Revenue Growth

Reviewed by Simply Wall St

Silvercorp Metals (TSX:SVM) caught investor attention after reporting its second quarter and six-month results. The company highlighted higher ore processed, a strong bump in gold output, and a 23% rise in quarterly revenue.

See our latest analysis for Silvercorp Metals.

It has been a brisk climb for Silvercorp Metals, with momentum clearly building after the company’s production update. The share price return year-to-date sits at a remarkable 92.53%. While the one-year total shareholder return is a solid 27.07%, the sharp move over the past 90 days and especially this year highlights renewed optimism around improved production and revenue growth.

If Silvercorp’s turnaround has your attention, now is the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

But with a stunning rally already in the rearview mirror, investors now face an important question: Is Silvercorp Metals still undervalued at current prices, or has the market fully priced in its renewed momentum and future growth?

Most Popular Narrative: 29.9% Undervalued

Compared to the last closing price of CA$8.76, the most widely followed narrative puts Silvercorp Metals' fair value much higher, signaling a sizable disconnect between price and potential. This narrative highlights high expectations driven by ongoing project expansions and a favorable silver market backdrop.

The company's progress on new mine developments, particularly the construction ramp-up at El Domo and advancement of Kuanping, positions it to significantly expand production volumes and diversify beyond China. This enhances future revenue and mitigates single-jurisdiction risk. Record operating cash flow ($48.3 million in Q1) and a substantial cash position ($377 million), together with disciplined capital allocation and access to additional financing (such as the $175 million Wheaton stream), support higher earnings stability, potential dividend capacity, and the ability to invest in further growth projects.

What really justifies this leap in fair value? It all hinges on aggressive future earnings, bold operational ramp-ups, and a profit margin that could rival industry leaders. Want to see which ambitious growth levers set these numbers apart from the usual mining stock? Dive in and find out what sets this narrative apart from the typical forecast.

Result: Fair Value of $12.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising operating costs in China or fresh regulatory hurdles could quickly challenge the bullish outlook and temper expectations for Silvercorp’s growth story.

Find out about the key risks to this Silvercorp Metals narrative.

Another View: Market Multiples Tell a Different Story

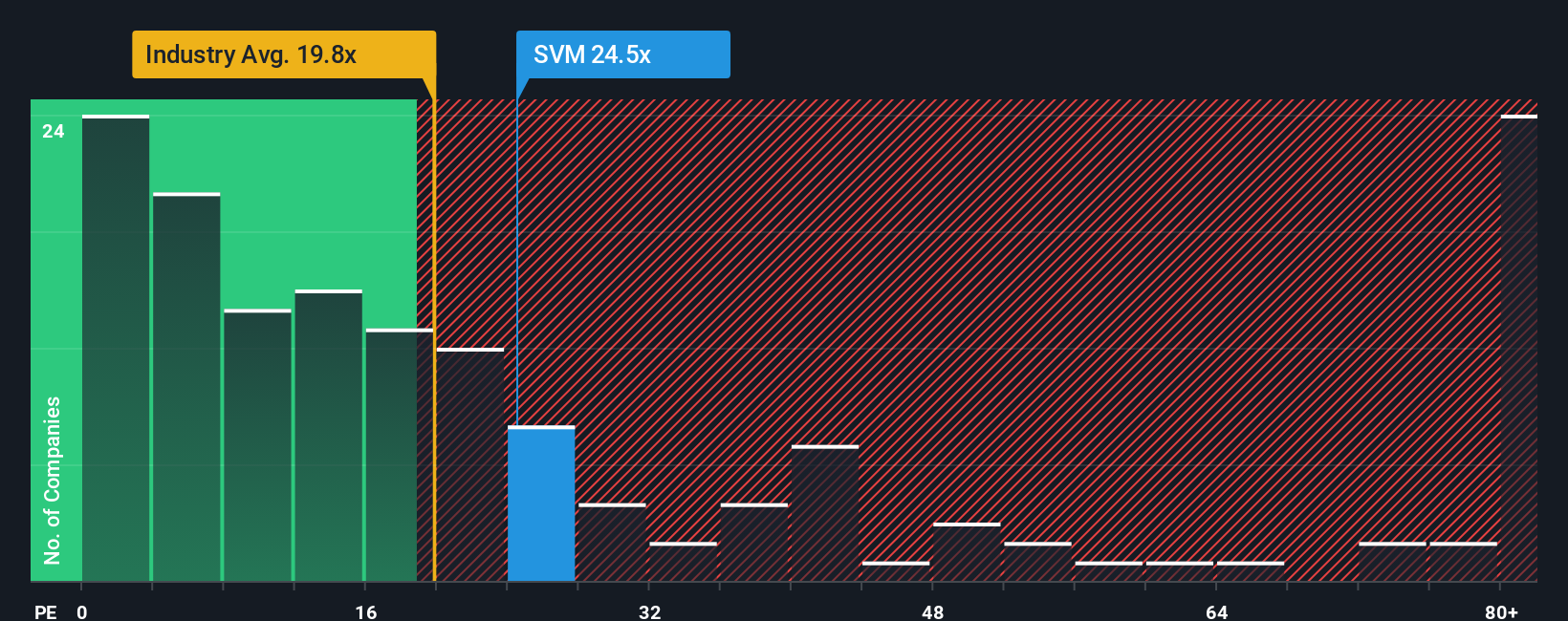

While a narrative-based fair value suggests Silvercorp Metals is undervalued, a look at its price-to-earnings ratio offers a cooler perspective. Silvercorp trades at 25.3 times earnings, which is higher than both the Canadian industry average of 21.2x and the fair ratio of 25.1x. This premium hints that optimism is already baked into the share price, elevating valuation risk if results fall short. Could the market be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Silvercorp Metals Narrative

If you want your own take or believe the numbers tell a different story, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Silvercorp Metals research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize the moment and search beyond the obvious, because the best opportunities rarely stick around. If you want to broaden your horizons, start here:

- Capitalize on attractive yields by checking out these 21 dividend stocks with yields > 3%, which offers income potential above 3% and solid financial strength.

- Fuel your portfolio with bold innovation by browsing these 26 AI penny stocks, a collection shaping the frontier of artificial intelligence and automation.

- Tap into tomorrow’s technology with these 28 quantum computing stocks, a selection driving game-changing advances in computing and secure communications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives