- Canada

- /

- Metals and Mining

- /

- TSX:SVM

Silvercorp Metals (TSX:SVM) Releases Updated Mineral Resource Estimate for Condor Project

Reviewed by Simply Wall St

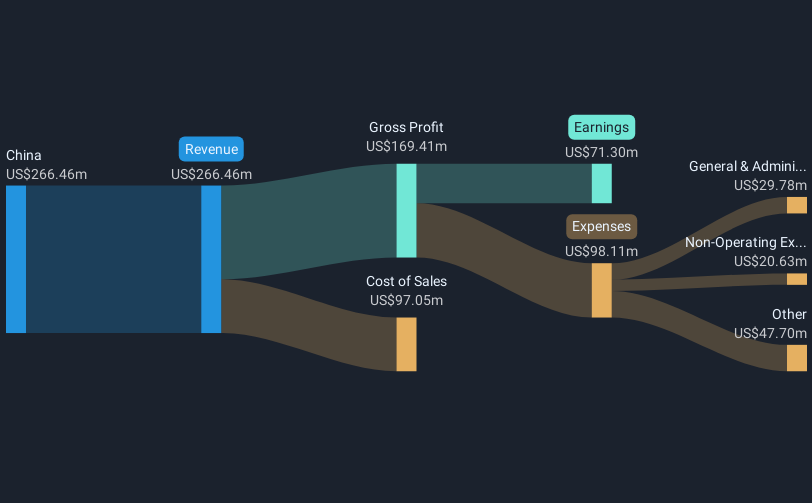

Silvercorp Metals (TSX:SVM) recently published an updated mineral resource estimate for its Condor gold project, which comes amid a notable 14% increase in its share price over the past month. This upward move aligns with the company's strong earnings report from May 22, where revenues and net income saw significant gains. Further backing investor confidence, Silvercorp declared a dividend, adding appeal for return-focused investors. In the broader market, stocks, including the S&P 500 and Nasdaq, experienced general upward trends, with the overall U.S. market rising 1.2% over the past week, which likely supported the company's positive share price momentum.

You should learn about the 2 possible red flags we've spotted with Silvercorp Metals.

The recent 14% increase in Silvercorp Metals' share price, bolstered by the updated mineral resource estimate for its Condor project, offers a positive backdrop to discuss the company's growth prospects. Over a three-year period, Silvercorp has achieved a total return of 70.15%, including share price appreciation and dividends, showcasing impressive performance. However, this growth should be contextualized given that the company's one-year return underperformed the Canadian Metals and Mining industry, which returned 34.1%. This contrast indicates that while there is positive momentum, challenges remain in matching wider industry gains.

The new developments, such as the Ying Mine expansion, present opportunities for increased revenue and earnings power. These projects, alongside rising metals prices, could support Silvercorp's revenue and earnings forecasts, which anticipate substantial growth over the next few years. Analysts predict revenue growth of 26.1% annually, with expectations of earnings reaching $122.4 million by May 2028. However, potential risks like rising production costs and geopolitical factors could impact these outcomes, requiring careful consideration.

Current share price movements also reflect optimism regarding Silvercorp's future potential, as indicated by a 29.3% discount to the consensus analyst price target of CA$7.31. This gap suggests opportunities for further appreciation if the company can meet or exceed market expectations. Considering the company's current position and future initiatives, Silvercorp appears to be in a phase of dynamic transformation, with the potential to further enhance shareholder value over the long term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives