Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSX:SSRM

Strong week for SSR Mining (TSE:SSRM) shareholders doesn't alleviate pain of three-year loss

While it may not be enough for some shareholders, we think it is good to see the SSR Mining Inc. (TSE:SSRM) share price up 28% in a single quarter. But over the last three years we've seen a quite serious decline. Regrettably, the share price slid 65% in that period. Some might say the recent bounce is to be expected after such a bad drop. After all, could be that the fall was overdone.

On a more encouraging note the company has added CA$71m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for SSR Mining

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

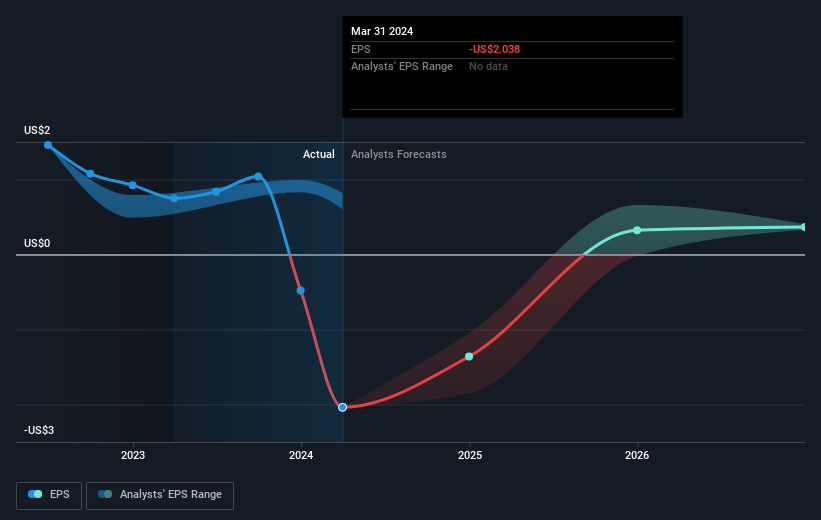

SSR Mining saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Investors in SSR Mining had a tough year, with a total loss of 63%, against a market gain of about 16%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. If you would like to research SSR Mining in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether SSR Mining is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SSRM

SSR Mining

Engages in the operation, acquisition, exploration, and development of precious metal resource properties in the United States, Türkiye, Canada, and Argentina.

Excellent balance sheet and good value.