Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Signal Gold Inc. (TSE:SGNL) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Signal Gold

What Is Signal Gold's Net Debt?

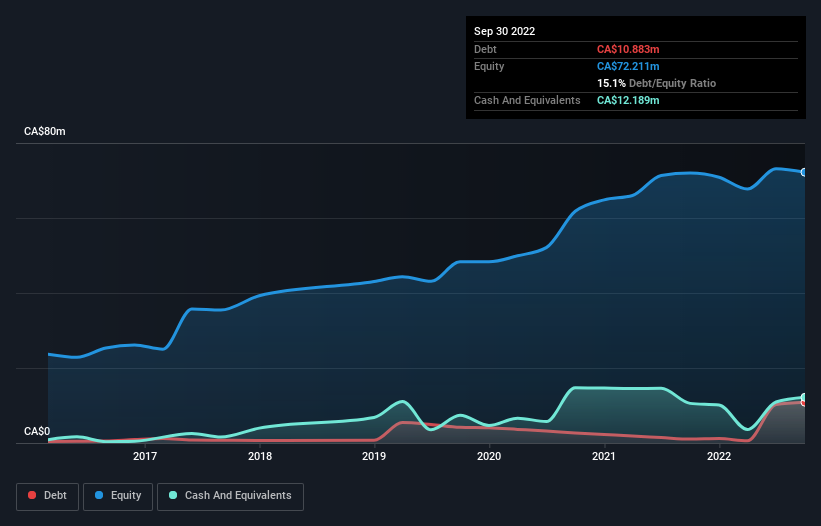

As you can see below, at the end of September 2022, Signal Gold had CA$10.9m of debt, up from CA$1.04m a year ago. Click the image for more detail. However, its balance sheet shows it holds CA$12.2m in cash, so it actually has CA$1.31m net cash.

How Strong Is Signal Gold's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Signal Gold had liabilities of CA$20.0m due within 12 months and liabilities of CA$9.47m due beyond that. On the other hand, it had cash of CA$12.2m and CA$409.9k worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$16.9m.

This deficit isn't so bad because Signal Gold is worth CA$76.0m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, Signal Gold also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Signal Gold can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Signal Gold wasn't profitable at an EBIT level, but managed to grow its revenue by 26%, to CA$38m. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Signal Gold?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Signal Gold lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through CA$13m of cash and made a loss of CA$6.4m. Given it only has net cash of CA$1.31m, the company may need to raise more capital if it doesn't reach break-even soon. Signal Gold's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. Pre-profit companies are often risky, but they can also offer great rewards. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Signal Gold (1 doesn't sit too well with us) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SGNL

Signal Gold

Operates as a gold development and exploration company in Canada.

Slight with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion