- Canada

- /

- Metals and Mining

- /

- TSX:RIO

Rio2 (TSX:RIO) Valuation: Assessing the Impact of Key Fenix Gold Project Milestones on Future Potential

Reviewed by Simply Wall St

Rio2 (TSX:RIO) announced that construction of its Fenix Gold Project in Chile has reached 63% completion as of the third quarter. Key infrastructure and plant work are finished, putting the project on track for its first gold pour in January 2026.

See our latest analysis for Rio2.

Momentum around Rio2 has accelerated alongside the tangible progress at Fenix Gold, with a strong 19.9% seven-day share price return and a remarkable 270% gain year-to-date. Looking beyond the short term, the stock’s three-year total shareholder return of 1,858% signals that optimism has been building for some time as the project milestones continue to accumulate.

If rapid gains from gold project milestones have you wondering what else is on the move, now is a perfect time to broaden your outlook and discover fast growing stocks with high insider ownership

With shares rallying and major milestones coming into view, investors are left to ask: has Rio2’s soaring share price already captured the value of its progress, or is there still room for upside if growth stays on track?

Price-to-Book of 5.8x: Is it justified?

Rio2 trades at a price-to-book ratio of 5.8x, notably below the peer average of 16.2x. This indicates a relatively discounted valuation versus comparable companies. With a last close price of CA$2.35, investors may see this as a sign that the stock remains undervalued next to its sector rivals.

The price-to-book ratio compares a company’s market value to its book value, making it especially relevant in asset-heavy sectors like mining. A lower ratio than peers often signals the market expects slower growth or higher risk, but it can also reveal a potential opportunity if company prospects improve.

This difference is significant: while Rio2’s price-to-book is far lower than the peer average, it is still above the broader Canadian industry average of 2.6x, so context is key. At current levels, the market might be underestimating future project cash flows or, conversely, pricing in operational risks that peers avoid. There is no fair ratio available for more context, so investors may need to look deeper at the company’s fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 5.8x (UNDERVALUED)

However, sustained revenue growth remains unproven. Operational setbacks at the Fenix project could quickly shift investor sentiment and impact future returns.

Find out about the key risks to this Rio2 narrative.

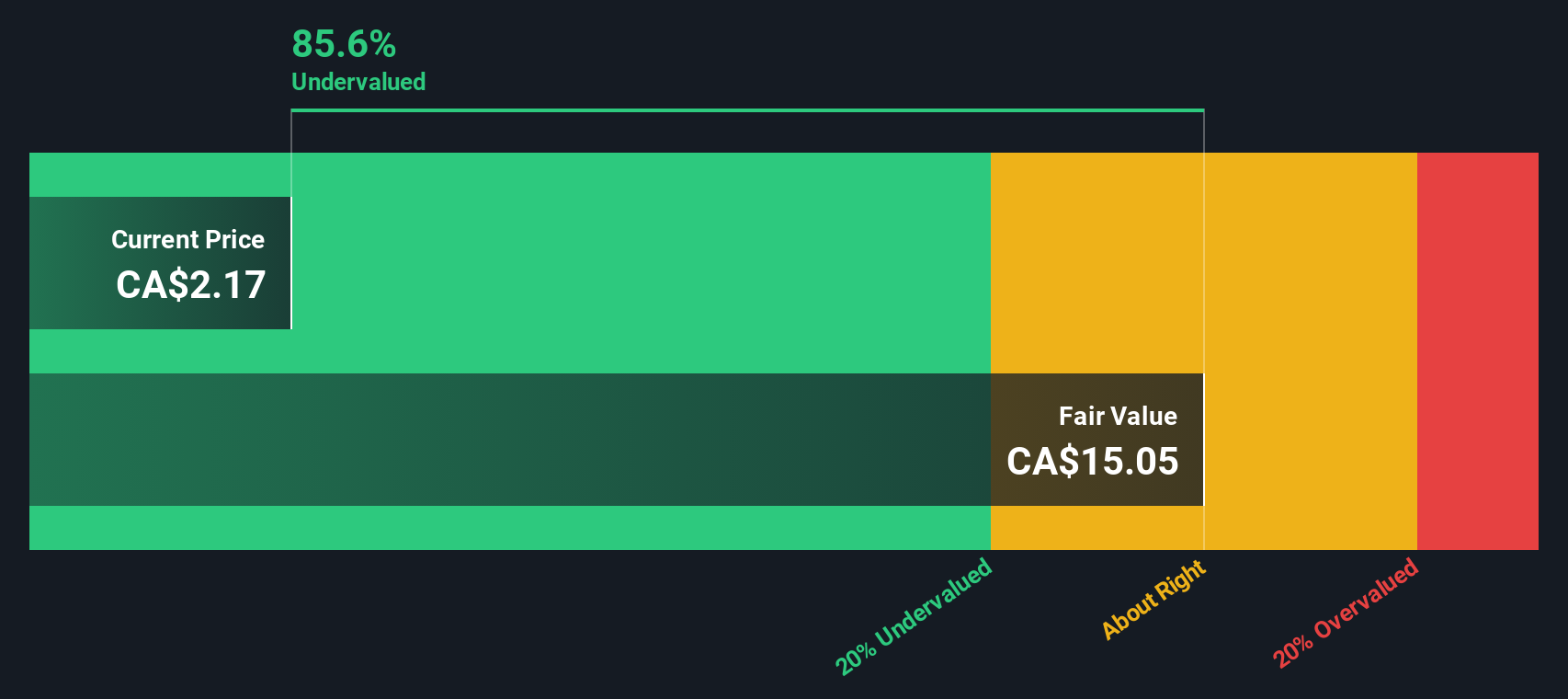

Another View: DCF Model Suggests Significant Upside

Taking a different approach, our SWS DCF model values Rio2 at CA$16.16 per share, which is well above its current price of CA$2.35. If this estimate holds up, the stock is trading at a substantial discount. Could this wide gap signal overlooked long-term potential, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rio2 for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 838 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rio2 Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft your own analysis in just a few minutes, so why not Do it your way

A great starting point for your Rio2 research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Ways to Invest Smart?

Upgrade your portfolio by chasing real potential. Go beyond the obvious and tap into exceptional opportunities. Otherwise, you might miss out on tomorrow’s winning stocks.

- Unlock steady income with reliable yields when you scan for opportunities among these 23 dividend stocks with yields > 3% that are delivering more than 3% returns.

- Spark your interest in groundbreaking innovation as you seek out the next wave of disruption with these 26 AI penny stocks making headlines in artificial intelligence.

- Ride the momentum of rapid growth in digital assets by targeting companies engaged with these 81 cryptocurrency and blockchain stocks, the fast-evolving world of cryptocurrencies and blockchain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RIO

Rio2

Engages in the exploration, development, and mining of mineral properties in Canada, Peru, Bahamas, and Chile.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives