- Canada

- /

- Metals and Mining

- /

- TSX:PPTA

Why Perpetua Resources (TSX:PPTA) Is Down 9.2% After Agnico Eagle and JPMorgan Invest $255 Million

Reviewed by Sasha Jovanovic

- Perpetua Resources announced it will raise US$255 million through a private placement, with Agnico Eagle investing US$180 million and JPMorgan Chase adding US$75 million to support the Stibnite Gold Project in Idaho.

- This investment not only provides significant project funding but also brings major industry expertise into the company's plans through a new technical and exploration advisory committee.

- We will explore how the participation of prominent investors like Agnico Eagle shapes Perpetua's investment narrative and project outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Perpetua Resources' Investment Narrative?

For those thinking about owning Perpetua Resources, the core belief has always centered on the company's success in transforming the Stibnite Gold Project from a complex environmental legacy site into a major producer of gold and antimony. The recent US$255 million private placement, with heavyweights Agnico Eagle and JPMorgan Chase stepping in, directly addresses one of the biggest near-term hurdles: securing enough funding to begin construction and meet regulatory requirements. This injection of capital shifts the balance of risk, potentially accelerating timelines and boosting confidence in project execution, while the formation of a technical committee could enhance project delivery. That said, dilution for current shareholders and continued losses, which remain pronounced as of the latest quarterly results, keep financial risks front of mind. Permitting, bonding, and the path to commercial production still loom large even after this financing. On the other hand, construction and environmental approvals are never just box-ticking exercises.

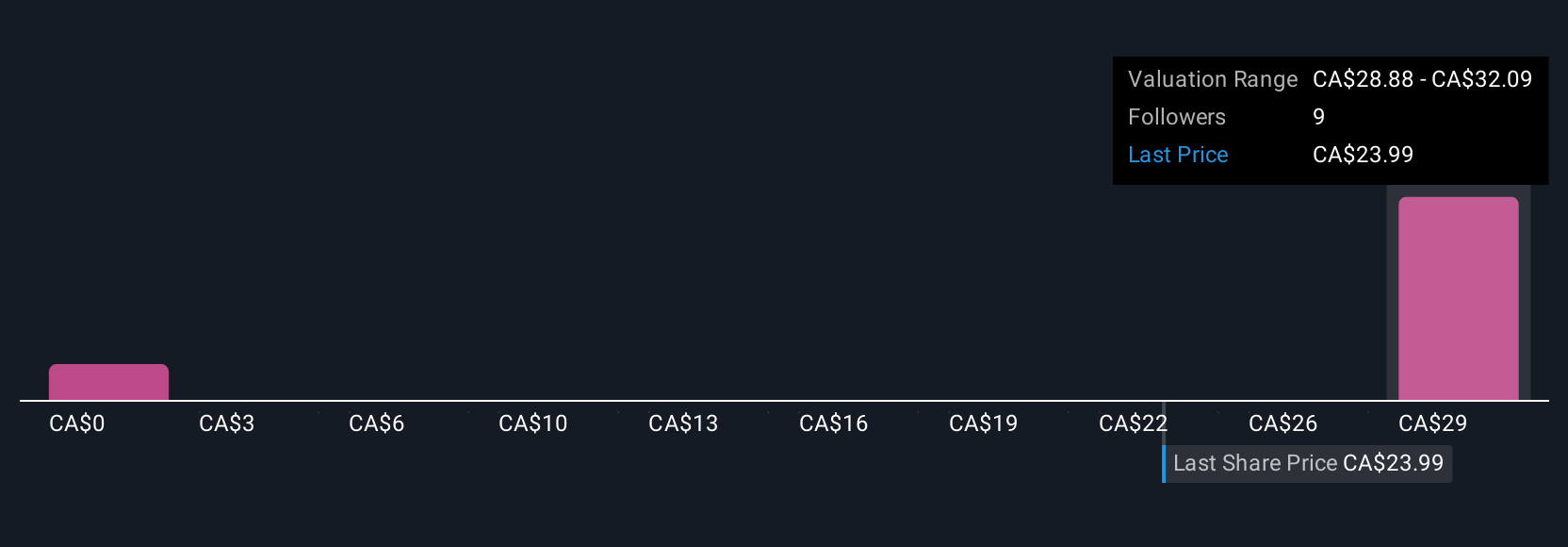

Our comprehensive valuation report raises the possibility that Perpetua Resources is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 7 other fair value estimates on Perpetua Resources - why the stock might be worth less than half the current price!

Build Your Own Perpetua Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perpetua Resources research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Perpetua Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perpetua Resources' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PPTA

Perpetua Resources

A development-stage company, engages in the acquisition of mining properties in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives