- Canada

- /

- Metals and Mining

- /

- TSX:ORV

Orvana Minerals Corp.'s (TSE:ORV) Price Is Right But Growth Is Lacking After Shares Rocket 66%

Orvana Minerals Corp. (TSE:ORV) shares have continued their recent momentum with a 66% gain in the last month alone. The annual gain comes to 153% following the latest surge, making investors sit up and take notice.

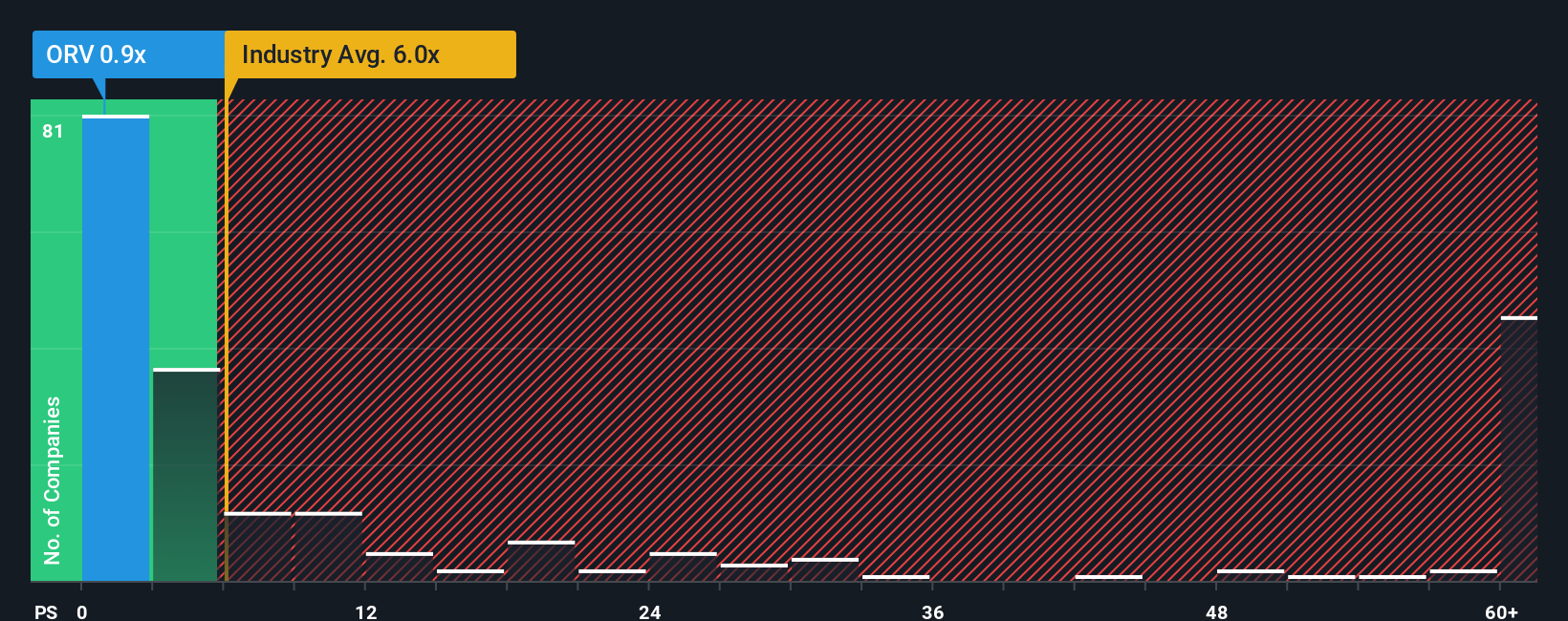

In spite of the firm bounce in price, Orvana Minerals may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 6x and even P/S higher than 44x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Orvana Minerals

How Has Orvana Minerals Performed Recently?

The revenue growth achieved at Orvana Minerals over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Orvana Minerals, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Orvana Minerals' to be considered reasonable.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 13% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 59% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Orvana Minerals' P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Orvana Minerals' recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Orvana Minerals revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Orvana Minerals that you should be aware of.

If these risks are making you reconsider your opinion on Orvana Minerals, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ORV

Orvana Minerals

A mining and exploration company, engages in the evaluation, development, and mining of gold, copper, silver, and other precious and base metal deposits.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives