- Canada

- /

- Metals and Mining

- /

- TSX:ORA

How Aura Minerals' Move to the S&P Global BMI Index (TSX:ORA) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Aura Minerals Inc. was recently added to the S&P Global BMI Index following its voluntary delisting from the Toronto Stock Exchange, with continued listings on Nasdaq and Brazil’s B3 exchange under current symbols.

- The company’s decision to consolidate trading in the U.S. market aims to improve stock liquidity and streamline ongoing listing expenses, while assuring BDR holders of continued support.

- We'll explore how Aura’s inclusion in the S&P Global BMI Index could influence its investment case, particularly regarding liquidity and investor visibility.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Aura Minerals Investment Narrative Recap

To be a shareholder in Aura Minerals right now, you need to believe in its ability to execute production growth while managing gold price volatility and cash costs. The recent addition to the S&P Global BMI Index and delisting from the TSX may modestly improve trading liquidity, but do not materially alter the key short-term catalyst: the successful commercial ramp-up at Borborema. The biggest risk remains production and cost consistency as Aura moves through its investment phase.

Among Aura’s latest updates, the Q2 2025 earnings report highlighted a return to profitability on increased sales, signaling some improvement in underlying operations. This financial result ties directly to the main catalyst, as higher production at Borborema and stabilized costs could help sustain momentum and address recent underperformance.

But investors should also keep in mind, if production setbacks or cost overruns persist, especially at sites like Almas…

Read the full narrative on Aura Minerals (it's free!)

Aura Minerals' outlook anticipates $1.3 billion in revenue and $404.9 million in earnings by 2028. This scenario is based on a projected annual revenue growth rate of 23.8% and an earnings increase of $465.3 million from current earnings of -$60.4 million.

Uncover how Aura Minerals' forecasts yield a CA$8.84 fair value, a 80% downside to its current price.

Exploring Other Perspectives

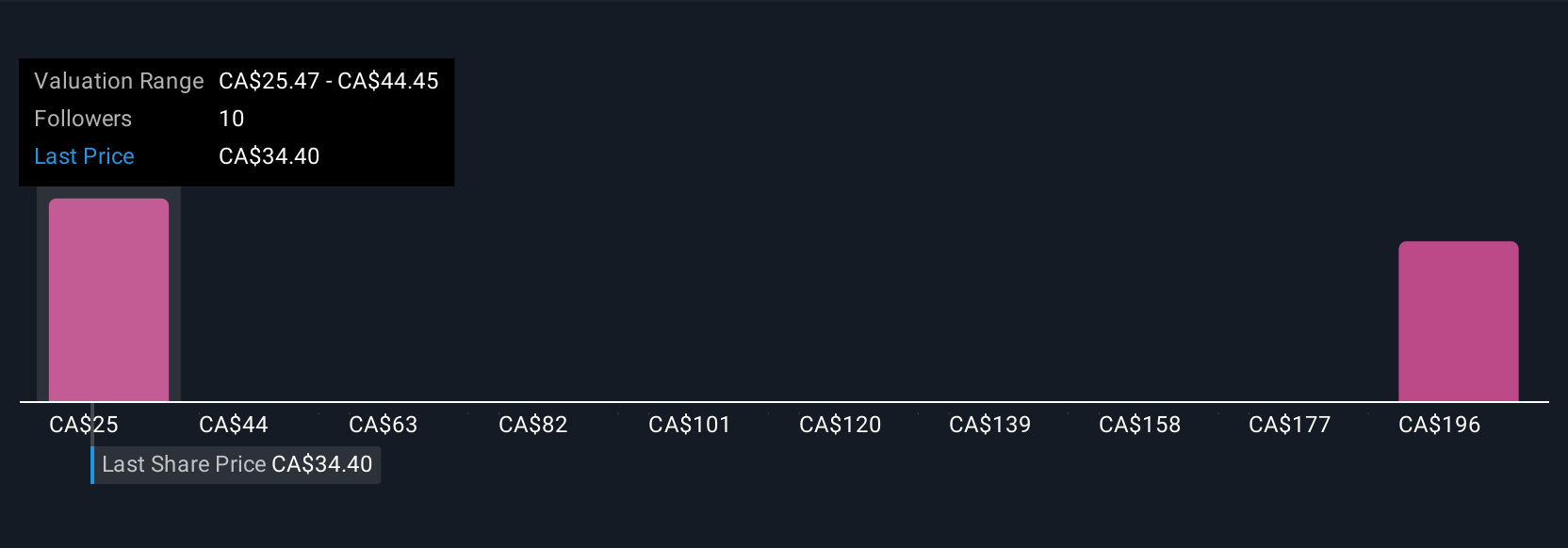

Three investors in the Simply Wall St Community offered fair value estimates ranging from US$8.84 to US$163.70 per share. Liquidity concerns affecting investor access remain central and may shape how broadly Aura’s growth story is recognized.

Explore 3 other fair value estimates on Aura Minerals - why the stock might be worth less than half the current price!

Build Your Own Aura Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aura Minerals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Aura Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aura Minerals' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ORA

Aura Minerals

A gold and copper production company, focuses on the development and operation of gold and base metal projects in the Americas.

High growth potential and fair value.

Market Insights

Community Narratives