- Canada

- /

- Metals and Mining

- /

- TSX:OLA

A Look at Orla Mining’s (TSX:OLA) Valuation Following High-Grade Gold Discovery at South Carlin Complex

Reviewed by Simply Wall St

Orla Mining (TSX:OLA) revealed high-grade oxide gold discoveries at its South Carlin Complex, extending beyond current pit designs. This news supports the company’s plans for open pit expansion and strengthens its long-term growth outlook.

See our latest analysis for Orla Mining.

Orla Mining’s recent high-grade discovery comes at a time when momentum is clearly building. The past month delivered an exceptional 35% share price return, and anyone holding for the full year has seen a remarkable total shareholder return of 184%. This run, fueled by positive drilling results and expansion plans, indicates that the market’s optimism around Orla’s long-term production growth story is gaining traction.

If you’re inspired by gold sector momentum or just looking to broaden your search, now is an ideal time to discover fast growing stocks with high insider ownership

The question now is whether Orla Mining’s rapid gains still leave room for upside, or if the company’s future growth has already been priced in by the enthusiastic market. Could this be a buying opportunity, or is it time for caution?

Most Popular Narrative: 16% Undervalued

Orla Mining’s last close of CA$19.60 sits below the consensus fair value estimate of CA$23.33 per share, highlighting persistent bullishness among the most closely followed market watchers. Investor attention is rising as the company posts standout growth and valuation metrics that outpace typical sector performance.

Robust production growth and revenue diversification from integrating Musselwhite, as well as future contributions from South Railroad and expanded Camino Rojo underground, are likely underappreciated catalysts that will increase long-term revenue and reduce operational risk.

Ever wondered what the narrative is betting on to reach that much higher price? Analysts are forecasting aggressive margin expansion, leveraging big project integrations, and counting on blockbuster earnings growth. Yet only a handful of key financial drivers support these bold projections. What are they? Click to reveal the narrative’s real growth engine.

Result: Fair Value of $23.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks like regulatory delays or unexpected production disruptions could quickly shift sentiment and challenge the current bullish narrative for Orla Mining.

Find out about the key risks to this Orla Mining narrative.

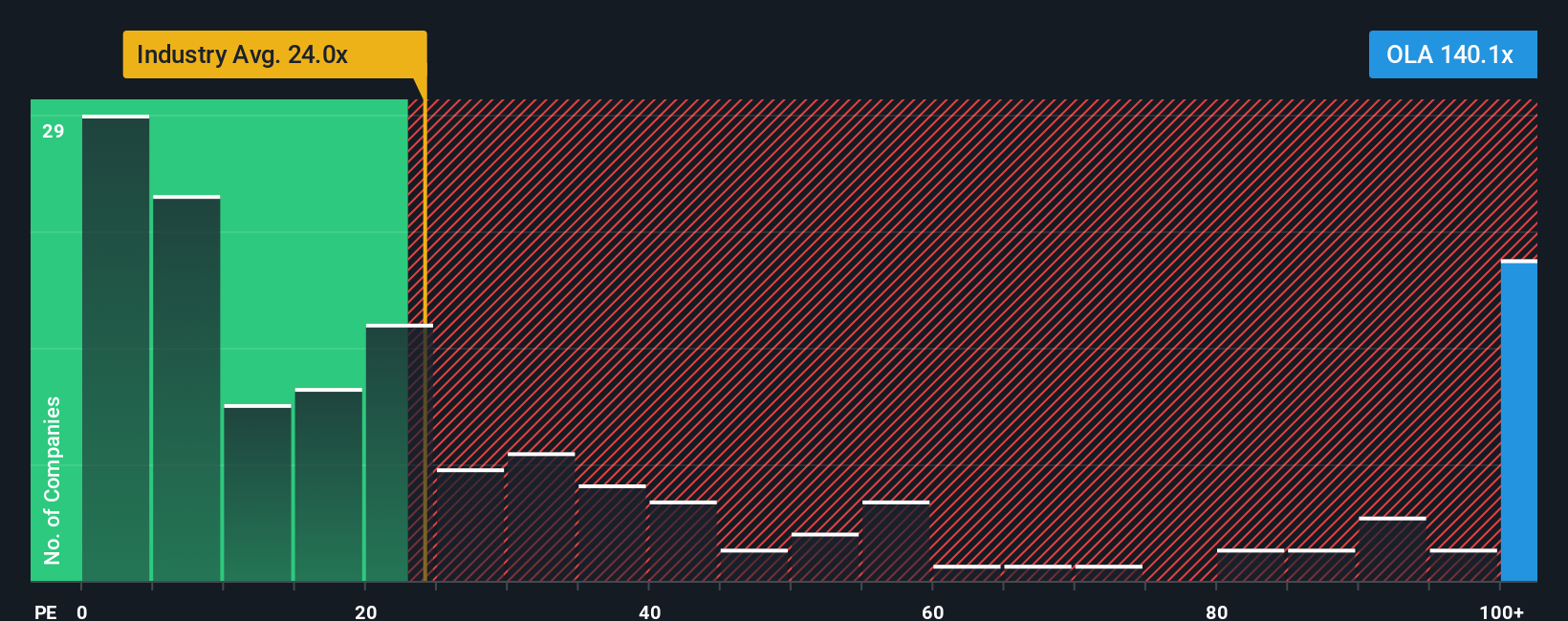

Another View: Earnings Multiple Raises Questions

When looking at valuation through the lens of the price-to-earnings ratio, Orla Mining appears far more expensive. Its P/E sits at 88.5x, which is dramatically higher than the Canadian Metals and Mining industry average of 20.6x and its peer average of 19.2x. The fair ratio, based on longer-term trends, is estimated at 23.6x. This signals substantial valuation risk if the market’s optimism fades. Is this premium justified, or has the stock run too far ahead of its fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Orla Mining Narrative

If you have a different perspective or want to put the data to the test yourself, you can craft your own story in just a few minutes with Do it your way.

A great starting point for your Orla Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by. Simply Wall Street’s screener highlights real-time trends and hidden gems so you stay ahead of the crowd.

- Boost your potential for outsized returns by scanning these 3563 penny stocks with strong financials, often overlooked by big funds. This can give you the edge before others catch on.

- Secure steady income by reviewing these 14 dividend stocks with yields > 3% that offer robust yields, so every portfolio refresh brings reliable cash flow opportunities.

- Position yourself for the next digital wave by analyzing these 25 AI penny stocks applying AI breakthroughs across industries. This allows you to act now on future-defining innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OLA

Orla Mining

Acquires, explores, develops, and exploits mineral properties.

High growth potential with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026